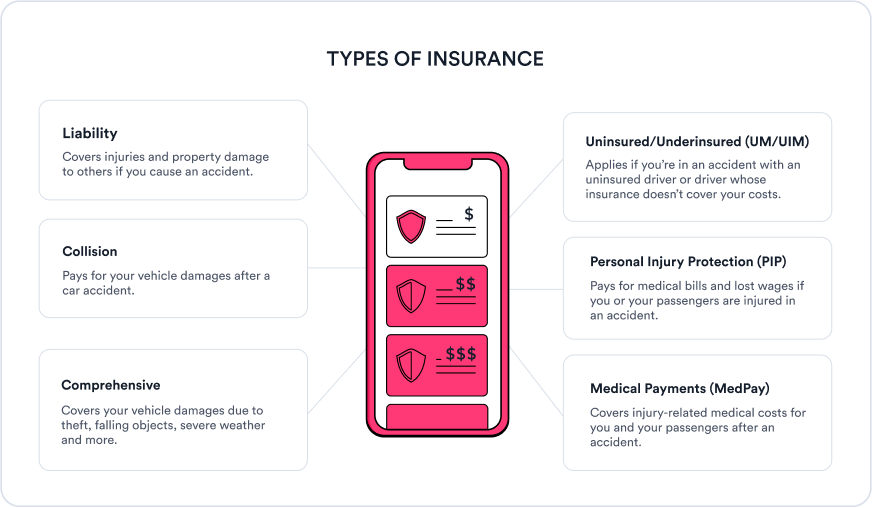

The most common types of auto insurance coverage include liability insurance, comprehensive coverage, collision coverage, uninsured/underinsured motorist coverage (UM/UIM), personal injury protection (PIP), and medical payments coverage (MedPay).

The 6 primary types of car insurance coverage

When you buy car insurance, your policy will start with the minimum liability coverage required by your state. Your policy will also include any additional coverages required in your state, including UM/UIM, MedPay, and PIP.

You can also add full coverage insurance to your policy—it’s not mandatory in any state, but if your car is financed, your lender may require you to carry it as part of your lending terms.

1. The bare minimum: Liability insurance

In almost every state, drivers are required to carry liability insurance to legally drive.

What it covers: If you cause a collision, liability insurance will help cover the other drivers’ accident-related expenses. Liability insurance is typically broken into two parts: Bodily injury liability, which pays for medical expenses up to your policy’s limits, and property damage liability, which covers damage to vehicles and other types of property.

How much does it cost? On average, state-minimum liability insurance costs around $77 a month—but your rate will depend largely on your carrier, the limits required by your state, and personal factors like your driving record.

Jerry’s experts analyzed thousands of real policies purchased by our customers to learn more about what drivers pay each month for minimum liability insurance. Here’s what they found:

| Insurance company | Minimum liability |

|---|---|

| AAA | $105 |

| Allstate | $85 |

| Assurance America | $125 |

| Bristol West | $158 |

| Clearcover | $66 |

| Nationwide | $61 |

| Progressive | $79 |

| State Auto | $58 |

Who needs it: Nearly everyone! New Hampshire is the only state that doesn’t require liability insurance, but it’s still a good idea. In all other states, you must have liability insurance to legally be on the road.

2. Protection from accidents: Collision coverage

When you’re shopping for insurance, you’ll likely come across the term “full coverage.” Also known as physical damage protection, full coverage is made up of collision and comprehensive coverage, which help protect your vehicle against various types of damage.

What it covers: Collision insurance pays for damage to your vehicle after an accident with another vehicle or stationary object. It’s one part of a full-coverage insurance policy.

How much does it cost? Collision insurance is usually included as part of a full-coverage policy, but some drivers opt to exclude comprehensive coverage.

Our experts found that on average, drivers pay around $140 a month for a policy that includes liability and collision coverage, without comprehensive coverage. Here’s how that breaks down by insurer:/

| Insurance company | Liability + Collision |

|---|---|

| Allstate | $233 |

| Aspire | $144 |

| Bristol West | $151 |

| Clearcover | $76 |

| Dairyland | $92 |

| Nationwide | $150 |

| Progressive | $127 |

| State Auto | $66 |

Who needs it: If you lease or finance your vehicle, your lender will require you to carry collision coverage. But even if you own your vehicle outright, carrying collision insurance is a good idea if your vehicle is new or holds its value.

