Key Insights

- On average, women pay $142 per year more than men for car ownership, and can pay between $300 and up to $7,800 during the length of ownership. Factors include vehicle purchase prices, repair service prices, and car insurance prices.

- Women pay an average of $117.12 more than men when buying new cars.

- Women pay an average of $22.94 more than men for car repairs.

- Women pay less than men for car insurance overall. However, when looking at insurance pricing along generational and gender lines, we found that Millennial, Gen X, or Boomer women may pay more than their generational male counterparts in 36 states.

The pink tax —an upcharge on some items, like razors and pens, that are marketed towards women—is a well-recorded phenomenon. New data from Jerry found that the pink tax goes beyond personal grooming or office supplies, however. Not only do Millennial, Gen X, and Boomer women pay more on insurance premiums than their generational counterparts in 36 states—they also pay more when buying new cars, and can be quoted more on repairing old ones when they don’t name an expected price on their repair.

Car Shopping and Repair

Our study utilized external data to find the average car repair price and most popular car in each state. We used studies from Yale and from the National Bureau of Economic Research to calculate the percentage of price markup that women across the country face when buying a new car or seeking a quote on auto repair.

The data shows that women were quoted approximately $22.94 more than men on the same auto repair when they neglected to ask for a price, and were quoted about $117.12 more than men for the same new car. We calculated this by looking at the average repair costs per year for each state, as well as the cost of the most popular make and model for each state in 2021, to get an understanding of how much more a woman might have spent than her male counterpart this year. These are the differences in repair and auto purchase pricing:

Pink Tax on Car Buying and Repair by State

| State | Most popular car | Car retail price | Car price + pink tax | How much more do women pay for new cars per state? | Average repair cost per year | Average repair cost per year + pink tax | How much more do women pay per state for repairs? |

|---|---|---|---|---|---|---|---|

| Alabama | Nissan Altima | $23,260 | $23,376 | $116.30 | $394.65 | $418.33 | $23.68 |

| Alaska | Honda Civic | $18,840 | $18,934 | $94.20 | $378.82 | $401.55 | $22.73 |

| Arizona | Honda Civic | $18,840 | $18,934 | $94.20 | $380.63 | $403.47 | $22.84 |

| Arkansas | Nissan Altima | $23,260 | $23,376 | $116.30 | $383.78 | $406.81 | $23.03 |

| California | Honda Civic | $18,840 | $18,934 | $94.20 | $403.13 | $427.32 | $24.19 |

| Colorado | Honda Accord | $23,570 | $23,688 | $117.85 | $396.41 | $420.19 | $23.78 |

| Connecticut | Honda Accord | $23,570 | $23,688 | $117.85 | $413.91 | $438.74 | $24.83 |

| Delaware | Honda Accord | $23,570 | $23,688 | $117.85 | $386.12 | $409.29 | $23.17 |

| Florida | Toyota Camry | $23,495 | $23,612 | $117.47 | $387.56 | $410.81 | $23.25 |

| Georgia | Honda Accord | $23,570 | $23,688 | $117.85 | $402.66 | $426.82 | $24.16 |

| Hawaii | Honda Accord | $23,570 | $23,688 | $117.85 | $370.31 | $392.53 | $22.22 |

| Idaho | Honda Civic | $18,840 | $18,934 | $94.20 | $385.27 | $408.39 | $23.12 |

| Illinois | Toyota Camry | $23,495 | $23,612 | $117.47 | $374.75 | $397.24 | $22.49 |

| Indiana | Chevrolet Impala | $27,895 | $28,034 | $139.47 | $361.38 | $383.06 | $21.68 |

| Iowa | Chevrolet Impala | $27,895 | $28,034 | $139.47 | $363.13 | $384.92 | $21.79 |

| Kansas | Toyota Camry | $23,495 | $23,612 | $117.47 | $375.22 | $397.73 | $22.51 |

