Finding the best car insurance rates can seem daunting, but it doesn’t have to be. To ensure you’re getting the best deal, compare free online car insurance quotes from multiple insurers. A car insurance quotes comparison tool can streamline the process, allowing you to quickly and easily find the policy that best suits your needs and budget — and even get car insurance online now.

What is a car insurance quote?

A car insurance quote is a ballpark figure of how much you’ll pay for car insurance. Think of it as an estimate to help you compare prices across different car insurance providers.

How to get a quote for car insurance

There are four common ways to find free quotes: directly from an insurance company, through a local agent, from an insurance comparison website, or with the Jerry app, a car insurance quote comparison tool.

Here’s how to get car insurance.

- Insurance company (such as Progressive) website: While it’s convenient to get car insurance quotes directly from a provider’s website, trying to get auto insurance quotes from multiple companies this way can be time-consuming and may lead to overpaying.

- Local captive or independent agents: While these folks can offer personalized service, they may not always provide the most competitive rates. Captive agents, tied to a single insurer, might prioritize their commission over your best interests, while even independent agents could steer you towards higher-cost policies for personal gain

- Quote comparison websites: Even the best car insurance comparison websites are essentially lead generation sites rather than actual online brokers. Once you request quotes, your information may be sold to marketing companies, or it may direct you to additional lengthy, multi-step quote processes.

Jerry car insurance comparison app: Jerry’s car insurance comparison app simplifies the process of finding affordable car insurance, all while safeguarding your information with advanced security measures. And because we’re a licensed broker, you can buy a policy right in the app.

How does car insurance work?

Car insurance is a financial safety net. Just like health insurance protects you from astronomical medical costs, car insurance shields you from financial trouble in case of an accident or other covered incident. Drivers can shop around car insurance companies to find the right policy. A policy lays out what’s covered, the limits, and how much you’ll pay each month or year (called a “premium”).

» Learn more: How to pay your car insurance

What do you need to get car insurance?

To get car insurance, you’ll need to provide information about yourself and your vehicle, including:

- Basic information: Your name, address, birth date and occupation, including driver’s license information for you and anyone else who will be on the policy.

- Vehicle information: Including the year, make, model, vehicle identification number (VIN), safety features, and whether you own or lease it.

- Driving history: Usually for the past five years, including tickets, accidents and any other traffic violations (excluding paid parking tickets).

- Usage information: Do you use your vehicle mainly for pleasure, commuting or business? How many miles do you drive a year? Be ready to provide realistic estimates.

- Insurance information: For instance, are you currently uninsured? How long have you been with your current insurer? Have you made any insurance claims in the past five years?

The more detailed information you provide about your insurance and driving history, your vehicle, and your habits, the more accurate your quotes will be.

So, what other information is needed for a car insurance quote? It may help to have information that can help you snag car insurance discounts on hand, such as a recent report card (for a student discount) or a copy of your military ID (for a military discount).

How are insurance rates determined?

Insurance companies aren’t psychic, but using statistics, they’re pretty good at guessing who’s likely to get into an accident. They weigh a complex set of characteristics like age, driving history, where you live and even the kind of car you drive to try to figure out how risky you are as a client.

Here are the key factors that affect car insurance rates.

- Driving record: Any at-fault accidents or violations in the last three to five years will likely affect your auto insurance rates. Usage-based insurance programs can help you lower your rate with discounts for real-time safe driving habits.

- Location: Insurers look at crash statistics, crime rates, and population density in your zip code when calculating your insurance premiums. If you live in a high-risk zip code, parking in an enclosed garage could help lower the cost of your coverage. State laws factor in, too. Minimum coverage can be more expensive in certain locations; for instance, insurance costs considerably more in New York than other states because it requires drivers to purchase personal injury protection (PIP), wrongful death coverage, and uninsured motorist coverage in addition to basic liability insurance.

- Vehicle type: Factors like the size and weight of the vehicle, the make and model, whether it’s electric, and the age of the vehicle itself all impact your rates. Bigger cars can cost more to insure since they are more likely to cause more damage in an accident. Sports cars with high-end features will cost more to insure than a standard sedan.

