Key Insights:

- Women have 0.04% higher mortgage rates than men on average and may pay up to $5,100 more than men over a 30-year fixed interest loan period.

- Single women pay 2% more than single men when buying homes but sell their homes for 2% less, resulting in an extra cost of $24,000 for single women in the home buying and selling process relative to men.

- Women pay up to $7,800 more than men during the length of car ownership.

The pink tax—an upcharge on items marketed toward women—is well-recorded in items like razors and pens. However, new data analysis from Jerry finds that the biggest household expenses, car and home ownership, are also more expensive for women than men. Altogether, women pay up to $37,000 more to own cars and homes than men for car ownership (buying, maintenance, insurance) and home ownership (buying, selling, and 30-year mortgage).

How $37,000 adds up

Women pay up to $37,000 more than men in mortgage rates, buying and selling a home, and different car ownership costs, including repairs, buying a new vehicle, and insurance. Women also upcharged by up to $7,800 in car ownership costs, paying more for car insurance, repairs and maintenance, and car buying.

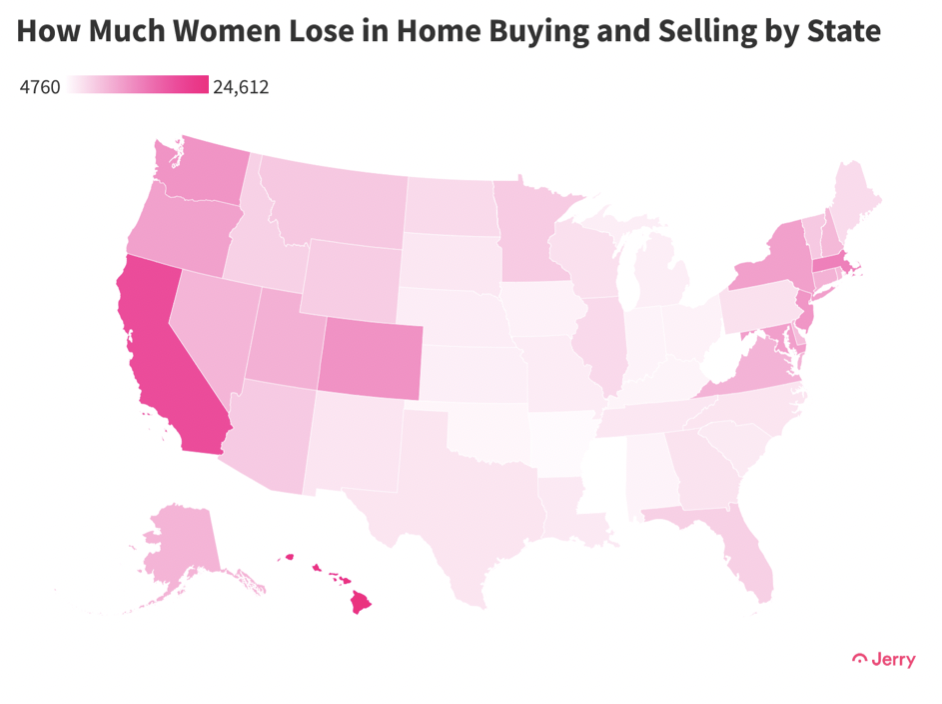

Single women pay 2% more for homes than men and sell for 2% less

Single women, in particular, pay more and make less money when buying and selling homes. A study from Yale found that single women are shortchanged by up to $24,000 compared to men in buying and selling their homes.

The specific amount that a woman loses out on in the buying and selling home process depends on the housing market in each state. However, the percentage in buying and selling remains the same for women regardless of other demographic factors, including race, income, and education. According to the authors of the study, women consistently buy for 2% more and sell for 2% less than men. This might be a result of women being held to higher expectations of generosity in the buying or selling process than men. Other implicit biases might also be at play. In any case, it indicates a significant pink tax on women who are buying and selling homes.

| State | How much more women pay |

|---|---|

| Hawaii | $24,612 |

| California | $20,200 |

| Massauchusetts | $15,264 |

| Colorado | $13,732 |

| Washington | $13,560 |

Women have 0.04% higher interest rates on mortgages

Data from the Home Mortgage Disclosure Act shows that women have 0.04% higher interest rates on their mortgages when compared to men. Coupled with median home prices per state, women are paying up to $5,100 more for their mortgages over 30-year loan periods

| State | How much more women pay |

|---|---|

| Hawaii | $5,174 |

| California | $$4,247 |

| Massauchusetts | $3,209 |

| Colorado | $2,887 |

| Washington | $2,851 |

An important determinant of mortgage rates is income. Women make less money than men: 82 cents on the dollar, according to recent studies by PayScale. With lower income, women have a lower credit score and less money to save for a down payment. This leads to women borrowing more money and at higher interest rates.