| Kentucky | Toyota Camry | $23,495 | $23,612 | $117.47 | $390.02 | $413.42 | $23.40 |

| Louisiana | Toyota Camry | $23,495 | $23,612 | $117.47 | $388.57 | $411.88 | $23.31 |

| Maine | Toyota Corolla | $18,600 | $18,693 | $93.00 | $354.38 | $375.64 | $21.26 |

| Maryland | Honda Accord | $23,570 | $23,688 | $117.85 | $392.40 | $415.94 | $23.54 |

| Massachusetts | Honda Civic | $18,840 | $18,934 | $94.20 | $381.87 | $404.78 | $22.91 |

| Michigan | Chevrolet Malibu | $21,680 | $21,788 | $108.40 | $356.16 | $377.53 | $21.37 |

| Minnesota | Chevrolet Impala | $27,895 | $28,034 | $139.47 | $375.73 | $398.27 | $22.54 |

| Mississippi | Nissan Altima | $23,260 | $23,376 | $116.30 | $392.33 | $415.87 | $23.54 |

| Missouri | Chevrolet Impala | $27,895 | $28,034 | $139.47 | $378.79 | $401.52 | $22.73 |

| Montana | Ford Explorer | $31,990 | $32,150 | $159.95 | $382.97 | $405.95 | $22.98 |

| Nebraska | Chevrolet Impala | $27,895 | $28,034 | $139.47 | $369.60 | $391.78 | $22.18 |

| Nevada | Toyota Camry | $23,495 | $23,612 | $117.47 | $392.45 | $416.00 | $23.55 |

| New Hampshire | Honda Civic | $18,840 | $18,934 | $94.20 | $364.77 | $386.66 | $21.89 |

| New Jersey | Honda Accord | $23,570 | $23,688 | $117.85 | $401.59 | $425.69 | $24.10 |

| New Mexico | Toyota Camry | $23,495 | $23,612 | $117.47 | $382.42 | $405.37 | $22.95 |

| New York | Honda Civic | $18,840 | $18,934 | $94.20 | $375.66 | $398.20 | $22.54 |

| North Carolina | Honda Accord | $23,570 | $23,688 | $117.85 | $397.56 | $421.41 | $23.85 |

| North Dakota | Honda Civic | $18,840 | $18,934 | $94.20 | $373.09 | $395.48 | $22.39 |

| Ohio | Chevrolet Impala | $27,895 | $28,034 | $139.47 | $354.24 | $375.49 | $21.25 |

| Oklahoma | Chevrolet Impala | $27,895 | $28,034 | $139.47 | $378.66 | $401.38 | $22.72 |

| Oregon | Honda Accord | $23,570 | $23,688 | $117.85 | $389.93 | $413.33 | $23.40 |

| Pennsylvania | Honda Accord | $23,570 | $23,688 | $117.85 | $377.08 | $399.70 | $22.62 |

| Rhode Island | Toyota Camry | $23,495 | $23,612 | $117.47 | $390.12 | $413.53 | $23.41 |

| South Carolina | Honda Accord | $23,570 | $23,688 | $117.85 | $394.27 | $417.93 | $23.66 |

| South Dakota | Chevrolet Impala | $27,895 | $28,034 | $139.47 | $378.63 | $401.35 | $22.72 |

| Tennessee | Nissan Altima | $23,260 | $23,376 | $116.30 | $394.18 | $417.83 | $23.65 |

| Texas | Honda Civic | $18,840 | $18,934 | $94.20 | $385.62 | $408.76 | $23.14 |

| Utah | Honda Accord | $23,570 | $23,688 | $117.85 | $399.15 | $423.10 | $23.95 |

| Vermont | Subaru Legacy | $22,195 | $22,306 | $110.97 | $359.64 | $381.22 | $21.58 |

| Virginia | Honda Accord | $23,570 | $23,688 | $117.85 | $397.24 | $421.07 | $23.83 |

| Washington | Honda Civic | $18,840 | $18,934 | $94.20 | $389.49 | $412.86 | $23.37 |

| West Virginia | Ford Focus | $17,860 | $17,949 | $89.30 | $372.93 | $395.31 | $22.38 |

| Wisconsin | Chevrolet Impala | $27,895 | $28,034 | $139.47 | $356.84 | $378.25 | $21.41 |

| Wyoming | Ford Explorer | $31,990 | $32,150 | $159.95 | $387.83 | $411.10 | $23.27 |