- Vehicle safety and security: Is it true that anti-theft devices will raise your insurance premiums? No, they usually lower them because they reduce the risk of theft. This is just one example of how safer vehicles with better anti-theft features tend to have lower rates for full coverage car insurance. What’s more, if your car insurance policy includes collision and comprehensive coverage, installing a security system or driver assistance tech could improve your auto quotes.

- Insurance history: If you don’t have a current insurance policy — or if your prior provider reports claims on your policy — you’ll see higher rates. Make sure your new policy starts before your old coverage ends to avoid a costly insurance lapse.

- Credit-based insurance score: Missed payments or nonpayment of your previous insurance bills can affect the cost of car insurance coverage. So can your overall credit score (in most states), which influences the credit-based insurance scores that insurance companies use in underwriting.

- Gender: Male drivers pay more than female drivers for the same coverage — and the difference is greater at younger ages.

- Marital status: Yes, married people pay less for car insurance. Providers see married people as more financially stable and responsible.

- Age: Young drivers pay more — especially teen drivers. If you’re shopping for car insurance for cheap with a new driver under 25 years old on your policy, expect higher rates. Taking advantage of discounts can help young drivers find relatively low cost auto insurance online.

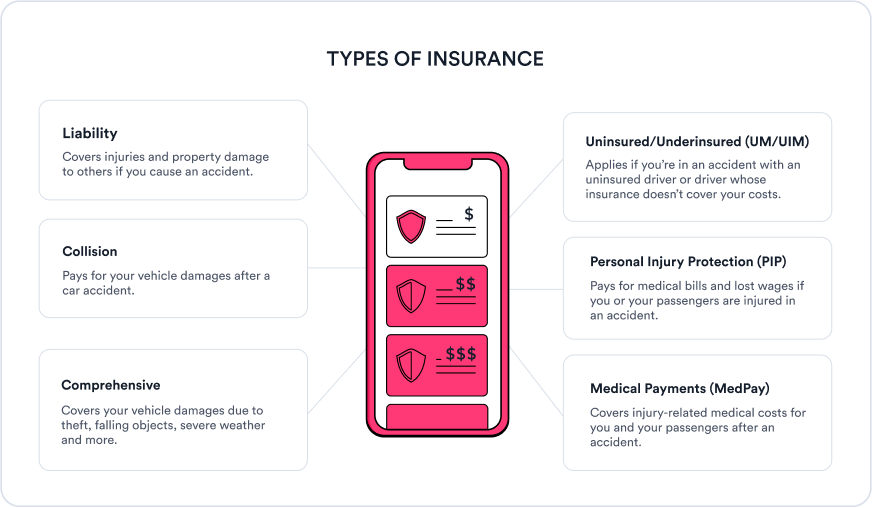

Types of car insurance

The three main types of car insurance are liability, comprehensive and collision. Most states (except New Hampshire) require liability insurance, and if you’re financing or leasing a car, you’ll usually need both comprehensive and collision coverage. That’s why these types of car insurance coverage are so common.

Let’s take a closer look at the typical types of car insurance coverage.

Liability coverage

Most states make you get liability insurance. This covers two things: bodily injury and property damage. If you cause an accident, liability insurance helps pay for the other person’s medical bills (bodily injury) and car repairs (property damage).

Uninsured/underinsured motorist (UM/UIM)

If you’re in an accident, and the other driver doesn’t have insurance — or doesn’t have enough to cover the costs of the damage — Uninsured/Underinsured Motorist (UM/UIM) coverage can come in handy. So, what does underinsured coverage provide? It fills the gap between what the other driver’s insurance pays and what you’re actually owed. This type of car insurance is required in some states.

Collision coverage

Collision insurance covers expenses to repair your vehicle if you’ve been in a traffic accident, no matter who is at fault. While it’s not always required by law, your lender will probably make you get it if you’re leasing or financing your car. Just remember, you’ll have to pay a deductible on this coverage before the insurance kicks in.

