After years of steep premium increases, up over 50% since 2021, industry experts predict that the market is poised for stabilization in 2025.

This relief comes at a crucial time. Jerry surveyed 1,000 American drivers across all age groups and regions of the country in its 2025 State of the American Driver Report to find out how people are impacted by the current era of higher-cost car ownership.

Results reveal that high insurance costs alone have pushed 32% of drivers to cut back on family vacations, 30% to reduce clothing purchases, and 26% to trim their grocery budgets in the past year alone.

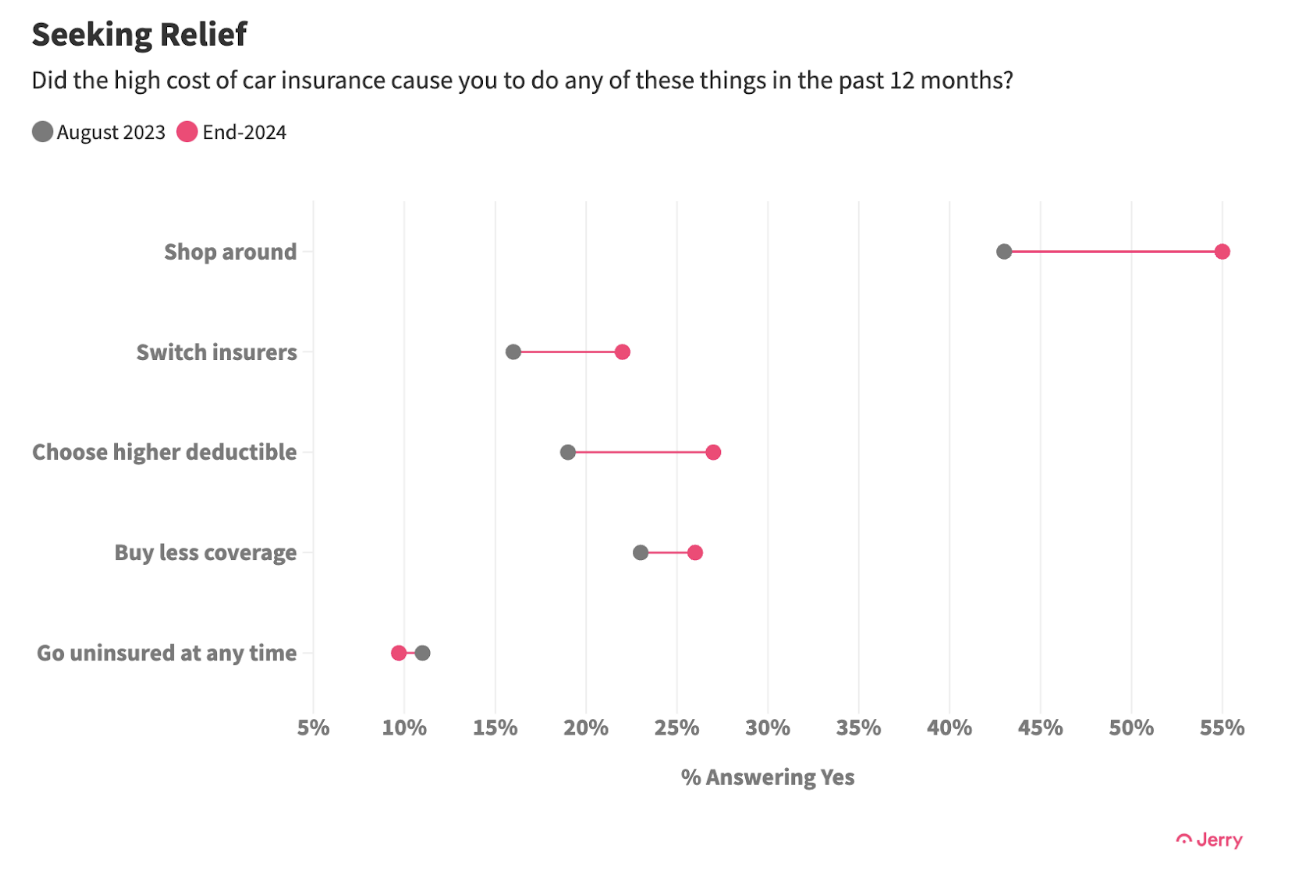

These high costs also motivated 27% of drivers to raise their deductibles to lower premiums, while another 26% cut back on coverage. Nearly one in 10 (9.7%) went completely uninsured at some point in the last year due to financial strain—taking on more risk than recommended and leaving many vulnerable.