Insurance Pricing

We analyzed our own data to see how insurance pricing compared between men and women, cross-referenced against states and generations.

The initial results didn’t indicate a huge difference in premiums: men in every generation paid higher average monthly car insurance premiums than women, and women only paid more than men overall in four states: Delaware, Michigan, New Hampshire, and North Dakota.

However, when we cross-referenced age with gender and state, a pattern began to emerge. For drivers under 24, men were overwhelmingly charged higher rates, with women under 24 only being charged more than their male counterparts in six states. Millennial women, on the other hand, were charged more than Millennial men in 15 states, while Gen X women were charged more than Gen X men in 19 states, and Boomer women were charged more than Boomer men in 14 states.

Younger men have the highest frequency of car accidents out of any demographic, which tracks with the insurance pricing division along gender lines for Gen Z drivers. However, a 2019 study from the Insurance Institute for Highway Safety found that women of any age were involved with far fewer crashes than men of any age. Despite this, in a total of 36 states, Millennial, Gen X, and Boomer women drivers were still charged more than their male counterparts.

Car Insurance Pink Tax by State (does not include data from states where men pay more)

| States | Average monthly premium for Gen Z men | Average monthly premium for Gen Z women | How much more do Gen Z women pay? | Average monthly premium for Millennial men | Average monthly premium for Millennial women | How much more do Millennial women pay? | Average monthly premium for Gen X men | Average monthly premium for Gen X women | How much more do Gen X women pay? | Average monthly premium for Boomer men | Average monthly premium for Boomer women | How much more do Boomer women pay? | Average state premium for all men | Average state premium for all women | How much more do women pay? |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Alabama | — | — | — | — | — | — | — | — | — | — | — | — | — | — | — |

| Alaska | — | — | — | — | — | — | — | — | — | — | — | — | — | — | — |

| Arizona | — | — | — | $168.03 | $173.77 | $5.75 | $137.59 | $158.21 | $20.62 | $124.93 | $149.38 | $24.45 | — | — | — |

| Arkansas | — | — | — | — | — | — | — | — | — | $111.20 | $122.67 | $11.47 | — | — | — |

| California | — | — | — | — | — | — | — | — | — | $140.54 | $180.94 | $40.40 | — | — | — |

| Colorado | — | — | — | — | — | — | — | — | — | — | — | — | — | — | — |

| Connecticut | — | — | — | $280.90 | $292.12 | $11.21 | — | — | — | — | — | — | — | — | — |

| Delaware | $302.10 | $371.84 | $69.75 | — | — | — | — | — | — | — | — | — | $283.33 | $314.78 | $31.46 |

| Florida | — | — | — | — | — | — | $238.29 | $239.50 | $1.21 | — | — | — | — | — | — |

| Georgia | — | — | — | — | — | — | — | — | — | — | — | — | — | — | — |

| Hawaii | — | — | — | — | — | — | — | — | — | — | — | — | — | — | — |

| Idaho | — | — | — | — | — | — | — | — | — | — | — | — | — | — | — |

| Illinois | — | — | — | — | — | — | — | — | — | — | — | — | — | — | — |

| Indiana | — | — | — | $125.20 | $146.48 | $21.28 | — | — | — | $95.89 | $100.40 | $4.51 | — | — | — |

| Iowa | $216.71 | $238.81 | $22.11 | $130.17 | $137.40 | $7.23 | — | — | — | — | — | — | — | — | — |

