When you file certain types of car insurance claims, you’re responsible for paying a set amount of money — your deductible — before your insurance company will cover the remainder of the claim. The most common deductibles are $500 and $1,000, but your insurance company will typically provide a range of options.

What is a deductible in car insurance?

Deductibles serve two main purposes — to share claim costs and risk between the insurance company and policyholder, and to help prevent frivolous claims.

If an individual policyholder is responsible for paying several hundred dollars or more each time they file a claim, it will reduce what the insurer has to pay. It also discourages someone from filing a claim each time their car gets a small scratch or ding — which is why insurers offer lower premiums in exchange for a higher deductible.

Not all types of car insurance require a deductible

Now that you generally know what deductibles are in auto insurance, let’s look closer at when they come into play.

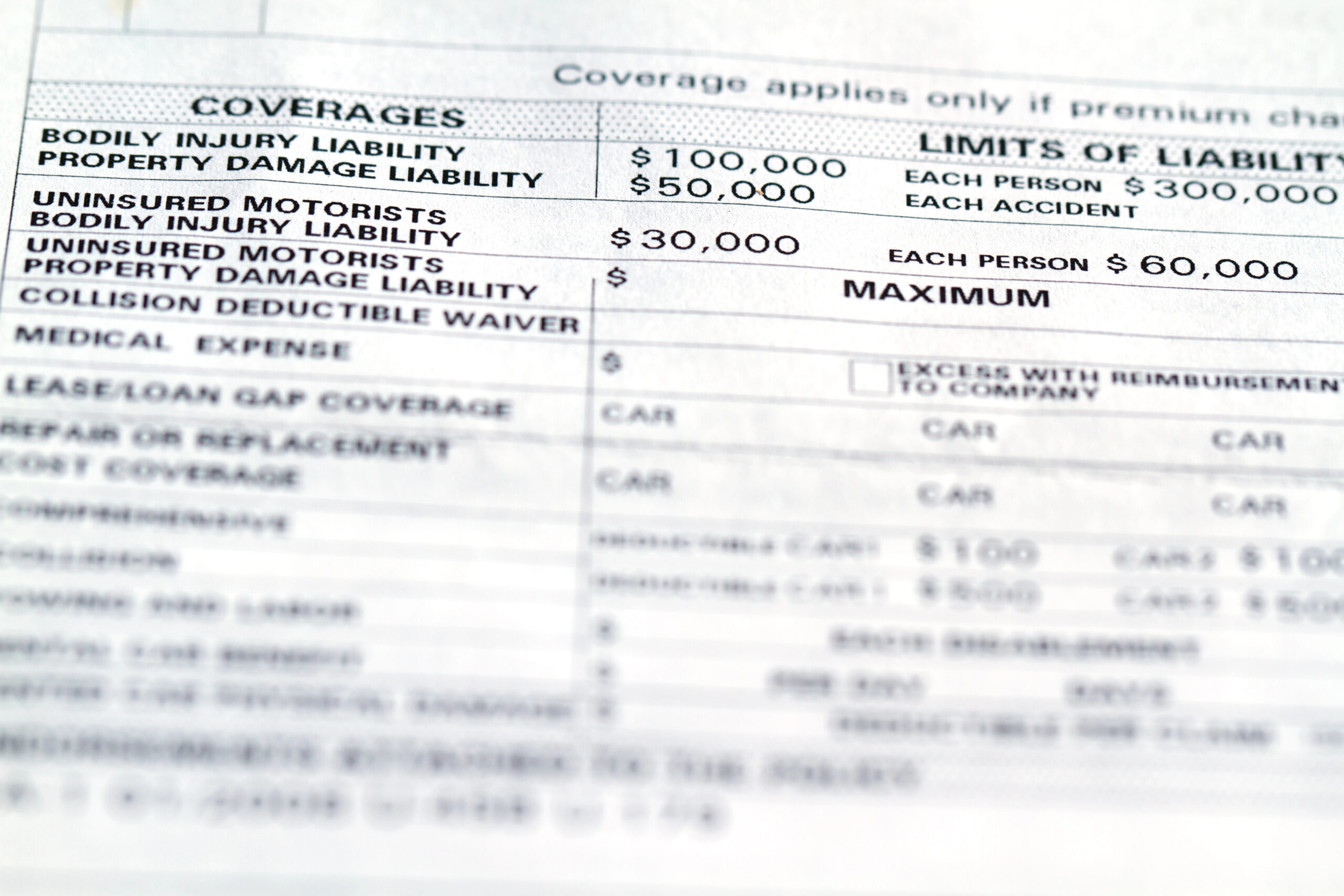

You’ll typically need to pay a deductible for the following types of car insurance coverage, though requirements will vary by state:

- Collision coverage: Covers repairs to your vehicle after a single-car accident or one involving another vehicle or stationary object, like a light pole.

- Comprehensive coverage: Covers damage to your car caused by events outside of your control such as theft, vandalism, severe weather, falling objects, hitting an animal, and more.

- Personal injury protection (PIP): Covers medical expenses and lost wages for both driver and passengers after an accident. It may also cover funeral expenses.

- Uninsured motorist property damage (UMPD) coverage: Covers car repairs from an accident with an uninsured driver.

You usually won’t need to pay a deductible for these types of auto insurance coverage:

- Your own liability coverage: Claims paid to another driver for property damage or medical bills resulting from an accident where you were found at fault.

- Another driver’s liability coverage: Claims for property damage or medical bills resulting from an accident caused by another driver.

- Medical payment (MedPay) coverage: Covers medical expenses for the driver and passengers of your car after an accident.

- Uninsured Motorist Bodily Injury (UMBI) / Uninsured Motorist (UM) coverage: Covers medical expenses for the driver and passengers of your car after an accident caused by an uninsured driver. If you’re curious about paying a deductible for Underinsured Motorist (UIM) protection, that will depend on the state you live in and your specific policy.