Comprehensive coverage

Comprehensive insurance covers repair costs unrelated to a collision, such as from a weather event, theft, vandalism or even hitting an animal while driving. Like collision, comprehensive insurance is typically required by lenders, though not by state law.

Personal injury protection (PIP)

No matter who’s at fault in an accident, PIP — or personal injury protection — helps cover medical bills, lost wages, child care and other expenses for anyone in your vehicle who is injured. It is required coverage in some states.

Is bodily injury the same as PIP?

Both PIP and bodily injury coverage pay medical bills after an accident; however, bodily injury covers other drivers’ bills if you’re at fault, whereas PIP covers your bills and your passengers’ bills, regardless of fault.

Medical payments (MedPay)

MedPay is an optional add-on to your car insurance policy that helps cover medical expenses — like doctor visits, hospital stays, surgery, etc. — for you and your passengers in case of an accident, regardless of fault. It differs from PIP as PIP covers things like lost wages.

Rideshare coverage

Your standard car insurance usually doesn’t cover you when you’re driving for a rideshare service. To be fully protected, you might need to add rideshare coverage to your policy.

Other optional types of car insurance

The above kinds of car insurance are the ‘major players,’ but there are several additional customizations you can opt into if you’d like.

- New vehicle replacement coverage: Good for brand new vehicles, this coverage protects your new car’s full value — even if it’s totaled — preventing losses due to depreciation.

- Gap insurance coverage: Gap insurance helps protect you financially if your car is totaled and you owe more on your auto loan than the car is worth.

- Roadside assistance: A useful add-on for unexpected situations while on the road.

Rental reimbursement coverage: This helps pay for a rental car while your vehicle is being repaired due to a covered claim like an accident or theft.

What else you need to know

What is “full coverage” car insurance?

Full coverage car insurance is a general term used to describe a policy that includes liability, comprehensive and collision coverage, protecting you and your vehicle in most situations. It’s a common way to refer to a policy that offers this level of protection for both you and your vehicle, though it’s not an official insurance term.

Liability vs. full coverage insurance

Liability insurance covers damage or injury you cause to others in an accident, and is required by law in most states. Full coverage, meanwhile, refers to having both liability and physical damage coverages (such as comprehensive and collision). Generally speaking, liability-only coverage is best for older cars with low value.

Which is more expensive, collision or comprehensive?

According to the Insurance Information Institute, collision coverage ends up costing you more out-of-pocket than comprehensive. The average cost of collision coverage is about $290 per year, roughly $150 more than the average cost of comprehensive coverage (which costs about $134 annually).

How much car insurance do you need?

Before you start comparing car insurance quotes, think about what you can reasonably afford to spend on insurance. Also consider how much coverage you need ahead of time.

It’s helpful to compare policies that all offer the same amounts and types of coverage so you can really see which company is offering the best rate — if a policy is cheaper but it offers considerably less protection, it may not actually be a better deal.

While you’re hoping to get cheap car insurance, make sure you’re not sacrificing quality or coverage to get a lower rate. Going beyond the minimum coverage requirements is usually a good idea, and being too thrifty could end up costing you more down the line if you need to pay out of pocket.

Here’s what to consider as you determine the right amount of car insurance for your risk tolerance.

» Learn more: What is the cheapest car insurance?

Your coverage preferences

Liability car insurance policy limits are formatted as XX/YY/ZZ, where

- XX = bodily injury/person

- YY = bodily injury/accident

- ZZ = property damage/accident

The split limits of typical state minimum liability requirements are 25/50/25, which refers to $25,000 of bodily injury liability per person, $50,000 of bodily injury liability per accident, and $25,000 of property damage liability per accident.

But for many drivers, this state minimum coverage isn’t practical enough to provide adequate financial protection in the event of an accident. Drivers should consider higher coverage amounts depending on their vehicle and financial situation.

Because liability insurance won’t pay for any physical damages to YOUR vehicle, many drivers also add full coverage insurance (comprehensive and collision) to their policies.