| Kansas | — | — | — | — | — | — | — | — | — | $100.40 | $143.79 | $43.39 | — | — | — |

| Kentucky | — | — | — | — | — | — | $168.34 | $184.48 | $16.14 | $179.43 | $246.40 | $66.97 | — | — | — |

| Louisiana | — | — | — | — | — | — | $254.26 | $269.21 | $14.95 | — | — | — | — | — | — |

| Maine | — | — | — | $130.50 | $141.00 | $10.50 | — | — | — | — | — | — | — | — | — |

| Maryland | — | — | — | — | — | — | $236.40 | $240.01 | $3.61 | — | — | — | — | — | — |

| Massachusetts | — | — | — | — | — | — | — | — | — | — | — | — | — | — | — |

| Michigan | $320.86 | $374.47 | $53.60 | — | — | — | $257.43 | $258.05 | $0.62 | $123.33 | $157.64 | $34.30 | $270.11 | $280.29 | $10.18 |

| Minnesota | — | — | — | — | — | — | — | — | — | — | — | — | — | — | — |

| Mississippi | $262.47 | $262.80 | $0.33 | $172.60 | $181.84 | $9.23 | — | — | — | — | — | — | — | — | — |

| Missouri | — | — | — | — | — | — | $141.60 | $148.28 | $6.68 | $165.65 | $189.95 | $24.30 | — | — | — |

| Montana | — | — | — | — | — | — | $91.87 | $116.60 | $24.73 | $71.00 | $124.00 | $53.00 | — | — | — |

| Nebraska | — | — | — | $141.79 | $149.71 | $7.92 | — | — | — | $90.50 | $162.00 | $71.50 | — | — | — |

| Nevada | — | — | — | — | — | — | $197.38 | $220.08 | $22.70 | $125.67 | $180.85 | $55.18 | — | — | — |

| New Hampshire | — | — | — | $148.34 | $227.07 | $78.73 | — | — | — | — | — | — | $179.55 | $187.27 | $7.72 |

| New Jersey | — | — | — | — | — | — | — | — | — | — | — | — | — | — | — |

| New Mexico | — | — | — | — | — | — | $126.17 | $141.21 | $15.05 | — | — | — | — | — | — |

| New York | — | — | — | — | — | — | $331.89 | $336.23 | $4.34 | — | — | — | — | — | — |

| North Carolina | — | — | — | — | — | — | $120.83 | $126.89 | $6.06 | — | — | — | — | — | — |

| North Dakota | — | — | — | $111.91 | $169.95 | $58.04 | — | — | — | — | — | — | $139.16 | $204.17 | $65.00 |

| Ohio | — | — | — | — | — | — | $125.24 | $133.53 | $8.29 | — | — | — | — | — | — |

| Oklahoma | — | — | — | — | — | — | — | — | — | — | — | — | — | — | — |

| Oregon | — | — | — | — | — | — | — | — | — | — | — | — | — | — | — |

| Pennsylvania | $254.53 | $255.38 | $0.85 | — | — | — | $166.93 | $170.79 | $3.85 | — | — | — | — | — | — |

| Rhode Island | — | — | — | $307.01 | $341.40 | $34.39 | $200.60 | $277.27 | $76.67 | $126.50 | $164.56 | $38.06 | — | — | — |

| South Carolina | — | — | — | $238.33 | $241.05 | $2.72 | $186.93 | $191.11 | $4.17 | $182.37 | $191.78 | $9.41 | — | — | — |

| South Dakota | — | — | — | $173.07 | $188.99 | $15.92 | — | — | — | — | — | — | — | — | — |

| Tennessee | — | — | — | — | — | — | $140.96 | $143.27 | $2.30 | — | — | — | — | — | — |

| Texas | — | — | — | $181.32 | $189.94 | $8.62 | — | — | — | — | — | — | — | — | — |

| Utah | — | — | — | $144.16 | $152.96 | $8.80 | — | — | — | — | — | — | — | — | — |

