Property damage liability (PD) helps repair or replace any vehicles or objects you damage up to your policy limits if you’re found at fault for a car accident. It’s part of liability car insurance and is mandatory in most states.

To simplify matters, Jerry’s insurance experts unpack everything you need to know about property damage liability coverage here:

What property damage liability insurance covers

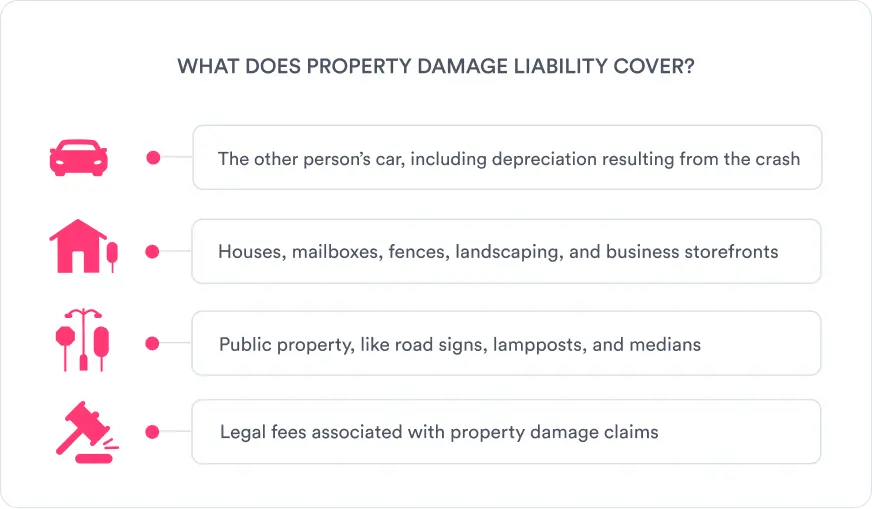

If you or someone driving your car with your permission causes an accident, property damage coverage helps pay for the cost of the damages. This includes damage to:

Property damage liability insurance can also cover legal fees if you’re sued for damages associated with an accident you caused.

Property damage liability insurance does not cover damage to your own vehicle or property. It also does not cover damages in excess of your coverage limits. To ensure you’re fully protected, experts recommend a full coverage car insurance policy that includes increased liability limits, collision insurance, and comprehensive insurance.

How property damage liability insurance works

If you’re found to be at fault for an accident, your insurance company will pay for the cost of repairs to—or replacement of—the other person’s property and/or vehicles up to your policy’s limit.

“Per accident” policy limits for property damage liability coverage are set at the state level and are typically part of an overall liability insurance policy that may also include:

- Bodily injury liability coverage (BI)

- Uninsured motorist coverage

- Personal injury (PIP)

- Medical payments coverage (MedPay)

For example: If your auto policy has a PD limit of $15,000 and you cause an accident resulting in $5,500 worth of damage, that bill will be covered. Since PD has no deductible, you won’t have any out-of-pocket costs associated with this insurance claim.

However, if you cause an accident that results in $20,000 worth of damage, your policy will only cover $15,000, and you’ll be responsible for the remaining $5,000—not to mention the damage to your own vehicle if you don’t carry collision coverage.

This is why insurance experts recommend drivers purchase higher liability limits than those required by your state’s car insurance laws.

How much property damage liability coverage do you need?

To drive legally, you must carry a policy that meets or exceeds your state’s requirements for property damage liability coverage.

