After an unprecedented borrowing spree, many Gen Z and Millennial drivers are struggling to make payments on their auto loans, pushing serious delinquencies among their age groups to multi-year highs. That’s as overall delinquency rates hit and surpassed pre-pandemic levels.

Both Gen Z and Millennials likely face a tougher road ahead. Gen Z drivers, especially, say car payments and other car-ownership costs, including insurance rates that are rising at the fastest pace in generations, have created financial stress in other areas of their lives, causing them to cut back on spending and to struggle to make other monthly payments.

For now, the economy and labor market remain strong but many economists expect both to weaken significantly — perhaps resulting in a recession — as the Federal Reserve continues its quest to rein in inflation. And a long-running forbearance on student loan payments is set to expire in coming months, meaning borrowers will no longer be able to hold off on making payments without penalty. That will spread many younger car owners’ budgets even thinner.

Key Insights

- New serious delinquencies on auto loans, defined as at least 90 days overdue, among people aged 18-29 hit a five-year high at the end of 2022. For those aged 30-39, they hit the highest level since 2019. Together, drivers ages 18-39 accounted for nearly $20 billion in auto loans that fell into serious delinquency in 2022.

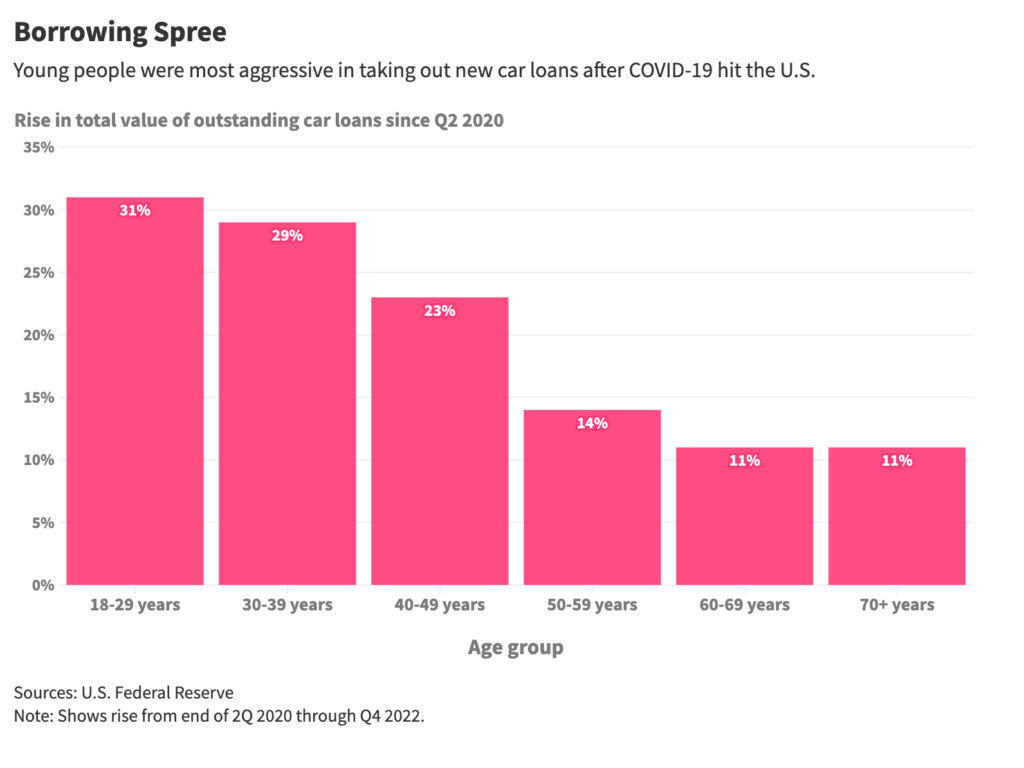

- Since the outbreak of COVID-19, the total dollar value of auto loans taken out by people under 40 has risen at the fastest pace on record in data going back to 2000. The total balance for borrowers 18-29 rose about $50 billion, or 31%. For those 30-39, the rise totaled about $80 billion, or 29%.