Your budget

Before you shop, evaluate your budget and estimate your car insurance cost. It’s important to choose a policy that you can comfortably afford, but that doesn’t mean you should always go for the cheapest policy you can find. It’s often worth paying a little more for additional coverage to protect you from significant out-of-pocket expenses if you need to file a claim.

How much is car insurance?

Although there are a number of factors that will go into calculating your individual car insurance rates, looking at average rates can give you a general idea of what you might pay. Our experts analyzed thousands of car insurance policies across dozens of insurance companies quoted in 2024 and 2025.

Average car insurance rates by state

What are the states with the most expensive car insurance?

|

Avg Monthly Quote

|

State

|

|---|---|

| $603 | NY |

| $387 | MD |

| $371 | CT |

| $355 | NJ |

| $336 | GA |

What are the states with the cheapest car insurance?

|

Avg Monthly Quote

|

State

|

|---|---|

| $116 | VT |

| $139 | ID |

| $144 | WY |

| $151 | IA |

| $154 | MT |

Insurance rates by provider

Jerry’s experts analyzed thousands of real policies quoted to our customers to learn more about what drivers pay each month for minimum liability insurance. Here’s a list of insurance companies plus the average costs for minimum liability coverage.

Who is the cheapest car insurance provider?

|

Avg Monthly Quote

|

Insurance Company

|

|---|---|

| $126 | Aspire Advantage |

| $165 | Anchor General |

| $172 | Commonwealth Insurance |

| $191 | Bluefire |

| $195 | Aspen |

| $197 | Freedom |

| $197 | Safeco |

| $199 | Mercury |

| $216 | Progressive |

| $218 | Trexis |

» Learn more: The best car insurance companies

Insurance rates by car

Car insurance rates are influenced by a vehicle’s make and model, with factors like value, safety features, theft risk, and repair costs playing key roles. Luxury cars often have higher premiums because of the potential for expensive repairs, while vehicles with advanced safety features and favorable safety ratings may qualify for lower rates.

What are the most expensive cars to insure?

|

Avg Monthly Quote

|

Car Make

|

|---|---|

| $730 | Polestar |

| $634 | Bentley |

| $462 | Maserati |

| $442 | Tesla |

| $439 | Genesis |

| $423 | Alfa Romeo |

| $381 | Mercedes Benz |

| $376 | Jaguar |

| $333 | Land Rover |

| $326 | Aston Martin |

What are the cars with the cheapest insurance?

|

Avg Monthly Quote

|

Car Make

|

|---|---|

| $60 | Sprinter (Dodge Or Freightliner) |

| $64 | Eagle |

| $76 | American Motors |

| $82 | Geo |

| $125 | Plymouth |

| $135 | Freightliner |

| $135 | Oldsmobile |

| $144 | Suzuki |

| $146 | Isuzu |

| $155 | Saab |

Can you find car insurance estimates by model?

Yes, you can find car insurance estimates by model using various online tools and resources. Keep in mind that these are only estimates though, as they don’t take into account your specific age, location, driving history and more.

Car insurance rates by age chart

Car insurance rates are generally lower for older drivers (ages 25 to about 70) and higher for younger drivers (under age 25) and senior drivers (older than 71) because of risk factors associated with each age group. However, these numbers vary by company. For instance, GEICO states age 25 is when its rates trend downward, whereas Progressive states the rates drop at age 19 and again at age 34 before trending upward again at age 75.

Here’s the average car insurance cost per month by age.

|

Age Group

|

Avg Monthly Quote

|

|---|---|

| 18-20 | $397 |

| 21-24 | $336 |

| 25-34 | $263 |

| 35-44 | $234 |

| 45-54 | $216 |

| 55-64 | $198 |

| 65+ | $203 |

Is insurance higher on younger drivers?

Yes, because this age group — especially teenagers — is inexperienced and thus, more prone to accidents (and more likely to make a claim), insurance rates are higher for younger drivers. As drivers gain more experience and build their driving record, their risk lowers, making it easier to find cheaper car insurance quotes.