Here’s how much PD coverage is required in each state and the District of Columbia:

| State | Property damage insurance minimum |

|---|---|

| Alabama | $25,000 |

| Alaska | $25,000 |

| Arizona | $15,000 |

| Arkansas | $25,000 |

| California | $5,000 |

| Colorado | $15,000 |

| Connecticut | $25,000 |

| Delaware | $10,000 |

| District of Columbia | $10,000 |

| Florida | $10,000 |

| Georgia | $25,000 |

| Hawaii | $10,000 |

| Idaho | $15,000 |

| Illinois | $20,000 |

| Indiana | $25,000 |

| Iowa | $15,000 |

| Kansas | $25,000 |

| Kentucky | $25,000 |

| Louisiana | $25,000 |

| Maine | $25,000 |

| Maryland | $15,000 |

| Massachusetts | $5,000 |

| Michigan | $10,000 |

| Minnesota | $10,000 |

| Mississippi | $25,000 |

| Missouri | $25,000 |

| Montana | $20,000 |

| Nebraska | $25,000 |

| Nevada | $20,000 |

| New Hampshire | $25,000 |

| New Jersey | $25,000 |

| New Mexico | $10,000 |

| New York | $10,000 |

| North Carolina | $25,000 |

| North Dakota | $25,000 |

| Ohio | $25,000 |

| Oklahoma | $25,000 |

| Oregon | $20,000 |

| Pennsylvania | $5,000 |

| Rhode Island | $25,000 |

| South Carolina | $25,000 |

| South Dakota | $25,000 |

| Tennessee | $15,000 |

| Texas | $25,000 |

| Utah | $15,000 |

| Vermont | $10,000 |

| Virginia | $20,000 |

| Washington | $10,000 |

| West Virginia | $25,000 |

| Wisconsin | $10,000 |

| Wyoming | $25,000 |

* Required for drivers who choose to use car insurance to prove financial responsibility

Unfortunately, state minimum insurance requirements rarely provide enough coverage to protect you fully from potential lawsuits following an at-fault accident. While the Insurance Information Institute reports an average PD insurance claim payout of $5,3131, a new car replacement averages close to $50,0002.

In other words, if you cause an accident that totals another person’s car, minimum property damage liability coverage limits probably won’t be enough to pay to replace it no matter where you live.

That’s why insurance experts recommend drivers increase their property damage liability limits to at least $50,000 per accident—but a $100,000 per-accident limit is best.

How much does property damage liability insurance cost?

Because PD isn’t usually sold on its own, it’s easiest to calculate its cost as half of your overall liability policy costs. For example, the average driver pays about $928 annually for minimum liability car insurance coverage, which makes the average annual cost for property damage insurance about $464.

Increasing property damage limits to $50k or $100k will increase your average rates—but it’s much more affordable—and much less of a hassle—than the potential lawsuits you’ll face if you don’t have adequate coverage.

Here are the average annual rates for minimum property damage liability car insurance in each state, plus averages for increased limits of $50k and $100k.