A lower income for women also means a worse debt-to-income ratio (DTI). A poor DTI ratio can make someone ineligible for loan refinancing, and can even affect their credit score. Because women have lower credit scores than men in comparable demographics, they are often ineligible for better loan rates on their mortgage.

As a result, women consistently spend more money on the same value of home than men, up to over $5,000.

In addition to saving money on the mortgage, a down payment of 20% or higher allows homeowners to avoid paying for mortgage insurance, which can cost between $360 and $840 per year. With a smaller down payment, women are more likely to pay mortgage insurance.

Women pay up to $7,800 more than men for car ownership

Women also pay a pink tax in car ownership. The average woman pays $142 more per year on car ownership than a man, and can pay between $300 and $7,800 more over the lifespan of a car.

There are several different reasons for this. Firstly, on average, women are quoted about $117 more than men when buying a new car. However, Jerry’s 2022 State of the American Driver report also found that women were more likely than men to believe they would be treated fairly at a car dealership. Women, therefore, both pay more for a new car than men and are less likely to think they will be overcharged.

On average, women are quoted $23 more than men for the same auto repair when they do not communicate an expected price. For American drivers, this has a widespread impact: 49% of American drivers take their car to a mechanic or dealership when maintenance or repair is necessary. American women drivers who account for nearly half the country are consistently overcharged for the same repairs as their male counterparts.

While women do pay less overall for car insurance, women over 24 are charged more than their male generational counterparts in 36 states. Men under 24 have the highest rate of car accidents and are charged more than women under 24 overall as a result. However, Millennial women paid more than their male counterparts in 15 states; Gen X women paid more in 19; and Baby Boomer women paid more in 14. Unlike men under 24, though, a 2019 study found that women of all ages were involved with far fewer crashes than men. Despite this, women over 24 were still charged more than men their ages in more than half the U.S.

| State | Housing pink tax | Car pink tax | Total pink tax |

|---|---|---|---|

| Hawaii | $29,768 | $1,680 | $31,448 |

| California | $24,447 | $1,416 | $25,863 |

| Massauchusetts | $18,473 | $1,404 | $19,877 |

| Colorado | $16,619 | $1,692 | $18,322 |

| Washington | $16,411 | $1,416 | $17,827 |

*You may notice the total doesn’t reach $37,000. This is because the pink tax on car ownership changes based on age — Gen X and Boomer women pay significantly more for car ownership than their generational male counterparts, and are the group of women that reach a $7,800 car ownership pink tax. The data in this table is averaged across all age groups. Read our study on the pink tax for car ownership here for more information.

Conclusion

Although the pink tax has a heavy impact on women who own cars and homes, there are a few ways to avoid price markups.

- Do your research. While women are charged more on car repairs when they don’t have an expected price in mind, knowing the average cost of repairs removes any difference in quoting between men and women.

- Negotiate firmly. When buying a car, women may be hesitant to speak up about price concerns. Be prepared to negotiate and do research before going into the dealership so that you’re ready for anything that comes your way.

- Look at doing business with other women. Although women are often overcharged when buying a home and undercharged when selling one, women do better on average when transacting with other women. Working with other women can result in a fairer price and allow both parties to benefit from working together.

Methodology

This study used data from World Population Review to ascertain the median home prices in each state, and used a study from Yale School of Management and data from the Home Mortgage Disclosure Act to calculate the prices by state. We also used studies from Yale and the National Bureau of Economic Research, as well as our own internal data, to calculate the pink tax on car ownership.

Ben Guess is an insurance writer and data journalist with a passion for accurate, detailed, and relevant reporting. A specialist in electric vehicles, driving trends, and general car knowledge, Ben’s mission is to provide car owners with the knowledge they need to make car ownership affordable. Ben has written over 150 articles for Jerry on topics ranging from EV sales to Gen Z driving trends.