Higher deductibles. Less coverage. Going without insurance for a while. Cutting spending on things such as groceries and clothing.

Those are just some of the steps American drivers, especially the young and women, have taken to cope with a staggering rise in car insurance premiums over the past couple of years, according to the results of a new survey conducted by Jerry.

Not surprisingly, more people are shopping around for better rates and switching insurance companies when they find them. Some are knowingly giving false information to insurers in an effort to limit the painful price hikes, even though most of them know the consequences could be devastating if their insurers found out.

The bottom line is that the vast majority of drivers (74%) believe car insurance—an inescapable expense for practically every working-age American—has become unaffordable for the average family. And despite their best efforts, more than one in four (28%) drivers who have insurance don’t believe their family would be protected from financial disaster if they were involved in a serious accident that caused one or more people to be hospitalized.

Drivers’ struggles with insurance are just one element of the car-affordability crisis. Higher prices for vehicles, repairs, and maintenance are weighing on all consumers. Those factors and others, including increases in the number and severity of traffic crashes, are also what has prompted insurers to raise rates at the fastest pace in decades.

Key Insights

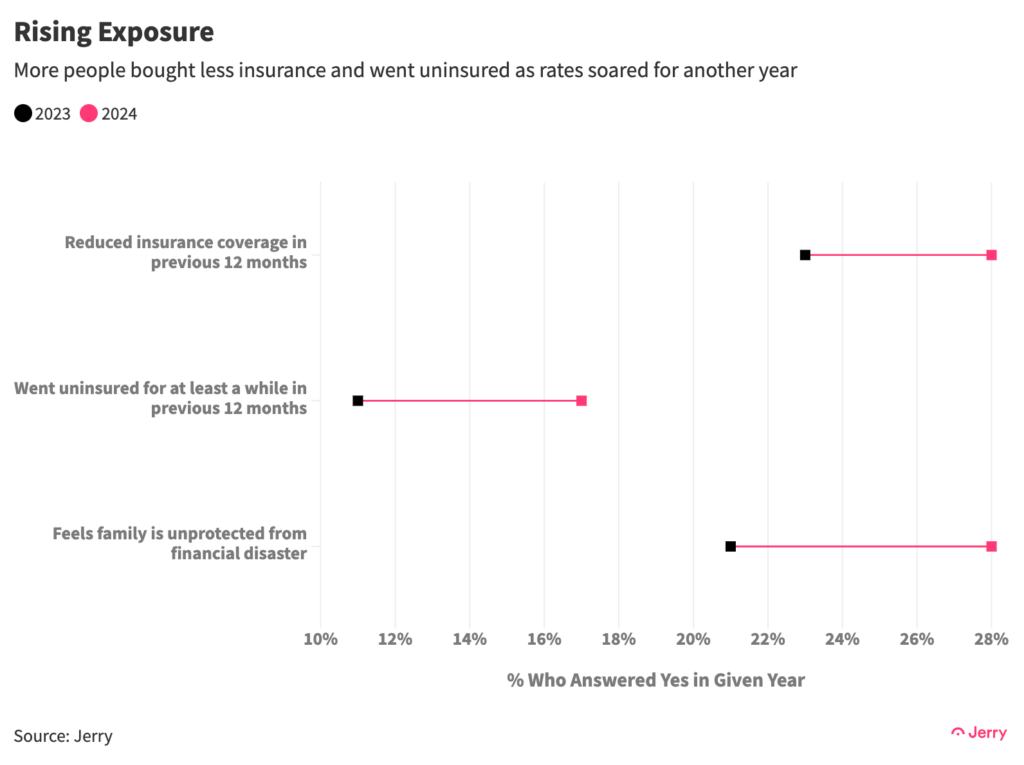

- More than a quarter (28%) of American drivers lowered their insurance coverage in the past year due to rising premiums, up from 23% who said they did so in a similar survey a year earlier. That includes 40% of Gen Z, 39% of Millennials, and 28% of Gen X drivers.

- A majority (60%) of those who lowered their coverage said they settled for less than they probably need.

