Key Takeaways

- Car insurance offers essential financial protection against accidents, theft and other types of vehicle damage. Depending on your coverage, it can even help with medical bills and legal expenses for you and others involved in an accident.

- Choosing the right insurance involves understanding each type of coverage and matching it to your needs. There’s no one-size-fits-all approach — what’s right for you may not be right for someone else.

- Multiple factors affect car insurance rates, which means shopping around can unlock major savings. Comparing different policies gives you the power to choose the coverage with the most value for your situation.

- Reviewing your policy regularly helps you get the best coverage for your budget.

All but one state has mandatory auto insurance coverage laws for drivers, so chances are high that you’ll find yourself shopping around for a policy at least once. Even after you have coverage, it can also pay to shop around regularly to make sure you have the right policy at the best possible price.

Car insurance is more than just a legal requirement though — it’s your financial safety net when life gets messy. Accidents, theft, storms, injuries — it’s there for it all. Whether you’re a first-time buyer or reviewing an existing policy, knowing your car insurance options — and picking the right one — gives you the peace of mind you deserve.

The process of buying auto insurance is more than just getting a single quote online, though. You’ll want to first determine your coverage needs, gather insurance quotes and options from multiple carriers, and design the policy that uniquely fits you, your driver profile and your budget.

Here’s a look at how to shop for car insurance and find the best rates along the way.

Shopping for car insurance: A step-by-step guide

Buying auto insurance isn’t a one-size-fits-all process, since everyone’s individual needs, requirements and even budget will vary. However, there are five simple steps that any driver can follow to shop smart and find the best, most affordable coverage possible, no matter what you need.

Step 1: Decide how you’ll shop

There are many ways to shop for insurance coverage, whether you prefer to work with someone one-on-one or compare auto insurance options in your pajamas. You can opt to:

- Request quotes directly from individual auto insurance companies.

- Go through an insurance agent or agency.

- Work with a trusted and independent insurance broker, like Jerry.

Getting quotes from each potential carrier can be an arduous experience, and means entering your information repeatedly before comparing all of your individual quotes. Not only is this time-consuming and complex, but you might miss out on carriers that could actually be a great fit.

Insurance agents offer a curated and traditional experience, but agencies typically only partner with one or two carriers. This could mean leaving coverage options and/or potential savings on the table.

With a broker like Jerry, you’re able to compare personalized auto insurance quotes from dozens of top providers in your area at once. The entire process takes less than two minutes online, allowing you to quickly find the best deals for your specific needs.

Online brokers and comparison tools make it easy to find and compare different quotes all at once. For example, if Company A offers $170/month with a $500 deductible while Company B offers $85/month with similar terms, opting for Company B could save you over $1,000 annually. It’s important to compare coverage details along with price to keep things apples-to-apples and get a sense for what you’re paying for.

Step 2: Determine your coverage needs

It’s difficult to make an educated decision if you don’t yet know what to look for when shopping for car insurance quotes. That’s why one of the most important steps is to figure out what sort of insurance coverage options you need and what your policy should look like.

At the very least, your policy will need to meet the state minimum coverage requirement where you live, which typically includes a combination of bodily injury and property damage liability and/or personal injury protection. Many drivers may find that they are more comfortable with higher coverage limits or even buying other optional types of coverage, too.

In no-fault states, for instance, each driver’s insurance covers their own injuries, no matter who is at fault — in these cases, Personal Injury Protection (PIP) is an additional requirement.

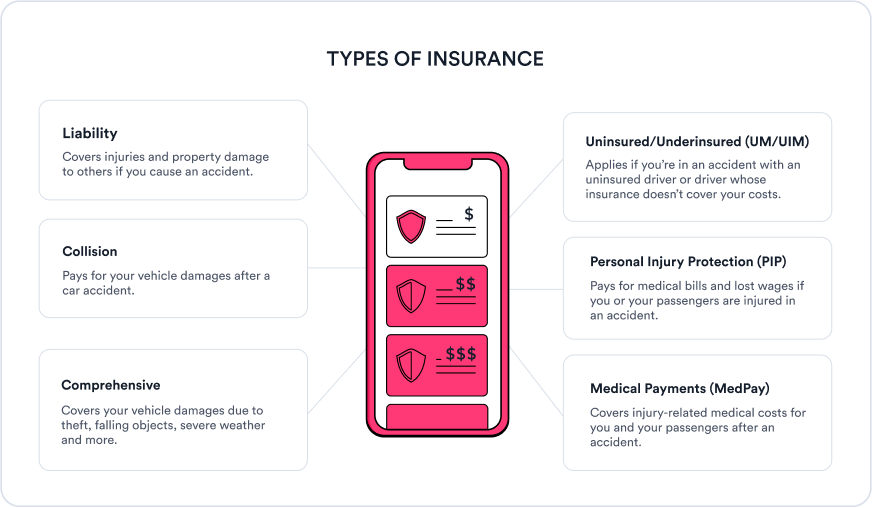

Here are the most common coverage options that may be available.

