Get into a car accident in North Carolina without insurance? If you’re not at fault, then you can still file a claim with the at-fault driver’s insurance provider—but that doesn’t mean you’re absolved from any legal consequences as an uninsured driver in the state.

Auto accidents are difficult enough without stressing yourself out about the harsh penalties that will likely come your way if you’re caught driving without insurance after an accident. On this page, we'll take a closer look at your options for filing a claim, all potential penalties as an uninsured driver, and even show you how to find affordable car insurance

to prevent a pricey accident!  4.7/5 rating on the App Store | Trusted by 5+ million customers and 7 million cars

4.7/5 rating on the App Store | Trusted by 5+ million customers and 7 million cars 4.7/5 app rating | Trusted by 5M+ drivers

4.7/5 app rating | Trusted by 5M+ driversWhat to do if you’re in a car accident without insurance in North Carolina and not at fault

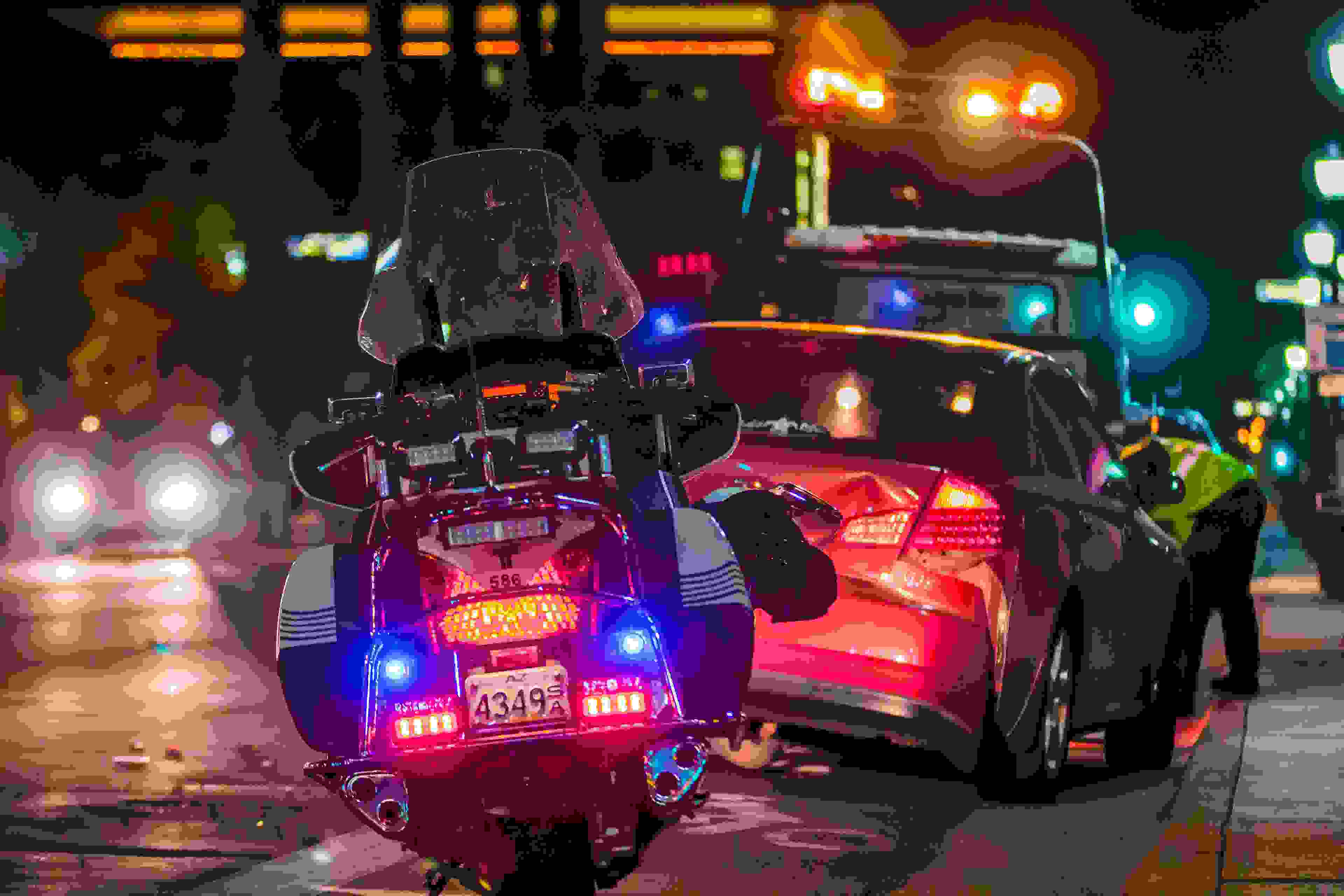

Driving without car insurance is considered a misdemeanor crime in North Carolina. And if you get into an accident, you may also face additional legal consequences. Here’s how to proceed if you get into an auto accident in North Carolina without insurance.

First and foremost: Don’t flee the scene of the accident. As with the rest of the United States, it is illegal to leave the scene of an accident in North Carolina, no matter who's at fault or whether you have insurance or not. A hit-and-run charge in North Carolina

may result in: Class 1 misdemeanor: Fines and up to 120 days in jail if the accident includes property damage

Class H felony: Fines, license suspension, and up to 25 months in jail if the accident includes bodily injury

Class F felony: Fines, license suspension, and up to 41 months in jail if the accident includes serious bodily injury or death

As you can see, it’s best to remain calm and stay put if you get into an accident without car insurance. Make sure to park your car in a safe place and check to see if everyone involved (including yourself) is free of injuries. Call 9-1-1 if needed, swap information with the other driver, and take plenty of photos of the accident to help prove that you weren’t at fault.