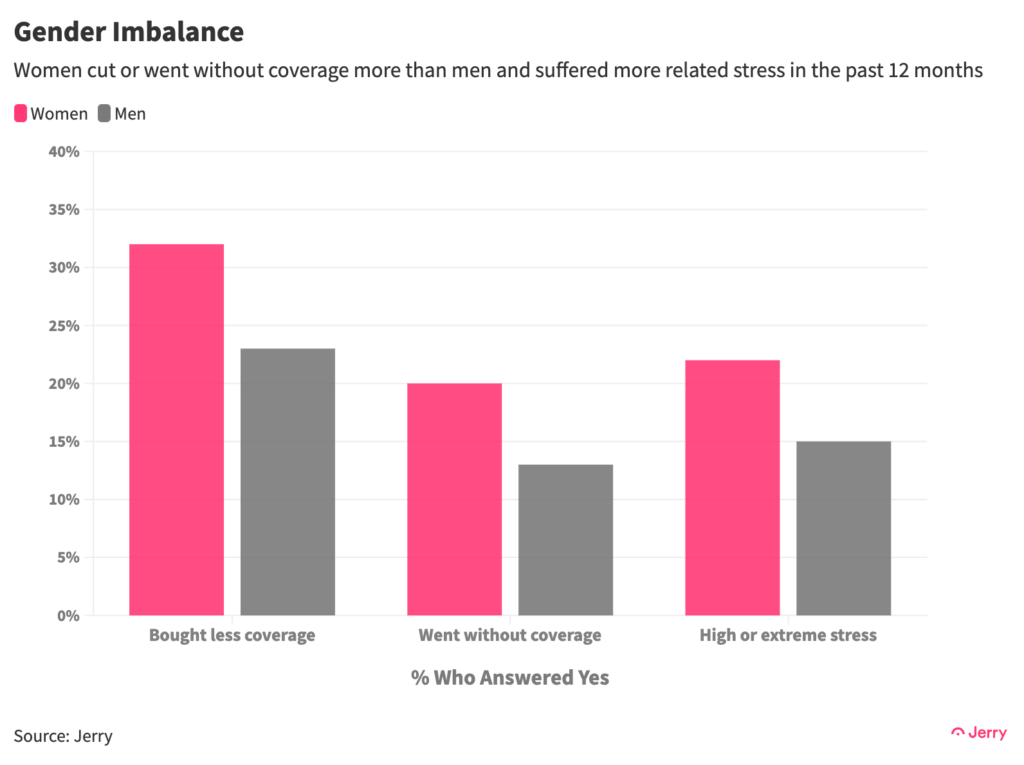

- Women are struggling with higher premiums more than men. They were more likely to buy less coverage (32% vs. 23% of men), to go without coverage (20% vs. 13%), and to rate the stress caused by car insurance as high or extreme (22% vs. 15%).

- More than a quarter (28%) of all respondents said they don’t believe their coverage will protect them and their families from financial disaster if they’re involved in an accident that requires one or more people to be hospitalized—an increase from 21% who said so a year ago.