3. Other-than-collision protection: Comprehensive coverage

What it covers: Comprehensive insurance pays for damage to your vehicle that isn’t the result of a collision—such as from a severe weather event, vandalism, or theft. It’s also included in a full-coverage insurance policy.

How much does it cost? Although comprehensive coverage is usually included in full-coverage insurance, some drivers do opt to purchase it as a standalone add-on to their liability coverage.

Our experts found that on average, a policy with liability insurance and comprehensive coverage costs around $132 a month. Here’s what those averages look like across several top insurance companies.

| Insurance company | Liability + Comprehensive |

|---|---|

| Allstate | $124 |

| Aspire | $157 |

| Bristol West | $203 |

| Clearcover | $76 |

| Dairyland | $173 |

| Nationwide | $88 |

| Progressive | $86 |

| State Auto | $86 |

Who needs it: Lenders will require comprehensive coverage on leased or financed vehicles. As with collision insurance, if your vehicle hasn’t yet depreciated significantly, it’s usually a good idea to carry this coverage.

Full-coverage costs an average of $165 a month—but your costs will depend on factors like where you live, the vehicle you drive, your driving record and claims history, and more.

See full coverage costs by carrier

| Insurance company | Full coverage |

|---|---|

| AAA | $215 |

| Allstate | $198 |

| Assurance America | $275 |

| Bristol West | $361 |

| Clearcover | $130 |

| Nationwide | $155 |

| Progressive | $178 |

| State Auto | $200 |

4. Enhanced personal protection: Uninsured/underinsured motorist coverage

What it covers: Uninsured motorist coverage (UM) pays for your costs if you’re involved in an accident with a driver who doesn’t carry an auto insurance policy. Underinsured motorist coverage (UIM) protects you if the other driver has insurance but the coverage limits aren’t high enough to cover your expenses.

UMBI VS UMPD

In most states, uninsured/underinsured motorist coverage is only available for bodily injury claims (UMBI/UIMBI). However, in some states, uninsured/underinsured motorist coverage is also available for property damage (UMPD/UIMPD).

How much does it cost? Jerry’s experts found that on average, a policy that includes UM/UIM costs around $202 a month

Based on those findings, this table shows the average monthly cost of policies containing uninsured and underinsured motorist coverage.

| Insurance company | UM/UIM |

|---|---|

| AAA | $260 |

| Allstate | $204 |

| Assurance America | $209 |

| Bristol West | $323 |

| Clearcover | $158 |

| Nationwide | $191 |

| Progressive | $190 |

| State Auto | $186 |

Who needs it: UM is required in 20 states, while only 14 require UIM. But even if your state doesn’t require this coverage, it’s a good idea if you live in an area with a high percentage of uninsured drivers.

UM is required in these states:CT, DC†, IL, KS, ME, MD†, MA, MN, MO, NE, NH†, NY, NC†, ND, OR, SC†, SD, VT†, VA*†, WV, WY†

*Also requires UIM

† Requires UMPD

Find out whether your state has a higher-than-average rate of uninsured drivers: III’s Facts + Statistics: Uninsured motorists

5. Coverage for medical bills: Personal injury protection

What it covers: Personal injury protection (PIP) pays for medical expenses after a car accident for the policyholder and any injured passengers, even if they don’t have health insurance. In addition, PIP will pay for lost income, childcare expenses, and funeral expenses related to the accident.

How much does it cost? Our experts found that drivers pay an average of $214 a month for coverage that includes personal injury protection. Based on that analysis, this table shows what drivers pay for policies with PIP across some of the nation’s top insurance providers.

| Insurance company | PIP |

|---|---|

| AAA | $253 |

| Allstate | $237 |

| Assurance America | $211 |

| Bristol West | $300 |

| Clearcover | $167 |

| Nationwide | $187 |

| Progressive | $217 |

| State Auto | $196 |

Who needs it: If you live in a no-fault state, you’ll need to carry PIP as per state law. The states that require it are FL, HI, KS, KY, MA, MI, MN, NJ, NY, ND, PA, and UT. Even though it isn’t a no-fault state, CT also mandates PIP.

6. For a quick payout if you’re injured: Medical payments

What it covers: MedPay supplements your health insurance and covers medical expenses for you, your passengers, and any injured pedestrians after an accident—whether you’re the at-fault driver or not. It covers doctor and hospital visits, ambulance expenses, rehab and nursing care, and even some medical equipment.