How do insurance companies collect deductibles?

In most cases, you’ll either need to pay your deductible out-of-pocket or have it subtracted from your insurance payout. Here’s how it works:

You may have to pay your deductible out-of-pocket to a repair shop

If your vehicle is damaged in a covered claim and you take it to a mechanic, your insurance company will often pay your claim directly to that mechanic less your deductible—which they leave for you to pay the repair shop before you can retrieve your vehicle. Here’s an example:

- You back into a lamppost while exiting a parking lot, causing $2,500 worth of covered damages to your car. You have full coverage with a collision deductible of $500, so you take your vehicle to a local mechanic and file a collision insurance claim.

- Your insurance company pays the claim amount ($2,500) minus your deductible ($500) by sending a check to the repair shop for $2,000.

- When you pick up the car, you pay the remaining $500 in repair costs and go on your merry way. While many repair shops will ask you to pay your deductible once the repairs have been completed, some may require you to pay it upfront when dropping off your vehicle.

Providers may subtract your deductible from a direct payout

If an insurance company writes you a check for your vehicle’s damages, you usually won’t need to pay a deductible out-of-pocket. The company will simply deduct it from your payout—hence the term deductible.

Let’s say that a tree limb falls on your car during a storm, causing extensive frame damage. Your car, which is valued at $7,500, is declared a total loss. You have full coverage with a $500 comprehensive deductible, so you file a claim with your insurance company for the loss. They then send you a check for its total value ($7,500) minus your deductible ($500) for a total payout of $7,000.

You can choose to pay your deductible on a case-by-case basis

Unlike health insurance, where you have one deductible amount to meet annually, you must pay your car insurance deductible every time you file a claim—which might help you determine whether to file one at all.

Who pays the deductible in a car accident?

The policyholder pays the deductible every time a claim is filed, with your insurer covering the remaining cost to repair or replace the vehicle.

What if my car repair costs less than my deductible?

There may be times when your car insurance deductible is more than the cost of the damage to your vehicle. In these cases, there’s unfortunately no point in filing a claim—you’ll have to pay for the whole amount out-of-pocket anyway and having a claim on your record will likely increase your monthly car insurance rates.