If you’re not at fault and the other driver has insurance, you can still file a claim with their insurance company for any potential damages that ensue from the crash—including vehicle repairs and medical expenses. But if the other driver is also uninsured, you can file a civil lawsuit instead to recover any necessary repairs, medical bills, or loss of income.

Who decides fault in a car accident in North Carolina?

If law enforcement is called to the scene of the crash, the police report will assist insurance providers in their decision. So in the end, it is up to the insurance company to conclusively determine who is at fault in the car accident.

That’s why it’s so important to provide as much evidence as possible if the other driver is at fault, even if you’re the one driving without car insurance. As mentioned before, take tons of photographs of the scene of the accident to prove that the other driver is financially responsible.

Do you need to report a car accident in North Carolina?

It depends. You only need to report an accident to the police if someone has been injured or killed during the crash. Additionally, you’ll need to involve the police if you or the other driver have suffered more than $1,000 in property damage.

If you’re not sure if there is more than $1,000 in property damage, it’s always best to err on the side of caution and file a report with the police.

What if you’re at fault?

If you’re at fault in a car accident without insurance, you’ll have to contend with some serious legal ramifications.

Because North Carolina is a pure contributory negligence

, you will be financially responsible for the other driver’s damages if you are found 100% at fault, and the driver can file a personal injury lawsuit to demand the money. If it is proven that the other driver is partially negligent for the accident, both drivers will have to handle their financial concerns. As a first offense, the penalties for driving without car insurance include up to 45 days of probation, fines up to $100, a 30-day license suspension, and a 30-day registration suspension. And the severity of legal penalties only increases with each offense, including up to 45 days in jail or probation if you get caught a second time driving without insurance.

What if you’re hit by an uninsured driver in North Carolina?

But what if the tables have turned and the other driver is the one without insurance?