Liability insurance

Nearly all drivers are required to carry a minimum amount of liability coverage in order to legally drive in their state. This usually includes both bodily injury coverage (which pays for someone else’s medical expenses) and property damage liability coverage (which pays to repair someone else’s car or property), if you’re deemed at-fault for an accident.

Each state sets its own laws regarding minimum liability insurance limits, though you can always purchase extra coverage to give you more financial protection. The most common state limits are “25/50/25” which includes $25,000 per person in bodily injury liability coverage and at least $50,000 total per accident, along with $25,000 in property damage liability coverage.

Buying more coverage — like $50,000/$100,000/$50,000 or even “100/300/100” — will cost more but protects you and your assets even better. And you might be surprised by how affordable this extra coverage can be.

If you’re a high-risk driver or have an SR-22 filing requirement, it can be difficult (and costly) to buy even state minimum car insurance. If you’re denied coverage by multiple insurance providers on the open market, consider looking into a non-standard car insurance company or state coverage programs to find the insurance you need.

Learn more: Find cheap car insurance quotes for high-risk drivers

Collision and comprehensive coverage

Liability coverage protects other drivers and their property, while collision and comprehensive coverage protect you and your vehicle. Without either of these coverages, you may pay out of pocket to repair or replace your car if you’re at-fault for an accident or even if it’s stolen.

- Collision coverage pays for collision-related damages to your vehicle, whether you hit another car or a stationary object (like a tree or fence) no matter who’s at fault. This coverage also extends to single-car rollovers as well as hit-and-runs. If you own a newer vehicle, this can be especially useful. It is also usually required if you’re financing your car.

- Comprehensive coverage covers vehicle repairs or a replacement if damages are caused by something other than a collision, such as vandalism, theft, flooding or another natural disaster. This coverage also kicks in if you collide with an animal. It can be a smart choice if you live in an area with high rates of theft or severe weather.

While you can sometimes opt to add just one, most drivers combine both comprehensive and collision coverage together; this is often referred to as buying a full coverage policy. This is optional in many cases, but you might be required to buy full coverage if you are still paying off an auto loan or lease.

While full coverage insurance gives you the most financial protection, it does cost more than liability-only coverage, though factors like your car insurance deductible and coverage limits will also impact the price.

Other coverages

Some states may require you to buy other coverages in lieu of, or sometimes alongside, liability protection. Even if this other coverage isn’t required in your state, certain options can keep you even better protected on the road.

- Uninsured/underinsured motorist coverage (UM/UIM): A 2022 study from the the Insurance Research Council found that around 14% of U.S. drivers are uninsured, in addition to many drivers who own coverage but have too-low of policy limits. UM/UIM coverage protects you if you get into an accident with one of these drivers by helping you pay the resulting medical and property damage bills. While optional for most drivers, this coverage is required in Kansas, Massachusetts and Missouri.

- Personal injury protection (PIP): Personal injury protection is required in all no-fault states and Oregon, where it covers things like medical bills, lost wages, essential services, and even funeral expenses for you and your passengers after an accident, regardless of who’s at fault. In certain states, some companies offer it as an optional coverage.

- Medical Payments (MedPay): Similar to PIP, MedPay covers health-related expenses after an accident. It’s only required in New Hampshire and Maine, but is available as optional coverage in most other states.

Factors Influencing Coverage Needs

- Vehicle Type and Age: Older vehicles with lower market value don’t always need full coverage. For newer or financed cars, comprehensive and collision coverage can help protect their value and are often required by lenders.

- Driving Habits and Usage: Daily commuters or drivers spending a lot of time on the highway may benefit from higher liability limits, since accidents are more likely.

- Financial Situation: Choosing the appropriate deductibles and limits can also depend on your budget and what you’re able to pay.

- Evaluating Coverage Options: Choosing the right coverage is all about balancing protection with cost. When you’re deciding on the right deductible, you want to strike a healthy balance between affordability and premium savings.

Step 3: Gather your documents

Car insurance shopping through a broker like Jerry makes the process faster and easier, but you will still need to provide certain documents to complete your purchase. Having this information on-hand will save you even more time and ensure you get the most accurate quotes.

