If you’re a first-time car insurance buyer, you’ll need to know about types of coverage, deductibles, discounts, comparison shopping, and the most reliable car insurance companies.

How to get a car insurance policy as a first-time buyer

Buying a new car is exciting, but if you’re also buying car insurance for the first time, it can seem daunting—especially with all of the coverage options, discounts, and state regulations involved. But with the right tips to follow, it can be a smooth, easy, and quick process.

What coverage do I need to legally drive?

To legally drive in most states in the US, you need to buy a state minimum policy.

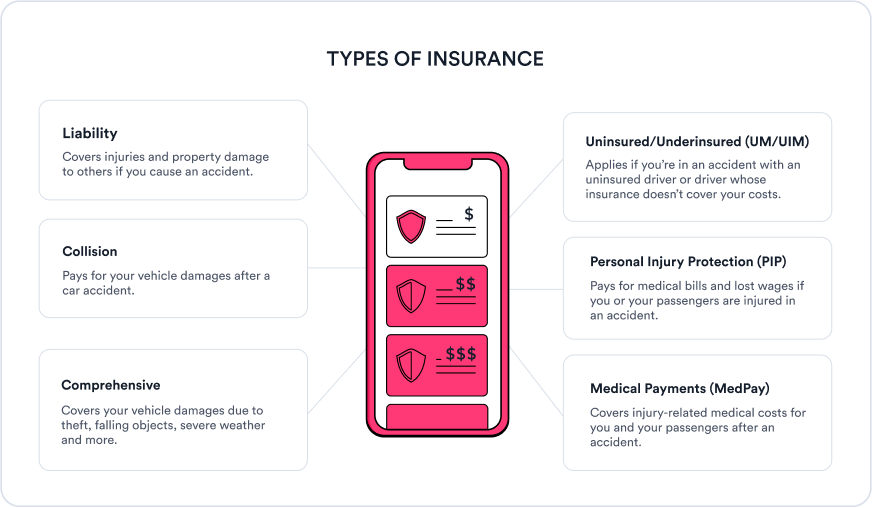

A state minimum policy is a type of car insurance coverage that helps pay for medical expenses and damages you cause to others in a crash. It includes liability insurance.

Some states will require you to purchase additional coverage for your state minimum policy. For example, if you live in a no-fault state, like Kansas, Massachusetts, Maine, or New Hampshire, you may also be required to carry personal injury protection (PIP), medical payments (MedPay), or uninsured/underinsured motorist insurance (UM/UIM).

Here is an explanation of the six basic types of car insurance you’ll likely hear about when you go to buy your first policy:

Additionally, each state has its own coverage limits in place for their minimum car insurance policies. Most states require limits of $25,000 per person in bodily injury liability, $50,000 per accident in bodily injury liability, and $25,000 per accident in property damage coverage.

Other states, however, may require more or less. Make sure to check your state regulations before purchasing a car insurance policy.

While state minimum coverage is generally the cheapest type of insurance, it may not be your best option. If you cause a serious accident, your liability limits may max out, leaving you on the hook for any remaining damages—and if you can’t pay out of pocket, you could be in danger of being sued by the other parties involved in the accident.

What coverage do I need to financially protect me and my car?

A state minimum policy gives you just enough coverage to get you legally driving on the road—however, it won’t cover any of your own damages if you get into a collision. If you don’t want to stress about paying for repairs or having to buy a new car after an accident, you’ll want to get a full coverage policy.

A full coverage policy is a type of car insurance that provides added protection for your vehicle in the event of an accident. It generally includes liability coverage, collision insurance, and comprehensive insurance, and is often required by lenders for those leasing or financing a new car.

Most drivers will benefit from a full coverage policy with higher liability limits, such as $50,000 per person/$100,000 per accident in bodily injury liability insurance, and $50,000 per accident in property damage liability coverage. It’s also worth considering including additional coverage in your plan, such as roadside assistance and gap coverage, especially if you lease or finance a new car.

What do I need to know about deductibles?

If you opt for a full coverage policy, you will need to know about deductibles and how they work. A deductible is a fixed amount that you’re required to pay before your car insurance company will cover a collision or comprehensive claim, and the total amount you pay can either raise or lower your car insurance rates.

BE AWARE:

Don’t ever increase your deductible to a limit you can’t realistically afford out of pocket, even if you need to lower your car insurance costs. If you can’t pay your deductible costs, you won’t be able to file a claim, so you’ll have to cover your repair costs out-of-pocket.

Can I get car insurance discounts as a first-time buyer?

Most insurance providers offer discounts as a way to help drivers save on premiums—no matter their profile or driving experience. Here are a few of the most popular discounts available among insurers:

- Good driver: Drivers who maintain a clean driving record for a certain number of years can earn savings with companies including Progressive and State Farm.