According to North Carolina law, all drivers are required to purchase at least $30,000 in uninsured motorist coverage

(UMC) per person and up to $60,000 per accident, along with the minimum liability insurance required. So if you’ve been hit by an uninsured driver, UMC will cover your medical expenses, your repair costs, and the medical bills of any passenger occupying your vehicle at the time of the accident. And as of 2019, there are about 7.4% of uninsured drivers on North Carolina roads per the Insurance Information Institute (III). That means you’ll have a 1 in 15 chance of getting into a car accident with a driver who lacks the proper liability insurance. While your chances of colliding with an uninsured driver aren’t nearly as bad as in many other states, you’ll still want to make sure you protect yourself with uninsured motorist coverage—it is mandatory after all!

Penalties for driving without insurance in North Carolina

Even though you’re able to file a claim with the at-fault driver’s insurance provider without insurance yourself after an accident, that doesn’t mean you’re off the hook for driving without insurance in North Carolina—especially since it’s considered a misdemeanor in the state.

As explained in the North Carolina General Statutes Section 20-279.21

, you’ll have to pay a $50 civil penalty fee and a $50 reinstatement fee that results in a $100 total, along with up to 45 days of probation, a 30-day license suspension, and a 30-day registration suspension for a first-time offense. For a second offense, you’ll have to pay a $100 civil penalty fee and a $50 reinstatement fee that will bump you up to $150 in fees with up to 45 days of probation or jail and the same license and registration suspensions.

But if you’re caught driving without insurance after an accident, your driver’s license may be suspended for up to one year. North Carolina is one of the few states that doesn’t require an SR-22 certificate

or proof of financial responsibility after you’ve been convicted of a major driving offense. But you may have to submit a DL-123 insurance form to reinstate your driving privileges that are provided by North Carolina insurance companies. Unfortunately, there’s no way around these penalties if you’re driving without insurance. You’re not able to purchase insurance afterward and apply it to your current predicament. The only way to avoid these penalties is if you had insurance coverage but simply didn’t have proof of insurance

with you at the time of the accident. In this case, your citation may be dismissed if you can provide the court with proof of insurance within 10 days of your violation.

Minimum required car insurance in North Carolina

Now that you know the legal consequences of driving without insurance in North Carolina, how much insurance do you need according to state law? All drivers must legally carry a car insurance policy with at least the following:

$60,000 of bodily injury liability per accident

But keep in mind that this is only the minimum liability insurance required in North Carolina. That means that even drivers with the minimum car insurance in the state may lack sufficient funds for more serious accidents. Many experts suggest purchasing more than the minimum limits with at least $100,000 per person, $300,000 per accident for bodily injury liability, and $100,000 for property damage liability when possible.

While North Carolina doesn’t require collision insurance

or comprehensive coverage

—both are great options that are meant to further protect your vehicle. With comprehensive insurance, in particular, your property will be protected from many unpredictable incidents such as vandalism or natural disasters in the state of North Carolina. Driving without insurance can increase premiums

And don’t forget: If you’re caught driving without car insurance

, you’ll end up having to pay more for insurance after the fact. That’s right—all serious violations and car collisions will stay on your driving record and therefore dramatically increase your rates. Specifically, driving without insurance in North Carolina will add three demerit points to your record. How to find cheap car insurance in North Carolina

If you haven’t met North Carolina’s minimum car insurance

requirements because of a lack of funds—we completely get it. Car insurance can certainly be costly but at the same time, you’re putting yourself at an even greater financial risk when you drive without insurance. That’s why Jerry

is here to help you find the best coverage at the best price for all budgets. Here’s how it works: just download the app and sign-up in less than one minute to compare quotes from over 55 of the nation’s top insurance companies right at your fingertips. Once you find a policy that works for your budget, Jerry’s team of expert insurance agents will get straight to work switching you over while helping you cancel your old policy if you have one.

How much can you save? On average, Jerry customers save over $800 a year on car insurance when they make the switch!

“I was literally floored by the savings Jerry

found for me. I was paying close to $960 every 6 months and now I’m paying $380 every 6 months for IDENTICAL COVERAGE in North Carolina!” —Olivia Z.

RECOMMENDEDNo spam or unwanted phone calls · No long forms