To buy car insurance, you should have the following available:

- Personal information including all drivers’ names, birthdates, driver’s license numbers, SSNs and relevant driving history details.

- Vehicle information including the make, model, year, trim and vehicle identification number (VIN) of all cars listed on the policy.

- Previous policy information (if applicable) including your current coverage period, existing limits and any claims that have been filed in the last five years. While not required, this is a great reference when building a new policy and avoiding coverage gaps.

- Driver history information such as any previous tickets, accidents, suspensions and driving-related convictions that may appear on your driving record. Providing this information upfront could save you the hassle of rates changing later when your driving history is checked.

- Expected habits for all drivers, including monthly and annual mileage, where and why you drive, and how often you’re behind the wheel.

- Any special information, like SR-22 filing requirements and your case number.

Step 4: Shop and compare insurance providers

Now you’re finally ready to comparison shop, gathering quotes from multiple different providers to see which policy best meets your needs and budget. Jerry’s comparison tools make this incredibly easy by offering quotes from more than 50 top carriers in just seconds.

Be sure to factor in any car insurance discounts for which you might be eligible such as bundling. Bundling car insurance with other policies, like homeowner’s or renter’s insurance, can help save big — up to 25%. Plus, safety features — like day-time running lights, blind-spot warning and anti-theft devices — might help you qualify for special discounts and more savings.

In addition to bundling, each carrier offers different discounts on coverage, but some common options include:

- Safe driver discount.

- Multi-car discount.

- Good student discount.

- Safe vehicle discount.

You should also look beyond just the price tag, keeping in mind each carrier’s reputation, how they handle claims and factors like customer satisfaction ratings.

Real customer reviews can give you a feel for what to expect — like how claims are handled, how responsive customer support will be when you’re in a bind, and whether drivers feel their premiums are fair. Feeling good about the company you purchase a policy from can give you peace of mind. Shopping through Jerry allows you to do more than just compare car insurance quotes. You can also look at provider ratings and read real customer reviews to help you find the best carrier for you.

Step 5: Buy your new policy

Once you find the best carrier and coverage for the right price, it’s time to make your purchase.

Be sure to read your policy documents carefully before signing your insurance agreement. You’ll especially want to look at your:

- Coverage limits.

- Covered drivers.

- Exclusions.

- Deductible(s).

- Coverage period.

- Policy premium.

Be sure to schedule your new policy to start before your current policy’s end date to avoid an insurance coverage lapse. You should also note that your final rate may differ slightly from the initial quote you were given, especially if you made changes to your coverage or added certain information.

After purchasing, you’ll receive an insurance ID card as proof of insurance; this is required in most states. You can keep this card in your vehicle in case you’re stopped or involved in an accident, or reference it easily through the carrier’s app.

Don’t stop there

Learning how to shop around for car insurance will benefit you more than once. Over time, your premiums and coverage needs may change, so it’s actually smart to shop around and compare rates every six months or so or if you experience a big life event (like getting married, moving or getting in an accident). Even if you’re happy with your policy, this helps ensure that you’re always getting the best deal.

Factors That Can Affect Your Rate

Driving history: Tickets and accidents generally increase rates; maintaining a clean driving record is one of the best ways to keep your premiums low.

Insurance history: Gaps in coverage may increase rates. If you’re insured consistently, you can expect lower premiums than if you have a gap in coverage.

Age and Gender: Younger drivers and males often see higher rates since they, statistically, are more likely to get into accidents, according to data from the National Highway Traffic Safety Administration. It’s worth noting that insurers are not allowed to use gender when pricing policies in some states. But, insurers can use age in all states. Safe driving discounts can help bring these costs down.

Vehicle Type: Luxury or sports cars often have higher premiums because they’re costly to repair and have a higher likelihood of theft.

Location: If you live in an urban area, you can expect to see higher rates — there’s more risk of accidents and thefts in these areas.

FAQ

-

What is car insurance?

-

Is roadside assistance available through your insurance?

-

Why do I need car insurance?

-

What are the different types of car insurance?

-

What is a deductible?

-

How are car insurance premiums determined?

-

What is the difference between collision and comprehensive coverage?

-

What is full coverage car insurance?

-

Do I need full coverage?

-

What is gap insurance?

-

Is bundling your car insurance and homeowners insurance a good idea?

-

How can I lower my car insurance premium?

-

What happens if I drive without insurance?

-

Does car insurance cover rental cars?

-

Can someone else drive my car and be covered?

-

How do I file a claim?

-

What is uninsured motorist coverage?