But there’s reason for optimism. Much slower, single-digit rate increases anticipated for 2025 will mark the end of relentless hikes and create the potential for more affordable and manageable premiums. As competition heats up, drivers will benefit from more choices and better control over their policies.

This shift in the car insurance market is an opportunity for drivers to rethink how they shop for car insurance. Read on to learn about and navigate these changes effectively—and how to maximize savings potential.

What’s Driving up Insurance Costs?

The Insurance Information Institute identifies a number of factors that contributed to the record-high rise in car insurance premiums in decades.

First, inflation significantly outpaced general cost increases, leading to higher vehicle repair and medical expenses. This means insurers face higher costs every time a claim is filed.

Combined with rising accident rates, including an increase in fatal crashes, insurers have experienced a larger volume of claims with larger payouts, forcing them to raise premiums to offset their losses.

Advanced car technology, including sensors and cameras—now standard in newer vehicles—has also played a significant role. While these innovations improve safety, they also make repairs more complex and expensive, contributing to a 28% increase in costs over the past three years.

It makes sense then that a staggering 76% of drivers believe they’ve been overcharged for car repairs. No other major type of bill creates more confusion, frustration, and distrust than the cost of car repairs and maintenance. Jerry survey respondents ranked this worse than credit cards, home repair services—even medical bills. So it’s clear that drivers have been feeling the financial pinch in more ways than one.

For these past few years, restrictive underwriting practices, inspired by this mix of economic factors, were the result of insurers playing it safe to avoid further losses and prevent passing even higher costs onto customers. But in 2025, this is set to change.

What’s Changing in 2025?

Market trends suggest insurers will begin loosening these restrictions as they work to regain market share. With competition on the rise, they’ll be focused on attracting customers with more competitive offerings.

As rate adjustments are approved, drivers can look forward to smaller, single-digit premium increases around the 2% to 3% range. To put that into perspective, rates rose about 25% last year, and over 51% the last three years. It’s progress.

Expect to see insurers introduce lower down payments, more flexible monthly plans, customizable payment schedules, and usage-based plans this year, offering drivers more control over how their coverage aligns with their budgets. With more options and offerings from both national and regional insurers, drivers will have greater opportunities to save.

To drive significant advancements in the customer experience, insurers are increasingly investing in artificial intelligence and automation solutions to streamline processes, boost efficiency, and provide faster, more seamless service.

Innovations like these could very well elevate the quality and speed of service to new heights, making shopping for car insurance in 2025 more convenient and customer-focused than ever.

Three Tips to Maximize Savings

Drivers are in their strongest position in years to secure better deals. Follow these tips to reassess coverage and take full advantage of this year’s anticipated market shift:

- Periodically review your coverage: Even if you’re satisfied with your current policy, it’s always a good idea to explore all your options. Rates can vary significantly between companies, and with the more competitive market in 2025, you might find better coverage for a lower price by comparing quotes. Start now and revisit six months to make sure you have the best deal.

- Leverage technology to save time: Use an app to compare quotes. This simplifies the car insurance shopping process, saving you time and effort while helping you find the best deal.

- Consider joining a telematics program: Telematics programs reward safe drivers with lower premiums. By allowing insurers to monitor your driving habits through a device or service, you could unlock discounts based on metrics like mileage, speed, and braking patterns. This could translate into significant savings over the year.

Methodology

Jerry’s 2025 State of the American Driver report is based on data from a nationally representative survey of 1,000 people conducted in November 2024 using a platform and audience from Pollfish. All respondents own or lease a vehicle, drive at least once a week, and are responsible for paying for car insurance for themselves and/or their family. Respondents were blended for age, gender, and region. More information about Pollfish and its audiences can be found on its website. Inflation figures are based on data from the Bureau of Labor Statistics. Data on EV charging stations comes from the Department of Energy.