It’s a major expense for most people, so much so that recent price hikes forced a majority of Americans to cut back on essentials such as groceries. And pretty much everyone has to buy it or else risk fines, losing their driver’s license and, in the worst case, financial disaster.

But how much do people really know about car insurance? Not a whole lot, it turns out, considering how expensive and important it is.

Jerry recently asked people in a survey about the basics of car insurance. Respondents didn’t quite fail the test. Call it a D-minus. On average, 63% chose the right answer to the questions asked. Only one question was answered correctly by more than 80% of respondents.

Here’s more of what we found:

Key Insights

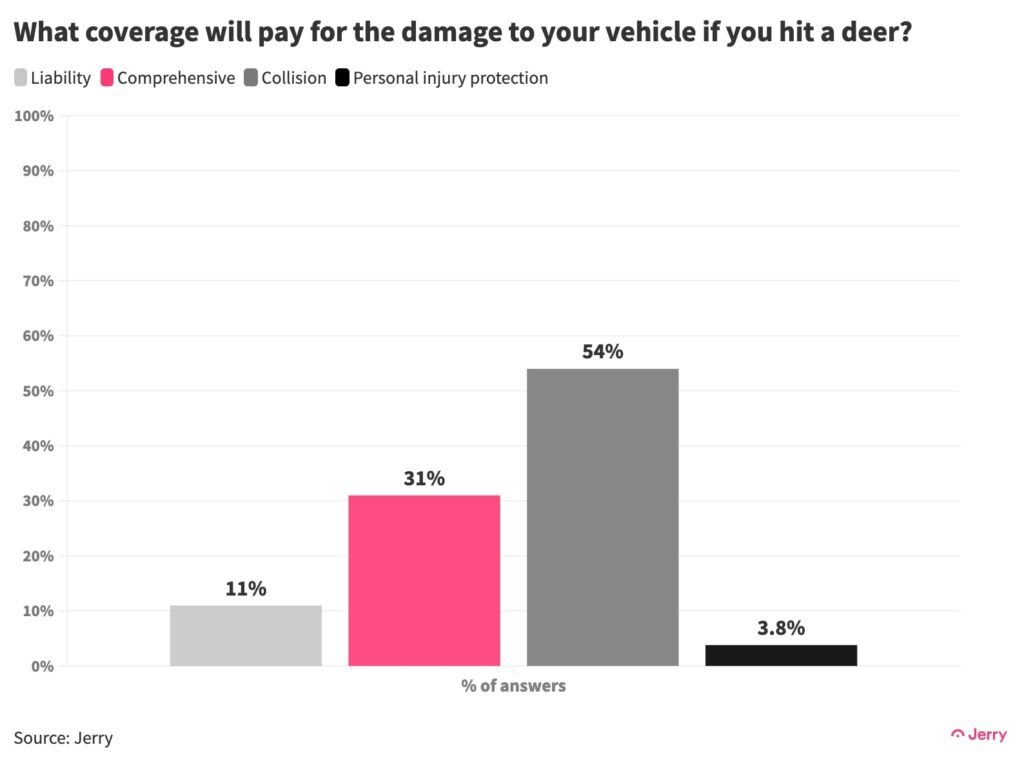

- Fewer than a third (31%) of respondents correctly identified the type of policy (comprehensive) that would cover the damage to their vehicle if they hit a deer.