| State | State minimum limit | 50/100/50 | 100/300/100 |

|---|---|---|---|

| Alabama | $764 | $842 | $937 |

| Alaska | $1,340 | $1,505 | $1,600 |

| Arizona | $798 | $1,001 | $1,096 |

| Arkansas | $733 | $821 | $916 |

| California | $787 | $1,069 | $1,164 |

| Colorado | $723 | $982 | $1,077 |

| Connecticut | $1,178 | $1,254 | $1,349 |

| Delaware | $996 | $1,174 | $1,269 |

| District of Columbia | $929 | $1,015 | $1,110 |

| Florida | $2,090 | $2,768 | $2,863 |

| Georgia | $1,253 | $1,422 | $1,517 |

| Hawaii | $981 | $1,111 | $1,206 |

| Idaho | $509 | $569 | $691 |

| Illinois | $756 | $802 | $897 |

| Indiana | $509 | $567 | $662 |

| Iowa | $522 | $577 | $687 |

| Kansas | $662 | $685 | $780 |

| Kentucky | $1,304 | $1,514 | $1,609 |

| Louisiana | $1,255 | $1,789 | $1,884 |

| Maine | $488 | $493 | $590 |

| Maryland | $1,090 | $1,131 | $1,26 |

| Massachusetts | $717 | $854 | $949 |

| Michigan | $1,414 | $1,458 | $1,553 |

| Minnesota | $805 | $837 | $932 |

| Mississippi | $712 | $861 | $956 |

| Missouri | $785 | $846 | $941 |

| Montana | $536 | $672 | $1,067 |

| Nebraska | $621 | $654 | $749 |

| Nevada | $753 | $1,079 | $1,174 |

| New Hampshire | $511 | $541 | $636 |

| New Jersey | $1,120 | $1,251 | $1,346 |

| New Mexico | $653 | $733 | $828 |

| New York | $1,459 | $1,544 | $1,639 |

| North Carolina | $511 | $550 | $645 |

| North Dakota | $875 | $888 | $983 |

| Ohio | $590 | $647 | $742 |

| Oklahoma | $721 | $914 | $1,009 |

| Oregon | $840 | $883 | $978 |

| Pennsylvania | $635 | $738 | $833 |

| Rhode Island | $798 | $932 | $1,027 |

| South Carolina | $1,360 | $1,525 | $1,620 |

| South Dakota | $639 | $661 | $756 |

| Tennessee | $713 | $790 | $885 |

| Texas | $1,022 | $1,161 | $1,256 |

| Utah | $804 | $923 | $1,018 |

| Vermont | $434 | $462 | $557 |

| Virginia | $733 | $753 | $658 |

| Washington | $777 | $936 | $1,031 |

| West Virginia | $704 | $760 | $855 |

| Wisconsin | $506 | $550 | $645 |

| Wyoming | $342 | $380 | $475 |

| National Average | $928 | $1,050 | $1,145 |

Other factors affecting liability insurance costs

Insurance providers use more than just your address to calculate your premiums. Additional factors involved in determining insurance costs include:

- Driving experience: Less driving experience means a higher risk of accidents, which means higher rates for coverage.

- Driving record: A history of tickets, at-fault accidents, and other violations indicates you’re a high-risk driver, which means increased premiums.

- Insurance history: A short insurance history or lapses in coverage could lead to higher insurance costs.

Depending on your state, auto insurance companies may also use your age, credit score, gender, and marital status to calculate your insurance rates.

Learn more: How car insurance is calculated

FAQ

-

What does property damage liability insurance cover?

-

Is liability insurance mandatory?

-

What is bodily injury liability?

-

How much does liability insurance cost?

-

Is property damage liability the same as comprehensive?

Methodology

To determine average insurance rates, Jerry’s experts analyze thousands of policies purchased by our customers. Our data are based on real policy premiums for all customers in a given category.

Where real customer data is unavailable, Jerry’s editorial team researches average rates using expert sources from Forbes, NerdWallet, ValuePenguin, WalletHub, The Zebra, and CarInsurance.com. Our data shows the average of the data shared by those sources.

Sources

- https://www.iii.org/fact-statistic/facts-statistics-auto-insurance ↩︎

- https://www.kbb.com/car-news/average-new-car-price-tumbling ↩︎

Sarah Gray is an insurance writer with nearly a decade of experience in publishing and writing. Sarah specializes in writing articles that educate car owners and buyers on the full scope of car ownership—from shopping for and buying a new car to scrapping one that’s breathed its last and everything in between. Sarah has authored over 1,500 articles for Jerry on topics ranging from first-time buyer programs to how to get a salvage title for a totaled car. Prior to Jerry, Sarah was a full-time professor of English literature and composition with multiple academic writing publications.

Expert insurance writer and editor Amy Bobinger specializes in car repair, car maintenance, and car insurance. Amy is passionate about creating content that helps consumers navigate challenges related to car ownership and achieve financial success in areas relating to cars. Amy has over 10 years of writing and editing experience. After several years as a freelance writer, Amy spent four years as an editing fellow at WikiHow, where she co-authored over 600 articles on topics including car maintenance and home ownership. Since joining Jerry’s editorial team in 2022, Amy has edited over 2,500 articles on car insurance, state driving laws, and car repair and maintenance.