| Vermont | — | — | — | $93.68 | $111.60 | $17.92 | — | — | — | — | — | — | — | — | — |

| Virginia | — | — | — | — | — | — | — | — | — | — | — | — | — | — | — |

| Washington | $249.42 | $269.61 | $20.19 | — | — | — | — | — | — | — | — | — | — | — | — |

| West Virginia | — | — | — | — | — | — | — | — | — | — | — | — | — | — | — |

| Wisconsin | — | — | — | — | — | — | $134.32 | $146.90 | $12.59 | $53.86 | $56.67 | $2.81 | — | — | — |

| Wyoming | — | — | — | — | — | — | $99.55 | $147.05 | $47.50 | — | — | — | — | — | — |

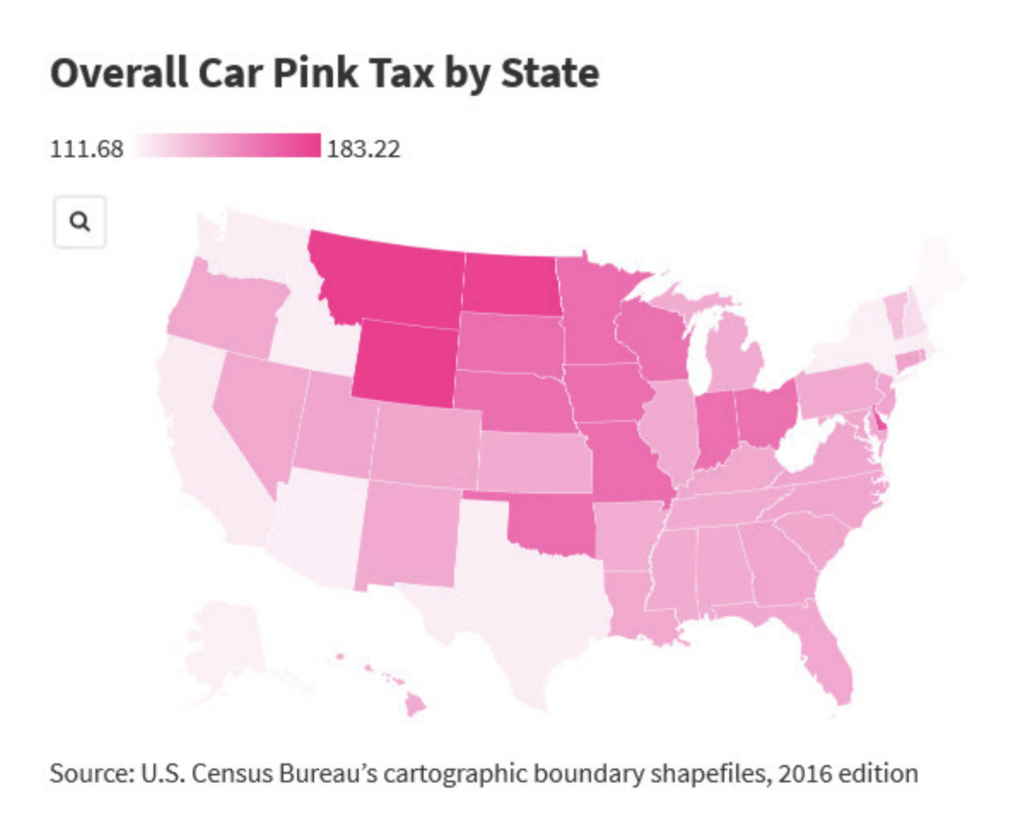

We found that the state with the highest overall pink tax for insurance premiums, car repair, and new car pricing was Wyoming, at $183.22, while West Virginia had the lowest overall pink tax at $111.68. The average pink tax in any state across the U.S., including the differences in men’s and women’s insurance premiums, car repair cost, and new car prices, was $142.34.

