Insurance companies provide a physical or digital card that serves as your proof of car insurance. If you’re driving and can’t prove that you have coverage, you could be fined or have your license revoked.

What is proof of insurance?

Proof of insurance is evidence that you hold a valid and current insurance policy that covers both you and the vehicle you’re driving. This ID card shows information related to you and your policy and helps entities like police officers and car dealerships quickly verify your coverage.

If you don’t receive a proof of insurance card after purchasing a plan, reach out to your insurer to get the appropriate documentation.

Once you get your insurance card, make sure to:

Keep it safe and accessible: Insurance companies usually issue two cards per vehicle, so you should be able to keep one card in your car at all times.

Switch it out every renewal: Every time your policy renews—or if you change insurance companies—you will receive an updated proof of insurance. Once the new card arrives, make sure to shred your old card, throw it away, and then put the new one in your vehicle.

All about your insurance card—and what it includes

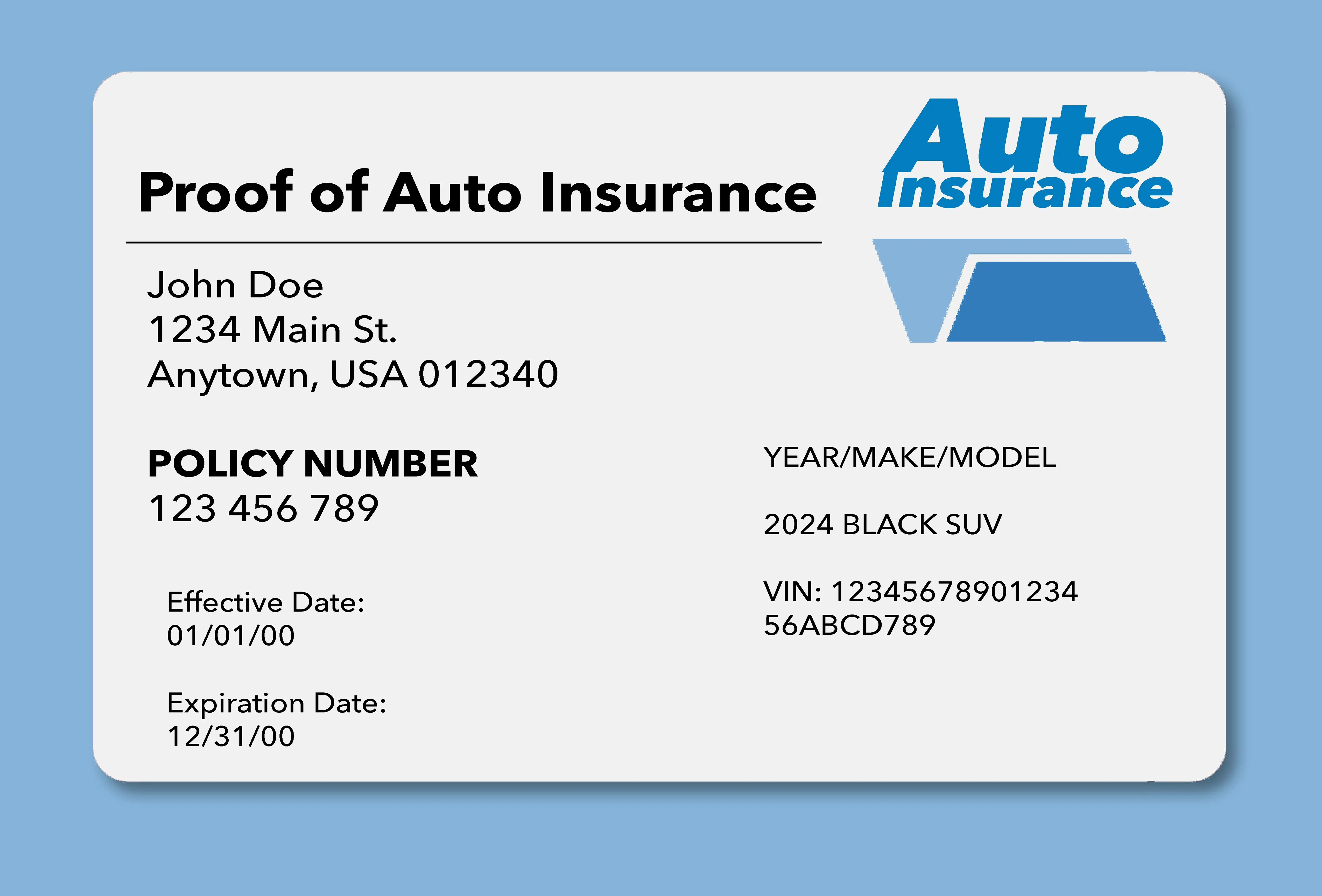

An insurance card usually shows the name of the insurance company plus basic information about you, your vehicle, and your policy.

The information normally included in a proof of insurance card or document includes:

- Driver info: Full name of all covered drivers (and sometimes their addresses).

- Vehicle info: Year, make, and vehicle identification number (VIN).

- Policy info: Name and address of insurance company, effective date, expiration date, and policy number.

In most cases, an insurance ID card that shows all of this information will qualify as proof of insurance. However, some lenders or leasing agents may also require you to prove that you’re carrying full coverage. In these cases, you might need to produce your policy’s full declarations page, which includes more information about the types of coverage and policy limits that you carry.