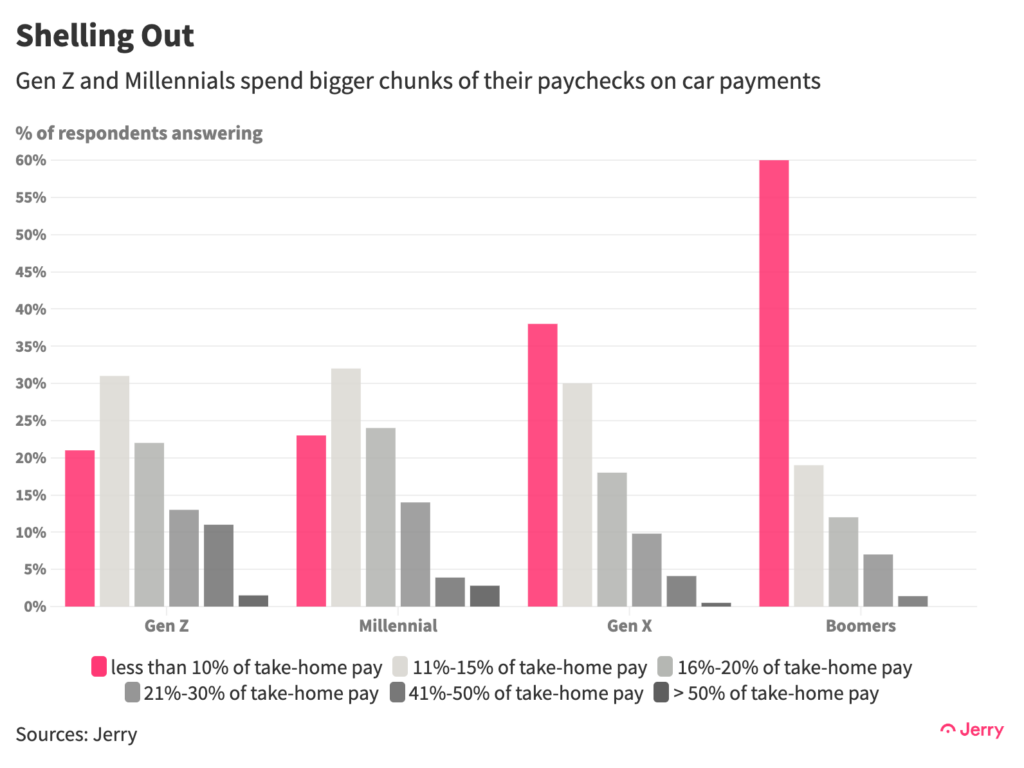

- Four out of 10 Gen Z drivers say they pay more than 15% of their after-tax household income on car payments, while one in five say they pay more than 20%. More than a third of Millennials say they pay more than 15% and 16% pay more than 20%.

- More than half of Gen Z drivers (52%) said the high cost of car ownership caused them to make at least one non-car monthly debt payment (credit card, mortgage, rent, etc.) at least 30 days late in 2022. A third (33%) of Millennials said the same.

- Total outstanding debt held by people under 30 has risen 37% since the pandemic began, more than any other age group, reaching $1.27 trillion at the end of 2022.

Borrowing and Buying

Gen Z and Millennials piled up on auto loans at a record pace after COVID hit the U.S., as interest rates plummeted and the government responded with stimulus measures, including cash payments and forbearance on student loans. The total value of car loans taken out by borrowers under 40 in the 10 quarters since the end of the second quarter of 2020 was higher than in any other 10-quarter period in data going back to 2000.

The increase in the value of auto loans was partly due to rising prices — from end-2019 to end-2022, the average new car loan rose from $17,000 to $24,000, according to the Fed. Still, younger people were much more aggressive borrowers relative to pre-pandemic days. In Jerry’s 2023 State of the American Driver report, 43% of Gen Z members said they had bought or leased their current vehicle since 2020. That was the highest rate of any generation.

Gen Z and Millennial drivers, in particular, are feeling the weight of their borrowing. Less than half of both generations are able to keep their car payments under 10%-15% of their household’s take-home pay, common thresholds recommended by financial advisers.

Conclusion

Before the pandemic struck, the rise in auto loan delinquencies had created concerns about a possible wave of defaults. Pandemic-driven government stimulus measures helped consumers gain a stronger footing and delinquencies plummeted. Now they have returned to and even surpassed pre-pandemic levels. This is especially true among borrowers with lower credit ratings, though their overall share of the auto loan pool plunged in recent years as banks tightened lending standards, reducing the risk of massive defaults.

Younger borrowers have loaded up on debt and are already struggling to stay afloat. For people in their 20s, 30s, and 40s, the increase in serious delinquencies on credit cards has already hit the highest level in more than a decade. If student loan forbearance expires as scheduled, their struggle could grow harder, particularly if the economy finally begins to sputter under the weight of higher interest rates.

Methodology

Unless otherwise stated, all figures on auto loan delinquencies and borrowing, as well increases in total borrowing, were calculated using data from the Federal Reserve’s Quarterly Report on Household Debt and Credit released Feb. 16.

All figures on spending habits and the impact of car ownership costs were taken from a survey conducted for Jerry’s 2023 State of the American Driver report.

Henry Hoenig previously worked as an economics editor for Bloomberg News and a senior news editor for The Wall Street Journal. His data journalism at Jerry has been featured in outlets including CBS News, Yahoo! Finance, FOX Business, Business Insider, Bankrate, The Motley Fool, AutoWeek, Money.com and more.