Otto Insurance bills itself as an easy way to find and compare cheap car insurance rates, but it doesn’t offer real quotes and instead distributes customer information to third parties.

Jerry put Otto’s car insurance products to the test and was unable to find insurance coverage through Otto. The editorial team also received multiple spam phone calls after filling out Otto’s forms. This experience lines up with online customer reviews that report negative and misleading experiences with Otto’s insurance shopping service.

Is Otto car insurance legit?

No, Otto Insurance—also known as Otto Quotes, LLC—is not a legitimate car insurance company.

Otto actually describes itself as a “a premier funds referral service” that “connects consumers to advertisers and insurance agencies only after we’ve gathered certain criteria from you.” The company’s website specifies that Otto doesn’t work with any insurance companies or provide insurance plans to consumers.

In other words, Otto doesn’t sell car insurance—it sells consumer data without offering any benefit to shoppers.

Otto car insurance pros and cons

Pros

- Easy to use

Cons

- Does not provide car insurance quotes

- Sells consumer data to advertisers

- Website messaging is unclear

- B- rating from Better Business Bureau

- 2.7 stars from TrustPilot

Otto Insurance review: We tried to get car insurance quotes from Otto—here’s what happened

Despite its “not a car insurance company” disclaimer, Otto does advertise car insurance quotes—so we put its quoting system to the test.

To see if Otto really offers car insurance quotes, I headed to OttoInsurance.com, clicked the “Start Saving” button, and created a user profile. Because Otto says that they share consumer data, I used a Google Voice phone number to avoid flooding my personal number with unwanted calls.

The sign-up process was fairly quick. Within five minutes, I completed the sign-up questions and Otto announced that they’d found a “winner”:

…but it wasn’t an actual quote. Instead, the “Access your quote” button took me to InsuredNation.com, where I was prompted to follow two new links for a “FREE quote” from either Experian or SmartFinancial.

Well, okay. I knew neither of these companies were insurance providers, but I recognized both brands as trusted sources. Maybe they would bring me to an actual quote. I started with the SmartFinancial link, which led me…

…right back to InsuredNation, with a secondary link for Experian. Frustrated, I headed back to InsuredNation and chose the Experian link instead.

This time, I was prompted to fill out another set of intake forms, entering the same information about myself, my address, and my vehicle that I’d entered earlier on Otto’s website. I filled out the form, hoping that at least this information would lead me to a real, concrete, quoted rate for a car insurance policy I could actually purchase.

No such luck. Instead, Experian redirected me to Insure.com, another rate comparison website. On Insure.com, I entered my ZIP code one last time, only to be sent back to InsuredNation and another site—Provide Insurance—that I officially lacked the energy to visit.

In total, this merry-go-round of rate comparison websites took me about 15 minutes to navigate—so the good news is that Otto only wasted a quarter of an hour of my time. However, I never received a single insurance quote, and about five minutes after I wrapped up my shopping experience, my Google Voice number started ringing.

I received five spam calls within the space of an hour before I made the wise decision to set my number to “Do not disturb.”

The bottom line: I spent 15 minutes shopping for car insurance with Otto without finding a single actual quote—and my phone number was sent to spam callers.

Why Otto can’t offer real insurance quotes

Although it advertises cheap insurance quotes—the name of the business is “Otto Quotes, LLC”—Otto can’t actually sell insurance policies. That’s because it lacks the authority of an insurance producer such as an agent or broker.

Only car insurance brokers and agents can sell car insurance policies. In order to do so, producers need a National Producer Number (NPN)—a unique number assigned to every licensed insurance producer through the National Association of Insurance Commissioners’ (NAIC) licensed process. Because Otto is not a licensed producer, the company has no NPN and can’t actually sell car insurance.