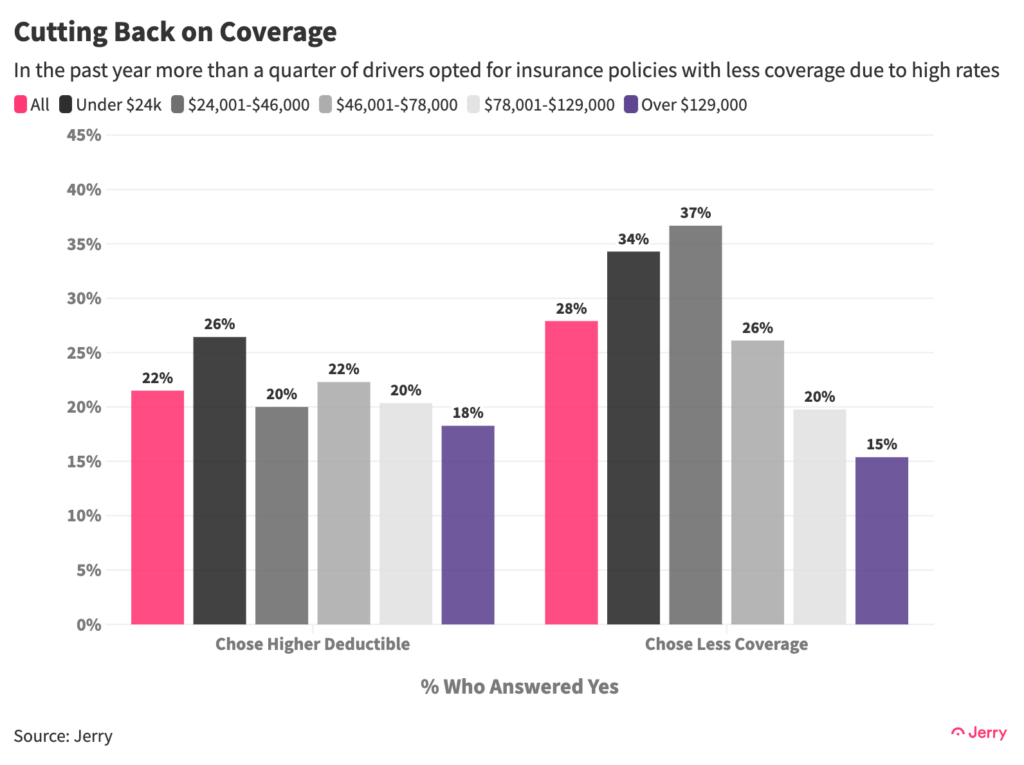

- More than one in five (22%) of those surveyed said they chose a higher deductible in exchange for lower premiums in the past 12 months. Yet 40%, including 49% of Millennials and 46% of Gen X, said they don’t have enough money in the bank to pay the deductible if it were due tomorrow.

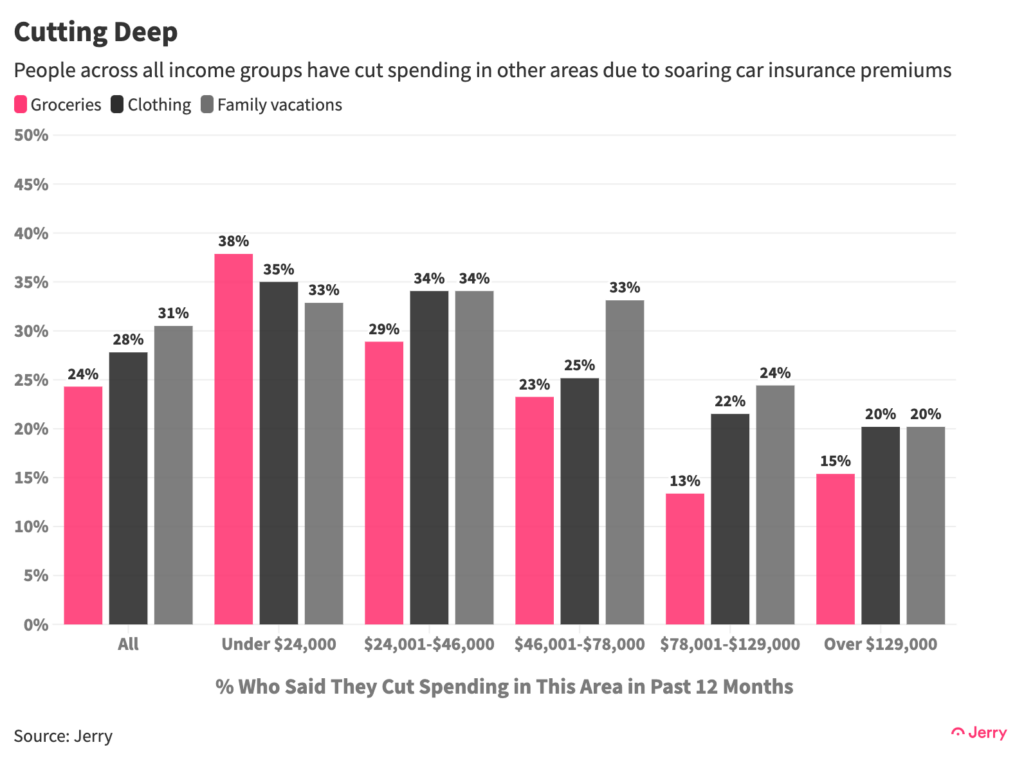

- The struggle to pay for car insurance is forcing people to sacrifice. A majority (57%) of drivers said rising car insurance premiums caused them to cut spending in other areas. That included groceries (24%), clothing (28%), and family vacations (31%).