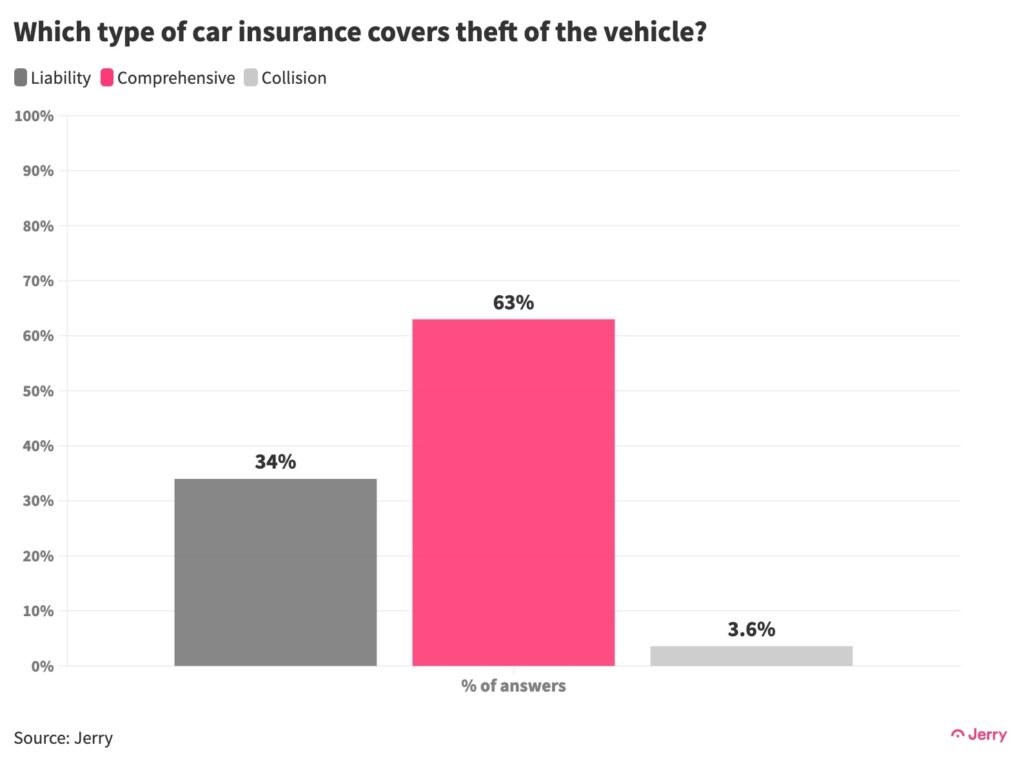

- More than a third (37%) of drivers were unable to identify the type of coverage (comprehensive) that would cover the theft of their vehicle.

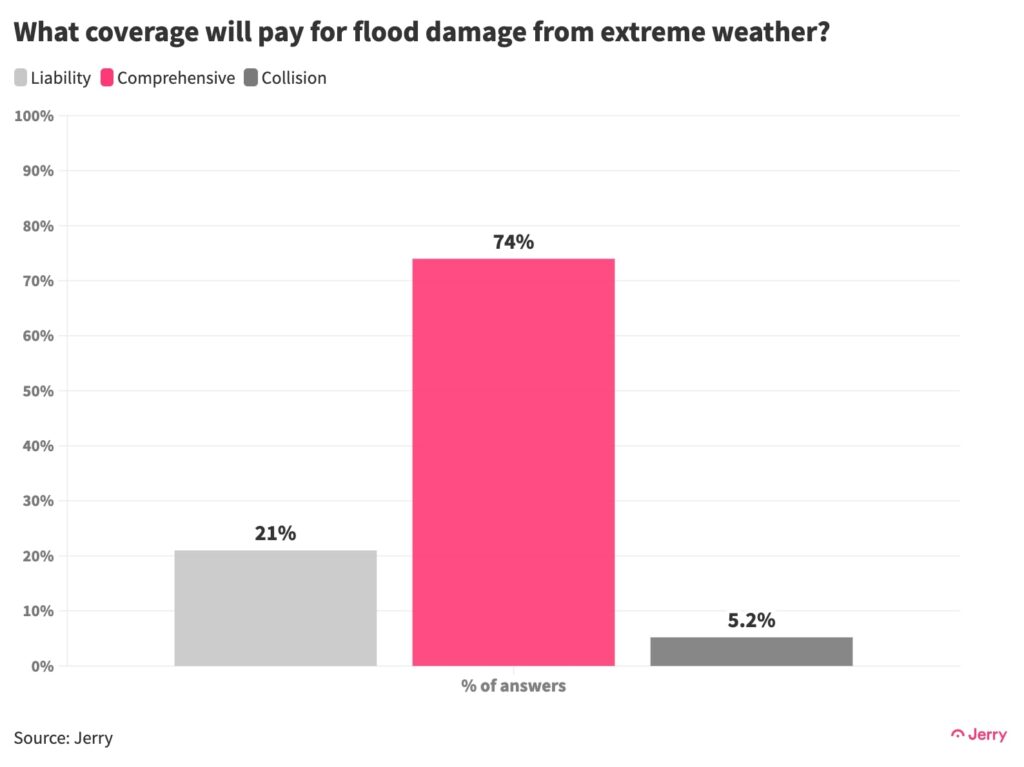

- More than a quarter of drivers (26%) were unable to identify which type of coverage (comprehensive) would pay for flood damage to their vehicle caused by extreme weather.

