Soaring costs for vehicle repairs are breaking American drivers’ budgets, forcing many to borrow money to keep their cars and trucks running and pushing some into delinquency and default on existing car loans.

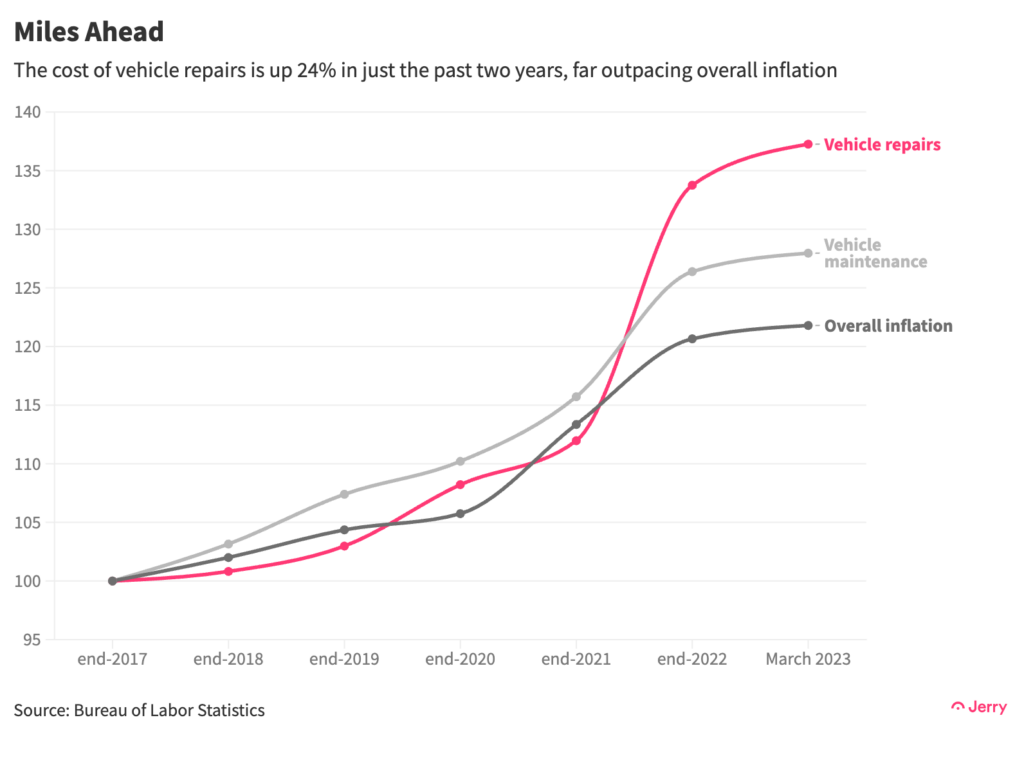

It’s another side to a growing car-ownership affordability crisis. As with so many products and services in the COVID-19 era, the cost of repairing cars and trucks has surged in recent years, rising 30% since March 2020, faster than overall inflation, which itself was the highest in four decades.