How much does it cost? Policies with MedPay cost an average of $199 a month. Based on our experts’ analysis, here’s what you’ll pay for MedPay coverage with several top insurance companies:

| Insurance company | MedPay |

|---|---|

| AAA | $252 |

| Allstate | $230 |

| Assurance America | $192 |

| Bristol West | $326 |

| Clearcover | $150 |

| Nationwide | $168 |

| Progressive | $178 |

| State Auto | $201 |

Who needs it: If you can’t afford out-of-pocket costs for the costs that MedPay will cover, investing in MedPay is a good idea—and it’s required to be included in car insurance policies in Maine and New Hampshire.

Optional coverage add-on

Most insurance companies offer a range of optional types of coverage that you can add to your policy. These add-ons allow you to customize your policy to get exactly the coverage you need.

- Gap insurance: If your vehicle is totaled or stolen, gap coverage pays the difference between your actual cash value insurance payout and your car loan or lease balance.

- New vehicle replacement coverage: After a total loss, new car replacement will cover the cost of replacing your vehicle with the same make or model that you previously had—but you’ll need to pay a deductible first.

- Rental car reimbursement: This coverage pays for a rental vehicle while your car is in the shop after a covered loss.

- Roadside assistance: Also known as towing and labor coverage, this offers towing, flat tire repairs, locksmith services, and more while you’re on the road.

- Non-owner insurance: You can purchase a non-owner policy if you don’t own your own vehicle but frequently drive a rental vehicle, borrowed car, etc.

- SR-22 insurance: While not technically a type of insurance, your state may require an SR-22 certificate if you’ve been convicted of a serious violation (like a DUI). It certifies that you carry at least minimum liability insurance. Your insurer will file it on your behalf.

- Rideshare insurance: If you drive for a rideshare company or a food delivery service, you’re likely not covered by your regular insurance policy. Ask your insurance agent if your provider offers rideshare coverage.

How to get the right type of insurance

When you’re building an insurance policy, consider your liability needs, whether you need full coverage, and any optional coverage types you want to add to your policy.

How much liability coverage do I need?

When you’re shopping for car insurance, your policy will automatically include liability coverage that meets your state’s requirements. But for the best protection, consider raising your liability limits to $100,000 of bodily injury liability per person, $300,000 of bodily injury liability per accident, and $100,000 of property damage liability per accident.

When you shop for car insurance with Jerry, you can easily adjust your coverage limits to include higher amounts of liability, so it’s easy to see what you would pay for additional liability protection.

”A general rule that I recommend is to carry enough coverage to protect your current and future assets – at least $100,000/$300,000 of liability coverage is recommended, but you may need more coverage depending on your financial situation.”

Do I need full coverage?

If significant vehicle repairs or a total loss would put you in a financial bind, buying comprehensive and collision coverage is a good idea. If your vehicle is leased or financed, full coverage will typically be a requirement.

Do I need any optional coverages?

Insurance add-ons are personal and you’ll be able to tailor your coverage to your situation.

- If you have a brand new vehicle, new vehicle replacement coverage is a good idea for at least the first few years

- If your vehicle is financed, gap insurance is a smart purchase until you owe less on your loan the the vehicle is worth

- Unless you belong to an auto club like AAA, roadside assistance is an affordable add-on for unexpected situations

- If you’re driving for a rideshare or food delivery company, you’ll probably need to purchase rideshare insurance

Compare quotes from multiple insurers to find the best rate for the coverage you need and the add-ons that make sense for you.

FAQ

-

What type of car insurance is required?

-

What is the cheapest type of car insurance?

-

What are the benefits of liability insurance?

-

What type of car insurance is best?

Expert insurance writer and editor Amy Bobinger specializes in car repair, car maintenance, and car insurance. Amy is passionate about creating content that helps consumers navigate challenges related to car ownership and achieve financial success in areas relating to cars. Amy has over 10 years of writing and editing experience. After several years as a freelance writer, Amy spent four years as an editing fellow at WikiHow, where she co-authored over 600 articles on topics including car maintenance and home ownership. Since joining Jerry’s editorial team in 2022, Amy has edited over 2,500 articles on car insurance, state driving laws, and car repair and maintenance.

Sarah Gray is an insurance writer with nearly a decade of experience in publishing and writing. Sarah specializes in writing articles that educate car owners and buyers on the full scope of car ownership—from shopping for and buying a new car to scrapping one that’s breathed its last and everything in between. Sarah has authored over 1,500 articles for Jerry on topics ranging from first-time buyer programs to how to get a salvage title for a totaled car. Prior to Jerry, Sarah was a full-time professor of English literature and composition with multiple academic writing publications.