- Another third (33%) of respondents said the cost of car insurance caused them to delay major spending, such as on a large home appliance or home-improvement project. That included nearly two thirds (64%) of those under 60 years old.

- In many cases, higher premiums meant going without insurance for at least a while. In fact, nearly one in five (17%) of survey respondents said they did so for some period of time in the previous 12 months, compared with 11% who said so a year earlier.

- Some have resorted to providing false information to insurers. Nearly one in five (17%) said higher premiums made them more likely to give insurers false information in hopes of limiting their rates, while 6.7% said they knowingly did so in the previous 12 months.

- About three quarters of respondents (74%) said car insurance has now become unaffordable for the average American family.

Soaring, and Soaring Again

Car insurance has risen 49% since January 2022, including 19% in the 12 months ending in July, making it one of the primary drivers of inflation this year. Combined with overall price increases in recent years, the steep back-to-back annual hikes in insurance rates have left many drivers struggling to get by. The number of people who have reduced their coverage, raised their deductible, or simply gone without insurance for a while because they couldn’t make the payments all rose from a year earlier, when Jerry conducted a similar survey.

Adding insult to injury, many drivers are taking on what they see as extra risk—and stress. A solid majority of those (60%) who cut back on their coverage said they were forced to buy less than they thought they needed. And nearly three in 10 (28%) respondents said they don’t think their insurance will protect their family from financial disaster in case of a serious accident involving one or more hospitalizations.

Paying More, Getting Less

For most families, the natural response to rising prices is to cut back on the volume of purchases or stop buying altogether. With car insurance, a necessity for most Americans, a significant number chose to simply buy less. In fact, more than a quarter (28%) of American drivers reduced their coverage level in the past 12 months, up from 23% who did so the previous year. That includes 40% of Gen Z respondents, 39% of Millennials, and 28% of Gen X drivers.

Even higher-earning households are feeling the pain. One in five drivers with a pre-tax household income of $78,000 to $129,000 cut their insurance coverage in the past 12 months, as did 15% of those whose household income topped $129,000.

Forced Sacrifices

While many lowered their coverage, a majority of respondents (57%) said they were forced to cut spending in other areas of their lives to afford car insurance. Nearly a quarter (24%) said they were forced to spend less on groceries, while more than a third cut back on entertainment.

This was true across income groups but especially true of younger drivers. Together, nearly two thirds (64%) of Gen Z, Millennial and Gen X drivers said they spent less in other areas because of insurance costs, compared to 40% of Baby Boomers.

Car insurance rates are also forcing people to cut major spending. A third (33%) of respondents said they delayed major spending, such as on a large home appliance or home-improvement project, because of insurance rates. That included nearly two thirds (64%) of those under 60 years old. And a majority (59%) said they were likely to keep an older car longer rather than buy a new one because a new one would cost more to insure.

Women Hit Harder

Higher premiums are weighing on women more than men. Women were much more likely to buy less coverage (32% vs. 23% of men), to go without coverage (20% vs. 13%) for a while, and to rate the stress caused by car insurance as high or extreme (22% vs. 15%). Women were also less likely to say they would be able to pay their deductible with cash on hand tomorrow, if needed (52% vs. 69% of men).