On the other hand, if your claim amount is significantly more than your deductible, you’ll likely benefit from filing a claim for the damages—even considering the potential higher premiums.

What happens if you can’t pay your car insurance deductible?

If you can’t cover the cost of your car insurance deductible, you might not be able to file a claim and will instead have to pay out-of-pocket for repairs yourself. In this scenario, you could either work out a payment plan with a mechanic or wait to file if the damage isn’t too bad.

Car insurance deductibles range in value

While most insurers will give you a choice of multiple deductibles, they don’t necessarily all offer the same options.

For instance, Safeco offers drivers a flexible range of up to seven different comprehensive and collision deductibles depending on the state you live in, with some as high as $5,000. Meanwhile, a provider like The General may have as few as just two deductible options capping out at $250, depending on your state.

When you’re choosing a car insurance deductible, consider factors like:

- How much insurance is legally required where you live.

- How much you’ve spent on coverage in the past.

- The size of your savings account and if you can handle covering a higher deductible out-of-pocket in the case of an accident.

- Whether anyone in your household is a high-risk driver, meaning you have an increased chance of filing a claim.

Need to Know

A $0 deductible car insurance plan — aka “zero-deductible insurance” or “no deductible car insurance” — is typically reserved for drivers with excellent credit and clean driving records. The same goes for vanishing deductible discounts, or incentivize-based coverage that rewards drivers who avoid accidents and tickets. And while California and Massachusetts drivers can add a collision damage waiver (CDW)to their auto policy that pays their collision deductible if an uninsured driver strikes them, CDWs aren’t widely available.

Higher auto insurance deductibles mean lower premiums

Why does having a higher deductible lower your insurance premiums? Because if you’re paying more out-of-pocket for each claim, you’re less likely to file a claim in the first place. And the savings can be significant— increasing your deductible can save you 15–40% on your premium, according to the Insurance Information Institute (III).

But that doesn’t mean higher deductibles are necessarily cost-effective. If you drive an older car and have a high deductible, you might receive little to nothing after a payout—even for significant damages to your vehicle. And if you’d have trouble paying a high deductible on short notice, it’s probably not a good financial option even if your car is newer.

Most drivers find that a $500 or $1,000 deductible offers a good balance of affordable rates and manageable out-of-pocket expenses after a claim.

NEED TO KNOW: You can change your deductible when you purchase or renew your car insurance policy.

Of course, deductibles aren’t your plan’s only cost factor. Auto insurance companies calculate premiums by looking at your vehicle, driving record, age, insurance history, credit score, and other aspects of your driving profile. How much you pay depends on all these factors plus your chosen deductible.

When you shop for car insurance with the Jerry app, we compare rates from over 55 insurance companies. You can choose your deductible level when requesting insurance quotes, making it easy to see how adjusting your deductible can impact your rates.

FAQ

-

Do I have to pay a deductible if I hit a car?

-

Do I have to pay deductible if not at fault? If someone hits my car, who pays?

-

What does $500 deductible insurance mean?

-

Is it better to have a $500 or $1,000 deductible?

Megan Lee is an editor, writer, and SEO expert who specializes in insurance, personal finance, travel, and healthcare. She has been published in U.S. News & World Report, USA Today and elsewhere, and has spoken at conferences like that of NAFSA: Association of International Educators. Megan has built and directed remote content teams and editorial strategies for several websites, including NerdWallet. When she`s not crafting her next piece of content, Megan adventures around her Midwest home base where she likes to drink cortados, attend theme parties, ride her bike and cook Asian food.

Expert insurance writer and editor Amy Bobinger specializes in car repair, car maintenance, and car insurance. Amy is passionate about creating content that helps consumers navigate challenges related to car ownership and achieve financial success in areas relating to cars. Amy has over 10 years of writing and editing experience. After several years as a freelance writer, Amy spent four years as an editing fellow at WikiHow, where she co-authored over 600 articles on topics including car maintenance and home ownership. Since joining Jerry’s editorial team in 2022, Amy has edited over 2,500 articles on car insurance, state driving laws, and car repair and maintenance.