Georgia’s cost of living is among the lowest in the country. In order to live comfortably, Georgia residents need to earn around $36,686 per year before taxes, which equates to a full-time wage of $17.64 per hour.

Georgia offers residents and visitors more than just great food, wine, music, and Southern hospitality. With access to Appalachia to the north, the Atlantic to the southeast, and a load of history and rich culture in between, Georgia makes for a great state to call home.

But how much will it cost you? In this article from Jerry

—the top-rated licensed insurance broker

—we aim to shed some light on the cost of living in Georgia. We’ll go over average food, transportation, and healthcare costs, then share some tips for finding affordable insurance in Georgia

. RECOMMENDEDNo spam or unwanted phone calls · No long forms

How high is the cost of living in Georgia?

The cost of living in Georgia is among the lowest in the nation, with a cost of living index of 89.2. This ranks Georgia as the 9th-lowest cost of living, just below Kansas (CODI of 89) and above Wyoming and Alabama (both with a CODI of 89.3).

The US national average is given a score of 100 on the cost of living index. Any number below 100 has a below-average cost of living, and any number above 100 has an above-average cost of living.

To give some additional comparisons to help make Georgia’s cost of living more salient, Florida has a CODI of 97.9, South Carolina sits at 95.9, and California’s CODI is 151.7 (the highest in the continental US).

Compared to the rest of the country, Georgia’s cost of living tends to be lower than most places. Let’s dive into some real costs to illustrate what this looks like in terms of food costs, healthcare, housing prices, and transportation fees.

Food: $280 per month

The most essential expense. For these food cost estimates, we’re talking groceries alone—no trips to McDonald’s or nights out at the bar. (But it seems that the price of eating out in Georgia tends to be comparable to the national average.)

Based on data from MIT’s Living Wage Calculator

, the average cost of food for a single adult in Georgia is around $280 per month. For a family of four, this grocery bill estimate increases to $821 per month. Healthcare: $492 per month

Healthcare costs are difficult to pin down for an area. The amount people spend on healthcare varies considerably depending on more factors than just local trends.

If you need prescription medication or have a family member with a chronic illness, of course your healthcare spending will be much higher.

That said, a 2020 report from the Bureau of Economic Analysis estimated that the average annual spending on healthcare in Georgia was $5,910 per person in 2020. That works out to around $492 per month, which is similar to the national average of $477 per month.

Housing: $885 to $1,417 per month

Housing prices in Georgia tend to be relatively affordable. The typical home value in Georgia (according to Zillow) is around $318,000. Compare this to the national average typical home cost of $337,560.

To put that in terms of monthly expenses, here is a breakdown of the average monthly housing payments for various unit types:

Median monthly mortgage payment: $1,417

Median one-bedroom rent: $985

Median two-bedroom rent: $977

Median three-bedroom rent: $1,102

Median four-bedroom rent: $1,377

Of course, these values vary considerably depending on where you live, and prices have been rising across the state. For example, the average rent for a one-bedroom apartment in Atlanta

is around $1,100, while the average rent in Warren County is about half that amount. Transportation: $459 per month

