If you’re looking for details about your car insurance policy, check out your car insurance declaration page. Policy details from this declaration page can help you file a claim, evaluate coverage needs, or lower your insurance premiums.

What is a car insurance declaration page?

A car insurance declaration page is a summary sheet for your car insurance policy that contains essential information about you, your vehicle, and your policy.

This declaration page — or “dec page” — can usually be found on the first page of your insurance policy. It will contain basic information about your policy, including all the drivers listed on your car insurance, information about the insured vehicles, and how much coverage you purchased.

For an auto insurance policy, your declaration page should cover at least the following:

- Information about your policy: It will outline your policy number and auto insurance company, the effective dates of coverage, and your agent’s name and contact information, if applicable.

- Who it covers: It should also list the name of the policyholder (or named insured) and other drivers covered under the policy.

- What it covers: You’ll find information about all vehicles covered by the policy on your declaration page, including the vehicle identification number (VIN), make, and model.

- How much it covers: All of the applicable types of coverage and coverage limits will be listed on your declaration page.

- What you have to pay: You’ll also find information about your expected financial contributions, like any deductibles and premiums for your policy.

Since all of this information is available on a single sheet, it’s a great point of reference for any policy information that you might need in a pinch, such as your agent’s contact information, your deductible, your agreed-upon premiums, or your coverage limits.

How to read a car insurance declaration page

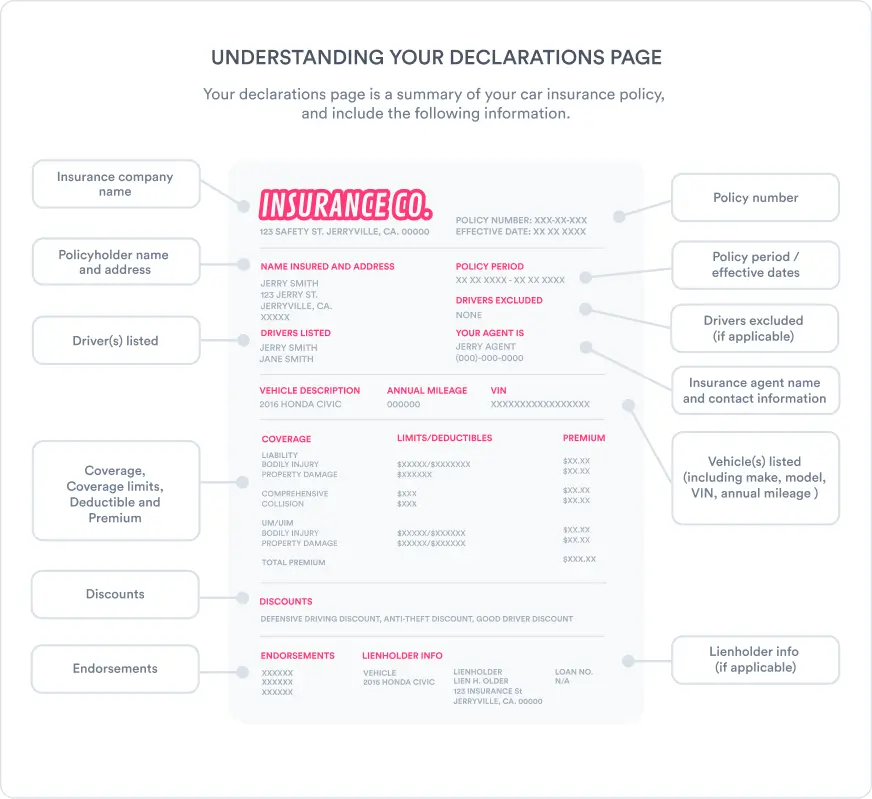

To help you better understand the information on your auto insurance declaration page, our expert insurance team at Jerry created this mock page example.

Not all auto insurance declaration pages are formatted the same, but they should include all applicable information.

At the top of the page, you’ll find your policy number and its effective dates—otherwise known as the start and expiration date of your policy period. As you move down the page, you’ll also see information about the policyholder and other covered or excluded drivers, plus your insurance agent, coverage limits, premiums, and any deductibles.

Following that, you may also see additional information, such as:

- Discounts: If you have a discount on your policy — such as for bundling your auto and home insurance or renters insurance policy — it will be on your declaration page.

- Lienholder information: If your car is financed or leased, the lender’s information will be included on your declaration page as a loss payee.

One thing it might not include is exclusions to your policy. You’ll need to contact your agent or look at your other policy documentation to find that information.

How to get a copy of your declaration page

When you purchase car insurance, you should receive a copy of your policy. The insurance declaration page will usually be the cover sheet for your policy and should be the first page you’ll see.

If you need a new declaration page, request one from your auto insurance provider by calling, visiting their website, or using their mobile app. Another solution is to use the Jerry app. If you purchase a policy with Jerry, you can find your declaration page and any other important policy information in our app’s virtual glovebox.

Can you use a declaration page as proof of insurance?

No — you should not rely on your car insurance declaration page as your sole proof of insurance. If you’re purchasing a vehicle or are pulled over by the police, your car insurance ID card is the best way to prove you have insurance and is accepted in all 50 states. You can also use a digital insurance ID card in every U.S. state except New Mexico.

Without one of these official documents, you risk getting into legal trouble during a traffic stop. You should always keep a copy of your insurance ID in your car’s glove compartment. Or, if you use Jerry, it can be found directly in the app.

FAQ

-

How can I obtain a copy of my auto insurance declaration page?

-

What are the parts of a declaration page?

-

Is an insurance declaration page the same as a binder?

Kayda Norman is an insurance writer and editor with more than 12 years of content experience. She previously worked at NerdWallet as an insurance writer and content management specialist. She has covered a wide range of insurance topics such as high-risk drivers, auto insurance rate factors, and credit-based insurance scores. Her work has been featured in The New York Times, The Washington Post, and USA Today.

Everett Cook is an award-winning journalist and editor with more than 10 years of experience across a variety of industries. In editing for Jerry, Everett’s mission is to help readers have a better understanding of the costs of owning or leasing a car and to better understand their vehicle in terms of insurance and repairs. Prior to joining Jerry, Everett was an editor for Axios. His previous work has been featured in The New York Times, The Los Angeles Times, The San Francisco Chronicle, The Atlantic, Atlantic Re:think, The Boston Globe, USA Today, and others. He’s also been a freelance writer and editor with experience in SEO, audience building, and long-term content roadmaps. Everett is a proud graduate of the University of Michigan.