- On three of the nine questions, fewer than 60% of respondents answered correctly, and only one question was answered correctly by more than 80% of respondents—a true-false question about whether raising their deductible could lower their premium.

- Fewer than half of drivers (41%) understood that if they had an accident while driving a friend’s car, premiums would likely go up for both of them.

- Nearly a quarter of respondents (23%) don’t know that in most cases their car insurance policy will cover accidents or theft involving their rental car.

Common Scenarios

Understanding what type of coverage will pay for what type of damage is a good starting point when buying insurance. But many people don’t know exactly what they’re buying. This information could save them money, helping them to make educated decisions about the cost of certain coverages versus the risk of paying for damages out of pocket, or avoiding unnecessary coverages altogether.

American drivers hit nearly 2 million animals annually, and deer are the most common, according to the Insurance Information Institute. Yet fewer than a third of respondents correctly identified the type of policy (comprehensive) that would cover the damage to their vehicle if they hit a deer.

This may seem like a trick question, given that hitting a deer would necessarily involve a literal collision, but it could be a costly misunderstanding, particularly for drivers in a state such as West Virginia, where they face the highest odds of hitting a deer (1 in 38 odds in 2023, according to the III).

A more straightforward question might be, Which type of car insurance will cover the theft of a vehicle? (There were more than 1 million cars stolen in the U.S. in 2023, roughly a 25% increase from 2019, with the most seen in California, Texas, and Florida.) In this case, nearly two thirds (63%) of respondents answered correctly that comprehensive coverage would be needed to be compensated for the theft. On the other hand, that means more than a third incorrectly chose liability or collision coverage.

It’s important for consumers to know if their car insurance protects them in the case of extreme weather, which is claiming more and more vehicles as climate change ramps up. Hurricane Ian, for example, damaged as many as 350,000 vehicles in Florida and the Carolinas in 2022. Some insurers are pulling out of disaster-prone states because extreme weather has become so common.

About three fourths (74%) of respondents correctly identified comprehensive coverage as the type that would cover damage from flooding. Still, more than one in four answered incorrectly, including 5.2% who cited collision coverage.

Cost Accounting

Many people appear mystified by how car insurance rates are set. Earlier this year, for example, in a different Jerry survey, 61% of respondents whose rates had gone up in the previous year said they didn’t understand why. What’s more, in this most recent survey, after two years of soaring premiums, nearly one in five (18%) respondents didn’t know that they might be able to lower their monthly premium by raising their deductible.

More than half of respondents incorrectly said it was false that in most states car insurance rate increases must be approved by the state government. One third (34%) didn’t know that their occupation can influence their insurance rate.

Separately, whose rates will go up if you are driving a friend’s car (with their permission) and have an accident? Fewer than half of drivers (41%) understood that in that situation, rates are likely to go up for both themselves and their friend.

Conclusion

It’s a bit hard to blame people for a weak grasp of the basics of car insurance. For one thing, the documents we get from insurers aren’t written in a language most humans can understand. But the critical role car insurance can play in protecting us from permanent financial ruin means it’s vital that we understand what we’re paying for and what we get in return. The results of Jerry’s survey indicate more efforts need to be made to educate consumers—and that consumers should make more effort to educate themselves.

Methodology

All survey data is based on a nationally representative survey of 1,000 respondents conducted in August 2024 using Pollfish. Respondents were filtered to include only those aged 18 years or older who either own or lease a vehicle, drive at least once a week, and were fully responsible for paying for auto insurance on their vehicle or their family’s vehicle. More information about Pollfish and its audiences can be found on its website.

Citing Our Research

Feel free to republish the research, data, and insights from this study! Just be sure to link back to the study and credit Jerry as your source in your article.

Example: “Data from the car insurance savings app Jerry showed that…”

Got questions? Shoot us an email at press@jerry.ai.

Heads up: The data was accurate when published, but it might be updated later.