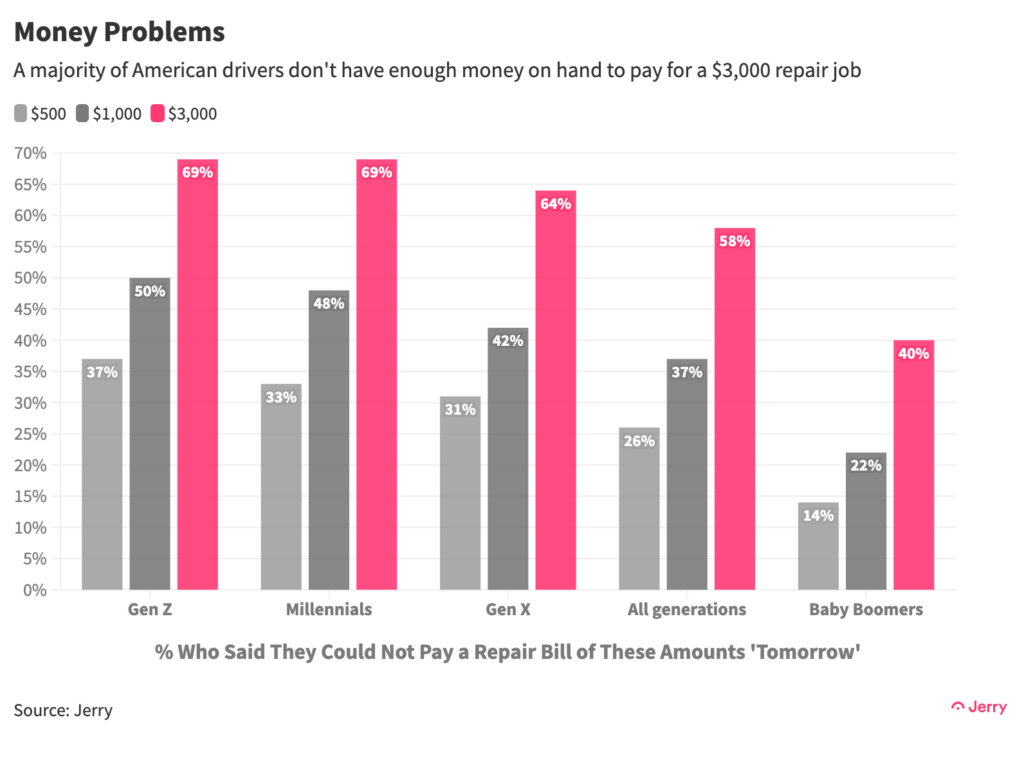

In a survey of 1,400 American car owners conducted by Jerry, a quarter of respondents (26%) said they would not be able to cover a $500 repair bill if their car broke down tomorrow. More than half (58%) said they couldn’t pay for a $3,000 repair bill—roughly the cost of replacing the transmission on a Honda Accord.