Stressed Out

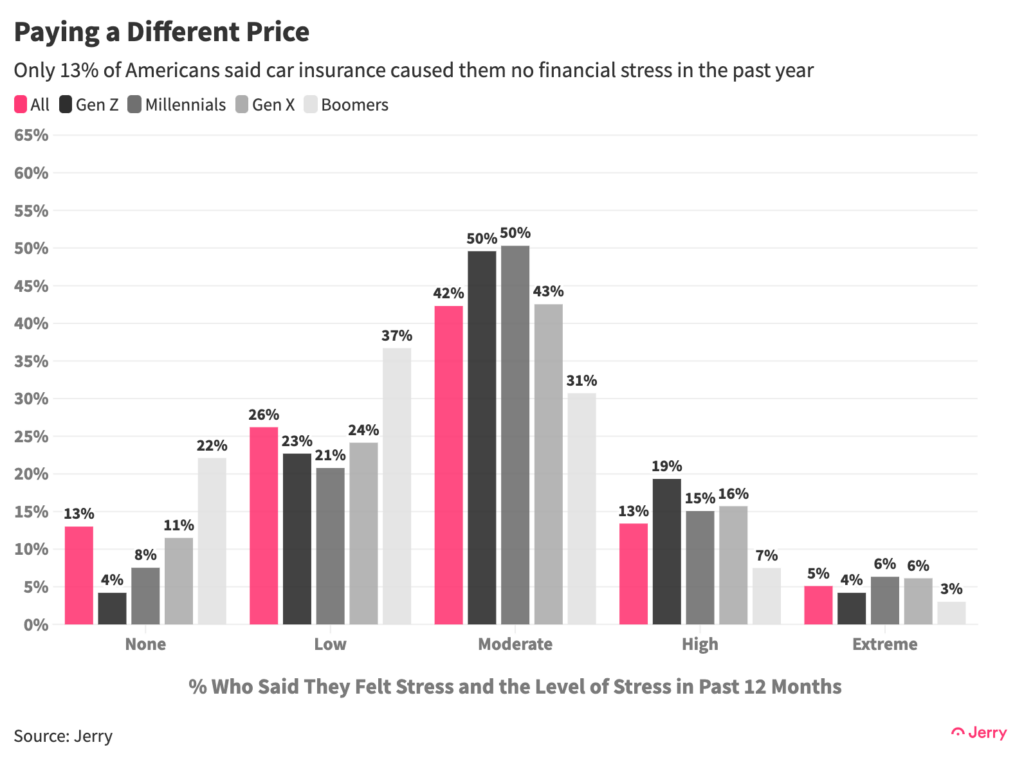

A hidden cost of the enormous jump in insurance rates is the stress felt by drivers as they struggle to pay the bills and take on additional risk in the form of reduced coverage or even periods of no coverage. Almost everyone is feeling the strain—nearly nine in 10 (87%) respondents said car insurance caused them at least some stress in the previous 12 months. Almost one in five (19%) said the stress level was high or extreme, up from 14% who said so a year ago.

Young drivers and women felt it the most. More than one in five members of Gen Z (24%), Millennials (21%) and Gen X (22%) experience high or extreme levels of stress, compared with only 10% of Baby Boomers. Meanwhile, 22% of women said the same, versus 15% of men.

Conclusion

While the worst of the COVID-19-driven inflation surge has passed, the car affordability crisis remains. Car insurance rates continue to soar as insurers play catch-up in reaction to the steep, enduring increases in claims-related expenses such as vehicle prices and repair costs. There are signs that the worst of the insurance rate hikes may be ending, with some insurers even talking about modest rate cuts in the near future. While this is certainly good news for drivers, rates remain dramatically higher than three years ago and three fourths of drivers (74%) say they are now simply unaffordable for the average family.

Methodology

All survey data is based on a nationally representative survey of 1,000 respondents conducted in August 2024 using Pollfish. Respondents were filtered to include only those aged 18 years or older who either own or lease a vehicle, drive at least once a week, and were fully responsible for paying for auto insurance on their vehicle or their family’s vehicle. More information about Pollfish and its audiences can be found on its website.

Data on the rising cost of car insurance was gathered from the U.S. Bureau of Labor Statistics.

Citing Our Research

Feel free to republish the research, data, and insights from this study! Just be sure to link back to the study and credit Jerry as your source in your article.

Example: “Data from the car insurance savings app Jerry showed that…”

Got questions? Shoot us an email at press@getjerry.com.

Heads up: The data was accurate when published, but it might be updated later.

Henry Hoenig previously worked as an economics editor for Bloomberg News and a senior news editor for The Wall Street Journal. His data journalism at Jerry has been featured in outlets including CBS News, Yahoo! Finance, FOX Business, Business Insider, Bankrate, The Motley Fool, AutoWeek, Money.com and more.