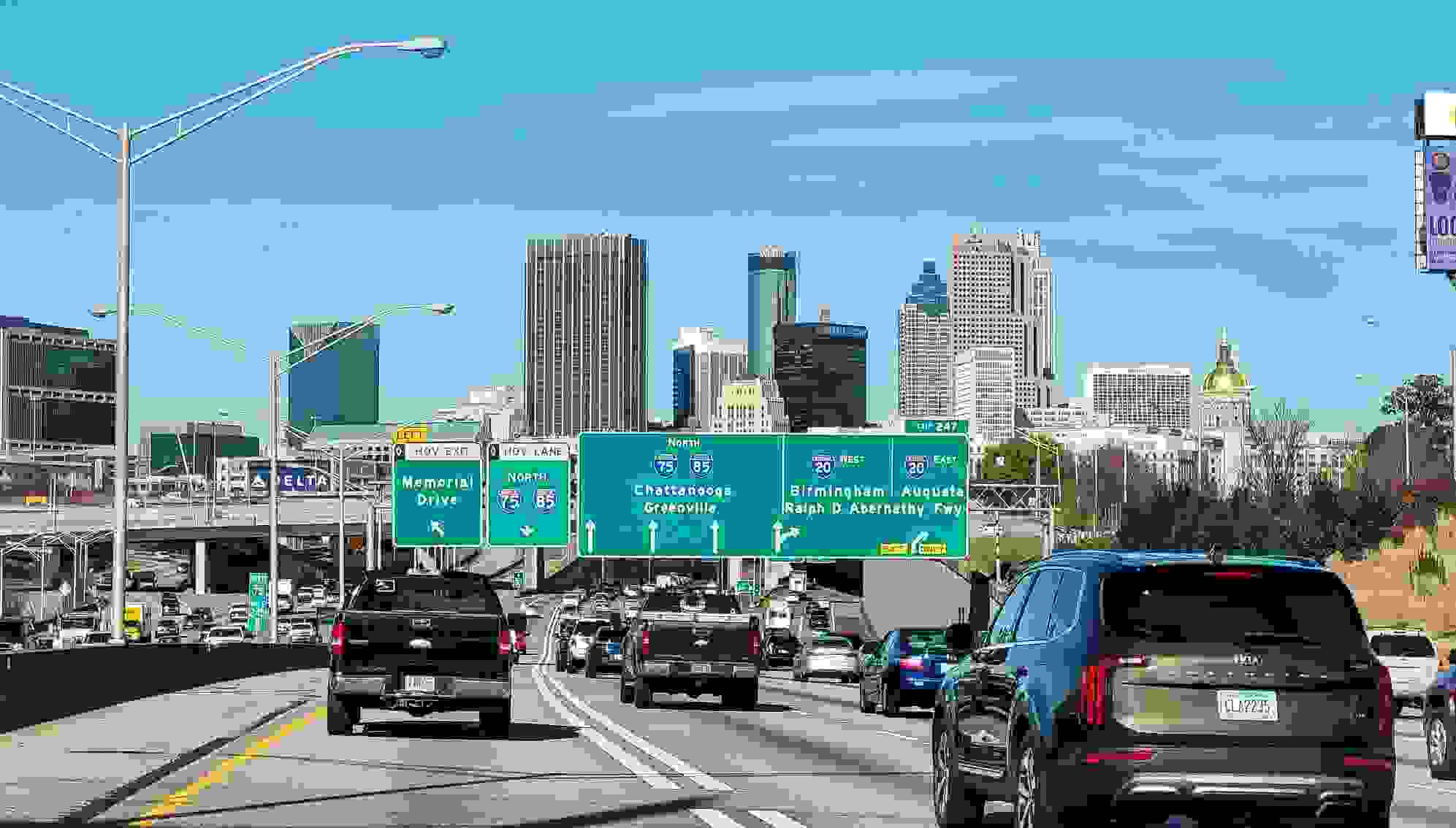

Transportation can be a major expense, especially for car owners—and as it turns out, most Georgians prefer to get around by car.

An estimated 89% of Georgia residents complete their daily commute by car. With an average commute time of 28 minutes, that’s a lot of driving and a lot of gas.

After factoring in gas, car insurance, monthly vehicle payment, public transport costs, and more, MIT’s living wage calculator estimated the average single adult in Georgia spends around $459per month on transportation, which is almost exactly the same as the national average.

Here are some numbers to help illustrate how Georgia’s transportation fees stack up:

Average annual cost of car insurance in Georgia: $2,996 to $3,761 per year for liability only insurance

only and collision and comprehensive coverage

added (US average: $1,627 and $2,297) MARTA 30-day pass in Atlanta: $95 (San Francisco’s monthly transit pass is $81)

Average cost of a gallon of gas, August 2022: $3.62/gal. (US average: $4.06/gal.)

How much you need to live comfortably in Georgia: $3,057 per month

Based on these numbers, a single adult would need to make around $3,057 per month before taxes to live comfortably in Georgia. That equates to about $36,686 per year before taxes, or a full-time wage of $17.64 per hour.

The average single adult in Georgia pays $7,227 in income taxes, so after taxes a livable salary in Georgia is $29,479 per year or $2,456 per month.

A living wage for a family of four jumps up to $36.80 per hour, or $76,548 before taxes.

The minimum wage in Georgia is $7.25 per hour, so it will be a challenge to live comfortably if your sole income comes from a minimum-wage job. (The estimated hourly wage to live above a condition of poverty is $6.19 for a single adult.)

The figures above only cover the essentials. They don’t factor in spending for entertainment or enjoyment—and let’s be honest, most people consider non-essentials an important part of life. To give an idea of how much some non-essentials cost in Georgia, let’s compare a few costs.

Average cost of a prepared meal, including fast food: $13 per person (US average: $13)

Average cost of a movie ticket: $12.63 (US average: $10.61)

Average cost of a date: $121.12 (US average: $116)

Average cost of a haircut: $75 (US average: $53)

Average sales tax: 7.35% (US average: 5.09%)

Of course, what constitutes a comfortable life is unique to the individual. For many, it’s possible to live comfortably with less than $3,000 per month, but others will need to seek out additional income to enjoy the hobbies and activities they love.

Georgia cities with the lowest cost of living

Some cities in Georgia are more expensive to live in than others. Unsurprisingly, the cost of living in Atlanta and the surrounding area tends to be more expensive than the rest of the state.

Other Georgia cities, though, have a cost of living well below the national and state average. Here are some examples (not including very small towns).

Columbus (COLI: 74.4): This bustling city along the Chattahoochee River is one of the most affordable cities in the state.

Macon (COLI: 74.7): Beautiful architecture, a rich history, and low living costs highlight this beautiful city in the center of the state.

Albany (COLI: 76.5): The cultural, economic, and recreation hub of southwest Georgia makes for a great affordable option to call home.

Warner Robins (COLI: 79.1): A smaller city in central Georgia, the affordable housing market, low crime rate, and lively culture make Warner Robins one of the most appealing Georgia cities to raise a family.

Augusta (COLI: 80.7): Augusta is the industry and cultural center of western Georgia with a thriving culinary, arts, and outdoor recreation scene.

How to easily find home or renters insurance in Georgia

If you do end up moving to Georgia, you will need to insure your home or rental unit. And Jerry

can do all the hard work for you to make sure you get a policy that meets your needs without overcharging your wallet. Jerry is the top-rated broker app for comparing insurance policies. All you have to do is answer a few questions, and Jerry will get to work finding you the best home insurance

and renters insurance

quotes across dozens of top insurance providers. We’ll even take care of all the paperwork to get you signed up once you find a policy you like.

“I moved states recently and my old provider didn’t cover me anymore, so I tried using Jerry

. They handled everything from fetching the quotes to purchasing the new policy. Now I save $30 a month with Progressive!” —Kay J.

RECOMMENDEDGet started now - select insurance you want to put on auto-pilot:

FAQ