» Learn more: How to find cheap car insurance for new drivers

At what age does insurance go down?

Assuming a clean driving record, insurance premiums typically start trending downward after drivers turn 25 years old. This is when insurance companies generally perceive drivers as statistically less likely to be involved in accidents. That said, your mileage may vary, as individual insurance companies use different algorithms to calculate risk and determine premiums.

How to lower my car insurance?

If you want to lower your car insurance premium, you have a few choices:

- Raise your deductible. Increasing your deductible — the amount you pay for a claim before your insurance kicks in — will reduce your rate. Select the highest deductible you could afford to pay out of pocket in the event of a claim. A common deductible is $500, but many people opt for $1,000 instead.

- Reduce your coverage. Removing or reducing certain coverages can bring your rates down, but you want to ensure you still meet the minimum required coverage in your state.

- Change your payment plan or term. If you pay your premium all at once instead of monthly, many insurance companies will offer you a discounted rate.

- Bundle house and car insurance, or other coverages. You can typically save by combining your new car insurance policy with another policy under the same insurer. For instance, many find savings when they get car and home insurance quotes together.

All things considered, the easiest (and quickest!) way to lower your car insurance premium is to compare car insurance quotes from different insurance providers. You’ll likely be able to find the same coverage you already have at a lower rate.

Tips for finding the best car insurance quotes

Forget the hassle of researching minimum insurance requirements and digging around for the lowest premium. Just compare car insurance quotes online and choose the one that best fits your budget and coverage needs.

Simplify getting car insurance quotes online with Jerry

For anyone thinking: “I need car insurance now,” the answer is Jerry, America’s first AllCar™ app. With PriceProtect™, compare car insurance quotes from more than 50 top insurance companies at lightning speed — we’re talking minutes..

Why?

- It’s convenient and will save you time — and it takes care of all the administration on your behalf

- It gives you access to multiple providers so you can quickly and accurately compare coverage options

- It’s a launchpoint to managing other car-related money issues such as refinancing car loans, estimating repair costs, and getting rewarded for safe driving.

As a licensed broker, you can buy the policy in-app instead of being redirected to another form, like other resources that promise online cheap auto insurance. In short, Jerry has all your insurance needs handled from start to finish. And it automatically alerts you when better rates are available so you know you’re always getting the best deal.

With Jerry, you can often find the same coverage you already have — but for less. Just insert the quick basics and it will get to work finding cheap car insurance quotes for you.

Once you’re ready to make the switch, Jerry handles all the paperwork. It’s the quickest, easiest way to get cheap car insurance quotes and save money.

Review multiple quotes

Now that you know how to get multiple quotes for car insurance, it’s time to look closely at what offers are available. Comparing rates from multiple providers is the best way to find the right car insurance coverage at the right price.

But here’s the thing: Each insurance company uses its own formula to calculate this risk. They each weigh the factors a little differently — and that means they’ll each rate you a little differently.

Know what to look for in car insurance plans

A full coverage auto insurance policy with high liability limits and add-ons like roadside assistance costs more than a cheap state minimum policy. But that doesn’t mean you should purchase a bare-minimum policy just to shrink your premium — you’ll also limit protection and sacrifice peace of mind.

Check for discounts

Take advantage of any car insurance discounts you may be eligible for — such as safe driver discounts for staying accident-free or telematics discounts for tracking your driving. You can also receive a discount for bundling your car insurance with homeowners or renters insurance.

Read customer reviews

Be informed. Consult reviews and pay attention to details about claims experiences, customer service interactions, responsiveness, and other elements that are important to you. Try to read between the lines and spot potential issues or negative patterns that would influence your choice.

FAQ

-

What’s the minimum coverage needed for a financed vehicle?

-

How much should I spend on car insurance?

-

Should I buy more car insurance than the minimum coverage?

-

Do I need full coverage?

-

Why does car insurance go up?

-

Do I need gap insurance if I have full coverage?

-

Does your credit score affect car insurance?

Methodology

Data in table are from quotes produced for Jerry customers on or after Jan. 1, 2024.