- Paid-in-full: You can either pay on a monthly basis, or pay in full for your car insurance. If you choose the latter, you can lower your rates with Direct Auto and Dairyland.

- Bundling: Drivers with home insurance or renters insurance can bundle their policy with their auto insurance and save at Dairyland and Nationwide.

- New car: Purchasing your first vehicle from a dealership? You can get lower insurance premiums with Travelers and Allstate.

Make sure to ask your insurance agent about any discounts you’re interested in to determine whether or not you’re eligible, or if there are other savings opportunities you may be missing.

How do I find the cheapest car insurance policy?

Once you have all the information above organized, you can begin shopping for car insurance quotes. To get car insurance rates, you’ll need to provide the following personal and vehicle information:

- Name, birthdate, current address

- Driver’s license number/Social Security number

- Driving history/insurance history

- Vehicle make, model, and year

- Vehicle identification number (VIN)

- Annual mileage count

There are several ways you can begin your shopping journey—either independently, with an insurance agent, or with the Jerry app. When searching for auto insurance quotes, Jerry can walk you through the process step-by-step, starting with profile creation.

From there, you can fill out your vehicle information and choose your coverage options to help you find tailored rates. The entire process, from searching for quotes to finalizing your policy, takes approximately one to two hours.

When purchasing a new vehicle, it’s important to either schedule your policy start date with Jerry or immediately begin your insurance coverage the same day. Just remember to also schedule your current policy to cancel at the same time to avoid a lapse in coverage.

Don’t buy auto insurance from the dealership:

Buying car insurance from a dealership may seem easier, but your coverage options will be limited and the premiums are usually much higher. To get personalized car insurance that meets your coverage needs, reach out to different insurance providers and compare rates.

What car insurance companies can I trust?

With so many insurance companies available, you might feel nervous about finding a company that is reliable and trustworthy.

To help you make informed choices when it comes to your policy, Jerry experts conducted one of the largest nationwide surveys, asking over 15,000 policyholders about their experience with their current insurer. From policy cost to customer satisfaction and claims handling, real car insurance buyers rated companies on a 5.0 scale—here are the results:

| Insurance company | Minimum coverage cost | Full coverage cost | Customer service score | Overall Jerry score |

|---|---|---|---|---|

Anchor General | $52 | $172 | 3.7 | 3.7 |

| Allstate | $57 | $198 | 3.8 | 3.6 |

| Clearcover | $66 | $130 | 4.4 | 4.7 |

| Gainsco | $98 | $222 | 4.3 | 4.5 |

| Mercury Auto | $74 | $146 | 4.4 | 4.1 |

| National General | $95 | $200 | 4.8 | 4.8 |

| Progressive | $95 | $178 | 4.2 | 4.2 |

| Travelers | $59 | $141 | 4.5 | 4.6 |

-

Methodology

Learn more: The best car insurance companies of 2024

Why is my friend paying less for car insurance than I am?

Car insurance rates are based on a variety of factors, so it’s common for drivers to pay different rates—regardless of whether they’re a young driver seeking their first policy, or an experienced driver swapping from a shared policy to an individual option.

Currently, the national average cost of car insurance in the United State is $121 per month, or $1,452 annually. However, these rates can change depending on various factors, such as:

- Age/driving experience

- Driving record

- Vehicle type

- Previous insurance history

Other factors that can also impact your premium costs include credit score, homeownership, and marital status, depending on where you live. On top of that, not all insurance agencies calculate car insurance rates in the same way, which is why it’s a good idea to always shop for insurance before buying—and re-shop your quotes every six months.

FAQ

-

What is the best car insurance for first timers?

-

Should you get insurance first before buying a car?

-

How much is car insurance for new drivers?

-

What factors affect car insurance rates for first-time buyers?

Hillary Kobayashi is an insurance writer and editor specializing in insurance and finance topics. Hillary’s mission is to use her knowledge and love of education to help car owners better understand how they can save time and money on car ownership. The articles Hillary has published for Jerry span topics from state-specific bill of sale requirements to SR-22 insurance information. Prior to joining Jerry, Hillary spent over ten years in education at Pacific University and the University of Oregon.

Sarah Gray is an insurance writer with nearly a decade of experience in publishing and writing. Sarah specializes in writing articles that educate car owners and buyers on the full scope of car ownership—from shopping for and buying a new car to scrapping one that’s breathed its last and everything in between. Sarah has authored over 1,500 articles for Jerry on topics ranging from first-time buyer programs to how to get a salvage title for a totaled car. Prior to Jerry, Sarah was a full-time professor of English literature and composition with multiple academic writing publications.