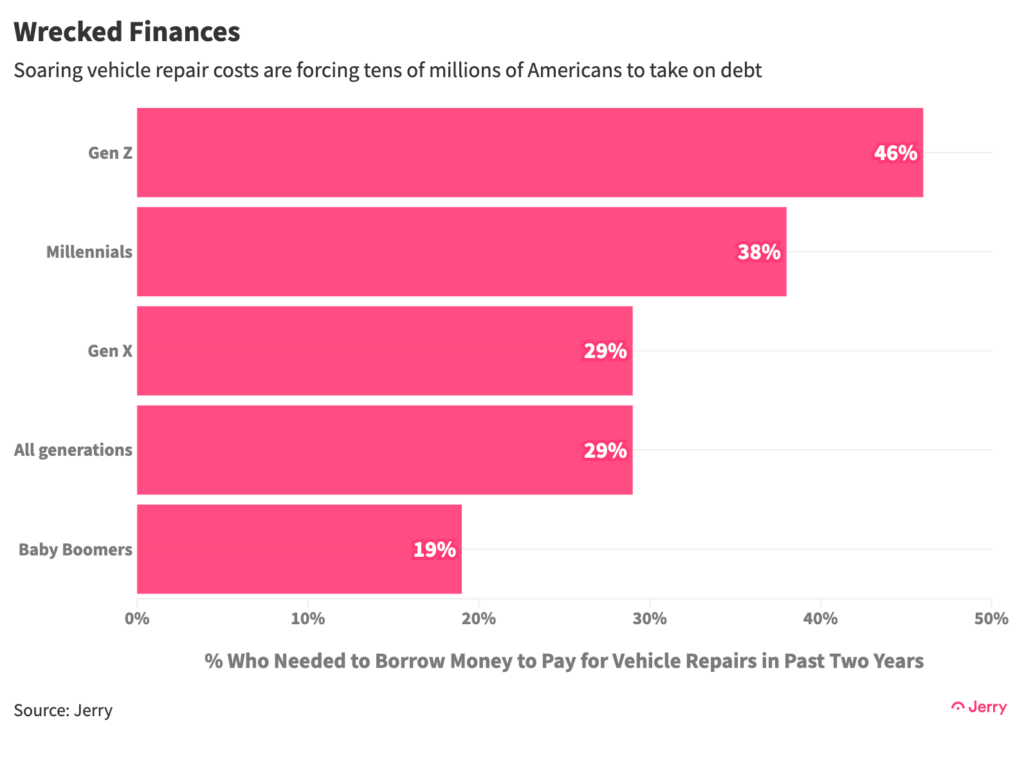

Many are borrowing the money—29% said they took on debt in the past two years to pay for a car repair. This is only adding to financial instability for many. Six percent of vehicle owners said a repair bill caused them to default on an auto loan in the past three years.

Key Insights

- Nearly a third of American vehicle owners (29%) took on debt to pay for vehicle repairs in the past two years.

- One in four (26%) Americans say they would not be able to pay for a $500 repair job if their car broke down tomorrow. More than a third (37%) could not cover a $1,000 repair job, and more than half (58%) could not pay $3,000.

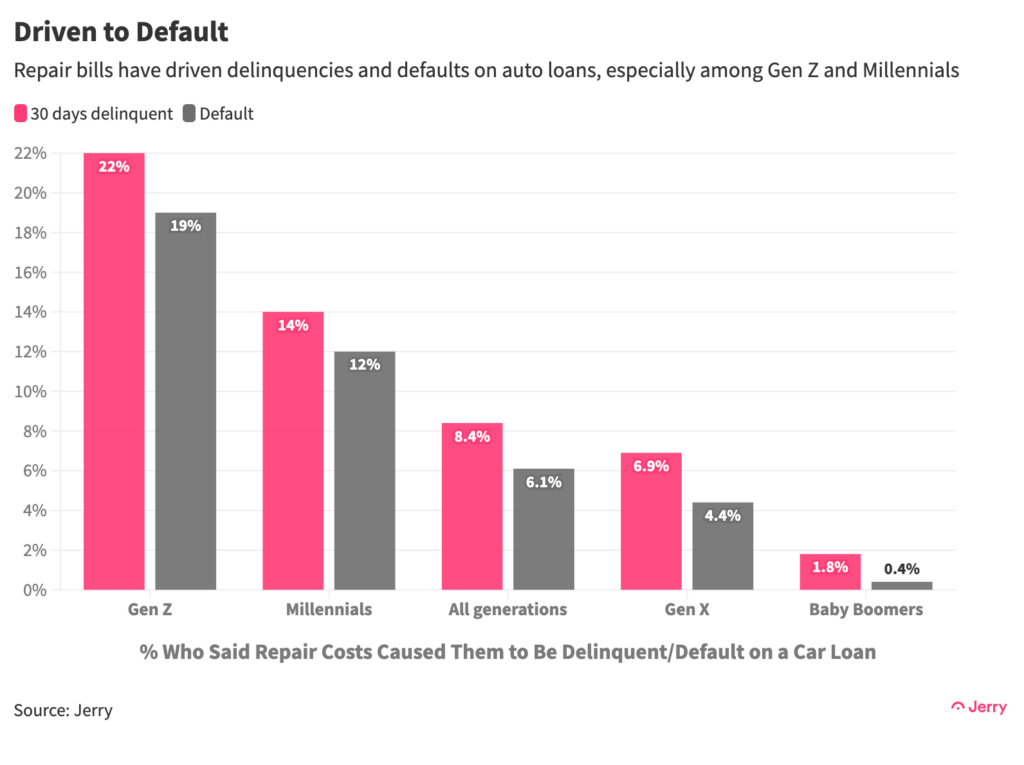

- In the past three years, 6% of American drivers have defaulted on a car loan because repair costs left them unable to keep up with payments or exceeded the value of their vehicle. For members of Gen Z, the figure is 19% and for Millennials it is 12%.

- More than one in five American vehicle owners say they would definitely or probably lose their job if their car broke down and they were unable to quickly repair it. Only 41% said they definitely would not lose their job.