When factoring in the average pink tax on car repair at a yearly rate, the average pink tax on car buying once, and the highest and lowest differences in insurance pricing, we also found that ultimately, a woman might pay between $332.32 and $7,858.72 more than a man on car ownership during an average car ownership period of eight years —hundreds to thousands of dollars more for what could be the same vehicle, the same driving record, and the same yearly repairs and maintenance, setting women at a clear financial disadvantage for car ownership.

Average Pink Tax per State

| State | Average Pink Tax |

|---|---|

| Alabama | $139.98 |

| Alaska | $116.93 |

| Arizona | $117.04 |

| Arkansas | $139.33 |

| California | $118.39 |

| Colorado | $141.63 |

| Connecticut | $142.68 |

| Delaware | $172.47 |

| Florida | $140.73 |

| Georgia | $142.01 |

| Hawaii | $140.07 |

| Idaho | $117.32 |

| Illinois | $139.96 |

| Indiana | $161.16 |

| Iowa | $161.26 |

| Kansas | $139.99 |

| Kentucky | $140.88 |

| Louisiana | $140.79 |

| Maine | $114.26 |

| Maryland | $141.39 |

| Massachusetts | $117.11 |

| Michigan | $139.95 |

| Minnesota | $162.02 |

| Mississippi | $139.84 |

| Missouri | $162.20 |

| Montana | $182.93 |

| Nebraska | $161.65 |

| Nevada | $141.02 |

| New Hampshire | $123.81 |

| New Jersey | $141.95 |

| New Mexico | $140.42 |

| New York | $116.74 |

| North Carolina | $141.70 |

| North Dakota | $181.59 |

| Ohio | $160.73 |

| Oklahoma | $162.19 |

| Oregon | $141.25 |

| Pennsylvania | $140.47 |

| Rhode Island | $140.88 |

| South Carolina | $141.51 |

| South Dakota | $162.19 |

| Tennessee | $139.95 |

| Texas | $117.34 |

| Utah | $141.80 |

| Vermont | $132.55 |

| Virginia | $141.68 |

| Washington | $117.57 |

| West Virginia | $111.68 |

| Wisconsin | $160.89 |

| Wyoming | $183.22 |

There are many factors influencing insurance quotes, car repair costs, or new car prices. Gender may be related to many of these factors, and it’s important to understand how or why car expenses might be heftier than expected when you’re a woman. Women have been disadvantaged by pricing for centuries; it’s unsurprising that it extends to car ownership today.

Avoiding the Pink Tax

There are a couple of good methods for avoiding any car ownership markups—especially if you’re a woman.

Car repair: The most important thing is to do your research beforehand. The studies we examined showed that when a woman knew the average price point for a repair in her area, the pink tax on the repair all but vanished—so do your research and make sure you know the average cost of a given repair before contacting a mechanic.

Car buying: Once again, doing your research on the average market price of a car is imperative—but so is being a firm negotiator. Women are often pressured into keeping their concerns to themselves, and it can be difficult to speak up about a price that feels unfair. However, doing so could save you hundreds of dollars on a new car—so do your research and find your voice before going into the dealership.

Car insurance: Insurance pricing can be based on several different factors, including your credit score, your driving record, and your location, as well as your gender. In order to make sure you’re paying the lowest possible rate on your insurance, it’s important to check all these areas to ensure that there’s not another reason for high pricing—there might be something you’ve missed. In addition to this, if you have a good driving record (or are working on cultivating one), have taken a driver training course, or have good grades (if you’re a student), you might be eligible for insurance discounts—so check with your provider to see if you might be eligible for a lowered rate.

Ben Guess is an insurance writer and data journalist with a passion for accurate, detailed, and relevant reporting. A specialist in electric vehicles, driving trends, and general car knowledge, Ben’s mission is to provide car owners with the knowledge they need to make car ownership affordable. Ben has written over 150 articles for Jerry on topics ranging from EV sales to Gen Z driving trends.