How to show proof of insurance

Showing your proof of insurance varies by state. For instance, two states don’t require you to always carry proof of insurance:

- Massachusetts: Your insurance information is already printed on your car registration—and because you should always have your registration in the car, there’s no need to carry a separate insurance ID document.

- New Hampshire: Though it is the simplest way to demonstrate financial responsibility, car insurance is not mandatory for all drivers in New Hampshire—so there are no laws about showing proof of coverage.

If you do need to show proof of coverage, you can always do that through your physical insurance card, as proof of insurance on a printed card from your insurance company is accepted in all 50 states.

You can also usually show that you have coverage by pulling up an electronic version from your insurance company’s mobile app. Digital proof of insurance is accepted in 49 states and Washington, D.C. The only state that doesn’t require law enforcement to accept an electronic copy of an insurance card is New Mexico, which means you’ll need a physical version of your insurance card even if you’re just driving through the state.

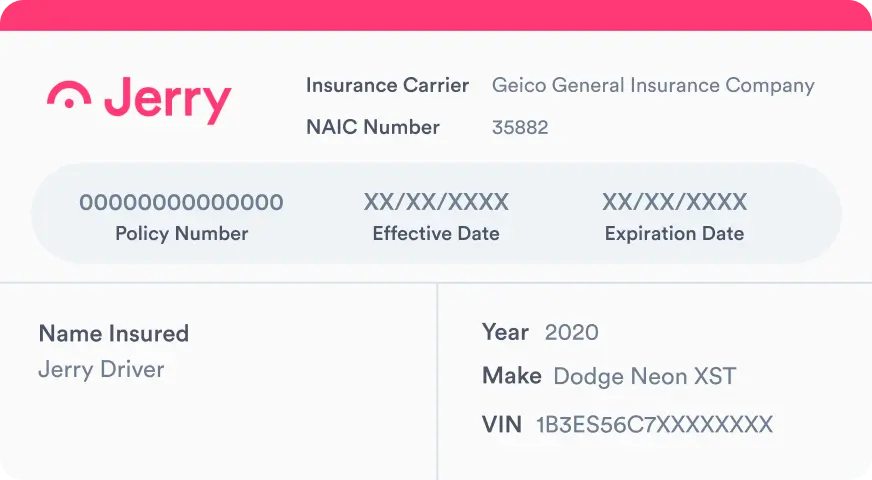

Another way to show proof of insurance digitally is through the Jerry app. You can find insurance ID cards on the app’s home screen, so you won’t have to search for the information you need.

Learn more: What is temporary car insurance? Do I need it?

Why and when you need proof of insurance

Car insurance is legally required in nearly every state, so you need to be able to prove that you have coverage whenever you drive your vehicle, and especially in the below scenarios:

- After a car accident

- When you get pulled over

- At the DMV

- If you lease a car

Learn more: Standard types of car insurance

What to do if you’re caught without proof of insurance

The consequences of not showing proof of insurance vary by state. Some states will give you a grace period to prove you have coverage, but if you can’t show proof, you may be treated as if you are driving without insurance. For example, if you are stopped by police and don’t have proof of insurance with you, the officer can write you a ticket.

Keep in mind that a failure to provide proof of insurance is a completely different offense than driving an uninsured vehicle. Driving without insurance is far more serious. It can result in fines, license suspension or revocation, vehicle impoundment, license reinstatement fees, and even jail time. It can also trigger higher rates for auto insurance in the future.

So if you’re ticketed because you lost an insurance card or otherwise can’t prove that you’re covered, you can contest the ticket later if you did have coverage at the time. However, you should respond to the ticket immediately so that the state doesn’t revoke or suspend your license, which they might do if they think you don’t have insurance.

While the charges could be dismissed, you may still have to pay a fine and/or court fees.

Law enforcement departments in many states use an electronic insurance verification system to identify uninsured drivers, where they can match vehicle registration to insurance records. If they don’t match, it will appear as though you don’t have coverage and you’ll be reported to the DMV. To fix this, contact your insurer right away to have the information corrected and resubmitted. In rare cases, your insurance company might have made a mistake in reporting your coverage to the state.

To learn more, visit your state’s Department of Motor Vehicles website for information about its minimum insurance requirements and the penalties for not having proof of insurance.

Kayda Norman is an insurance writer and editor with more than 12 years of content experience. She previously worked at NerdWallet as an insurance writer and content management specialist. She has covered a wide range of insurance topics such as high-risk drivers, auto insurance rate factors, and credit-based insurance scores. Her work has been featured in The New York Times, The Washington Post, and USA Today.

Everett Cook is an award-winning journalist and editor with more than 10 years of experience across a variety of industries. In editing for Jerry, Everett’s mission is to help readers have a better understanding of the costs of owning or leasing a car and to better understand their vehicle in terms of insurance and repairs. Prior to joining Jerry, Everett was an editor for Axios. His previous work has been featured in The New York Times, The Los Angeles Times, The San Francisco Chronicle, The Atlantic, Atlantic Re:think, The Boston Globe, USA Today, and others. He’s also been a freelance writer and editor with experience in SEO, audience building, and long-term content roadmaps. Everett is a proud graduate of the University of Michigan.