- A third of American vehicle owners worry “often” or “always” that an unexpected car repair bill will create a stressful financial hardship for them and their family. More than 8 in 10 worry about that at least sometimes.

Repair Costs

There are multiple factors behind the surge in repair costs. For one, parts are more expensive and difficult to obtain, partly due to COVID-driven supply-chain disruptions. Also, a shortage of auto technicians is adding to pressure on prices, driving up wages and contributing to a record backlog of repair work at shops across the country.

Many of those paying the price are owners of older vehicles, which means tens of millions of people. As prices for new and used vehicles spiral higher, more Americans are buying older cars and trucks and keeping them longer, pushing the average age of personal vehicles on the road to a record-high 12.2 years in 2022. Those older cars need to be repaired when they break down—a nearly inevitable event.

But even newer cars are more expensive to repair, equipped with more sophisticated and expensive technology that requires greater expertise to fix—at the cost of higher wages for technicians. Driver-assistance technologies, in particular, require trained specialists who earn higher pay than the average automotive technician.

Perhaps that’s why people in different income groups, with the exception of the top quintile, reported little variation in borrowing to pay for repairs. Among the bottom four quintiles, 30%-32% said they took on debt to pay a repair bill in the previous two years.

Underlying Financial Stress

Of those 29% of Americans who were forced to borrow money to keep their cars running over the past two years, more than half (56%) borrowed $1,000 or less, including a quarter (24%) who borrowed less than $500, a clear sign of financial stress. Others took on much more debt. Nearly one in five (18%) of those who needed to borrow took on more than $3,000 in debt, while 3.1% borrowed more than $10,000.

Younger generations—Gen Z and Millennials—were more likely to borrow money for repairs than their older counterparts, with nearly half of Gen Z (46%) saying they did so, compared with only 19% of Baby Boomers. Among Gen Z, 15% said they borrowed from friends and family—their most frequent source of funding—while 13% said they took out a bank loan and 9.2% took out an auto title loan.

Other generations relied most often on their credit cards, with the intention of paying them off over time, while 10% of Millennials borrowed from friends and family, 8.6% took out bank loans and 3.2% took out auto title loans.

Delinquencies and Defaults

Sometimes repair bills stretch budgets to the breaking point, creating delinquencies and defaults. That’s what happened with many of the people who borrowed money for repair bills. In all, 8.4% of respondents say a repair bill caused them to be more than 30 days late on an auto loan payment in the past three years. That includes more than one in five members of Gen Z, 14% of Millennials and 6.9% of Gen X.

Six percent of American vehicle owners report defaulting on a car loan during the past three years because repair costs left them without enough money to make payments or exceeded the value of their vehicle, rendering a repair pointless. Again, Gen Z suffered the worst—with 19% reporting such a default. The rate was 12% for Millennials and 4.4% for Gen X. Boomers avoided that fate almost entirely, with fewer than 1%.

Conclusion

The soaring cost of auto repairs is taking a toll on car owners, creating financial difficulties and the stress that goes along with them. While COVID accelerated the cost increases, the long-term trend remains up as car makers deploy ever-more sophisticated and expensive technology in vehicles. Electric vehicles offer hope of lower maintenance requirements, but for now the cost of repairs remains part of an increasingly burdensome affordability crisis for American drivers.

Methodology

All survey data is based on a nationally representative survey of 1,431 respondents conducted in May 2023 using Pollfish. Respondents were filtered to include only those aged 16-75 who owned a vehicle and were fully responsible for overseeing and paying for repairs and maintenance on that vehicle. More information about Pollfish and its audiences can be found on its website.

Data on overall inflation and the costs of vehicle repair and maintenance were gathered from the U.S. Bureau of Labor Statistics. The data was indexed to a Dec. 2017 starting point.

Henry Hoenig previously worked as an economics editor for Bloomberg News and a senior news editor for The Wall Street Journal. His data journalism at Jerry has been featured in outlets including CBS News, Yahoo! Finance, FOX Business, Business Insider, Bankrate, The Motley Fool, AutoWeek, Money.com and more.