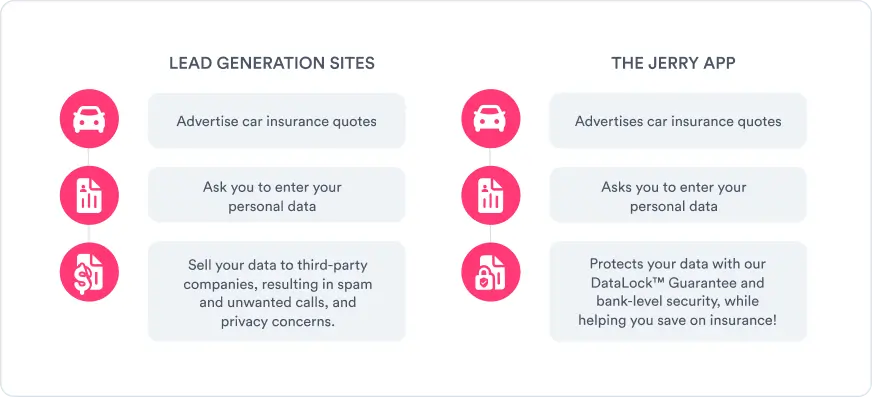

So what is Otto? Rather than an insurance broker, Otto is a lead generation website—a type of site that captures consumer data and sells it to companies in search of sales leads.

How to get your info off of Otto’s site

Because lead generation is Otto’s primary purpose, the site provides instructions for shoppers who want to remove their contact information from Otto’s files.

To get your information removed, you’ll need to:

- Email info@ottoinsurance.com: Include your phone number and email address in the body of the email and request that it be erased.

- Wait for confirmation from Otto: The website states that you should hear back from Otto’s customer response team within 24 to 48 hours.

What is a lead generation website?

Lead generation websites are common in the online insurance shopping world, and they can be deceptive. In most cases, a website will promise to offer an online quoting service, but actually directs you to other comparison services while passing along your phone number and other information to insurance companies as well as advertisers.

While lead generation is a legitimate business tactic, it’s also susceptible to fraud, and can cause problems for consumers. That’s why the Federal Trade Commission (FTC) put out a set of guidelines in 2019 to help consumers avoid lead generation scams.

Alternatives to Otto for auto insurance quotes

Otto isn’t an effective way to shop for car insurance—so it’s better to turn to an alternative. Your best options are:

- Shopping for yourself: All car insurance companies offer free quotes, often through an easy online or mobile quoting process. If you’re up for a lot of legwork, you can fill out forms for each company you’d like a quote from and compare the results.

- Working with a broker: Brokers can extend the scope of your search and provide expert insight into the strengths and weaknesses of individual insurance companies. There’s typically no fee to use a broker, and they’re legally required to inform you of any fees they may charge.

Jerry is a licensed car and home insurance broker that partners with trusted national companies like Progressive and Nationwide to provide real free quotes for car, homeowners, and renters insurance. Jerry’s insurance licenses and privacy policy are available on the company’s website.

Learn more: Is Jerry legit?

FAQ

-

Is Otto Insurance a reliable company?

-

Who owns Otto insurance?

-

Is Otto Insurance the same as Otto Insurance Group?

-

Is OTTO insurance a scam?

-

What coverage options does Otto car insurance offer?

-

Does Otto Insurance offer coverage in all states?

-

What coverages are included in Otto car insurance policies?

Sources

- https://f.ottoinsurance.com/about

- https://www.bbb.org/us/fl/miami/profile/insurance-consultant/otto-insurance-0633-92028407

- https://www.trustpilot.com/review/ottoinsurance.com

- https://ottoinsurance.com/faq.html

- https://consumer.ftc.gov/consumer-alerts/2019/04/lead-generation-bait-and-switch

-

Licensed Insurance Agent

R.E. Fulton is an expert insurance writer specializing in car ownership topics from car shopping and loan advice to insurance and repair guides. R.E.’s mission is to create unique and accessible content that helps readers to become more successful and independent car owners. R.E. has written and edited over 900 high-performing articles for Jerry, with an average of 1 million+ views. As a senior writer on Jerry’s editorial team, R.E. draws on over 10 years of experience as a professional writer and digital publishing specialist. Prior to joining Jerry’s editorial team in 2021, R.E. worked as a writing coach at Columbia University, the Rochester Institute of Technology (RIT), and the University of Rochester. They serve as a managing editor for peer-reviewed history publication Nursing Clio, where their work has appeared regularly since 2015.

Sarah Gray is an insurance writer with nearly a decade of experience in publishing and writing. Sarah specializes in writing articles that educate car owners and buyers on the full scope of car ownership—from shopping for and buying a new car to scrapping one that’s breathed its last and everything in between. Sarah has authored over 1,500 articles for Jerry on topics ranging from first-time buyer programs to how to get a salvage title for a totaled car. Prior to joining Jerry, Sarah was a full-time professor of English literature and composition with multiple academic writing publications.