Shopping for car insurance requires a lot more than getting a single quote online; you’ll need to intentionally pick your shopping method, determine your coverage needs, and get several quotes to ensure you’re getting what you need at the best rate.

The smart way to shop for car insurance

Shopping for car insurance can feel complicated since insurance isn’t one-size-fits-all—but it doesn’t have to be. Here are five simple steps you can follow to shop smart, find the coverage you need, and potentially lower your car insurance premiums.

Step 1: Pick a shopping method

There are three basic methods for insurance shopping:

- Requesting quotes from an insurance company

- Using an insurance agent/insurance agency,

- Working with a trusted, independent insurance broker like Jerry

While shopping with an insurance agent has its benefits, oftentimes, agencies only partner with one or two providers, which can lead to you leaving savings on the table. Similarly, requesting quotes from multiple provider websites isn’t only time consuming, but it also only allows you to see one insurer’s quote at a time.

With Jerry, you can compare personalized auto insurance quotes from dozens of top providers in your area in one spot. The entire quoting process takes less than two minutes, and can help you find the best deals for your profile.

However, whichever method you choose, it’s important to make sure it’s the right solution for you and your vehicle.

Learn more: How to get same day car insurance you can trust

Step 2: Determine your insurance coverage needs

Before you dive straight into shopping for insurance, you’ll need to look at your insurance coverage options and decide what you need.

Your car insurance should include at least your state minimum coverage requirements, but most drivers find they need additional types of coverage, too. Here are some common car insurance coverage options that you can choose from.

Liability insurance

All drivers are required to carry liability coverage in order to drive their vehicle. Liability insurance includes bodily injury coverage and property damage liability coverage and covers medical expenses and vehicle repairs for third parties, up to your policy limits.

Each state sets the liability limits for drivers in accordance with their car insurance laws. These are the limits you’re legally mandated to purchase. However, you can choose to go above your state minimum coverage.

At Jerry, our expert insurance agents recommend increasing your limits to 50/100/50 or 100/300/100, depending on your financial situation. This way, you can be sure your assets and future finances are well protected in a variety of scenarios.

Take a look at how your liability limits can impact your car insurance rates with some of the top providers:

| Insurance provider | 25/50/25 | 50/100/50 | 100/300/100 |

|---|---|---|---|

| AAA | $199 | $262 | $299 |

| Allstate | $194 | $222 | $245 |

| Clearcover | $133 | $176 | $173 |

| Direct Auto | $178 | $242 | $279 |

| Mercury Auto | $188 | $229 | $246 |

| National General | $160 | $216 | $227 |

| Nationwide | $167 | $181 | $194 |

| Progressive | $158 | $192 | $198 |

| Safeco | $164 | $206 | $197 |

| State Auto | $169 | $190 | $210 |

Collision and comprehensive coverage

If you’re in need of added protection for your vehicle, there are two types of policies that you should consider:

- Collision coverage: Pays for damages to your vehicle sustained during a collision, whether that collision was with another vehicle or with a stationary object, including accidents like hit-and-runs.

- Comprehensive coverage: Usually paired with collision insurance and covers car repairs or a replacement vehicle following damages caused by something other than a collision, such as vandalism, theft, or a natural disaster.

For both types of coverage, you will need to set a deductible and pay the corresponding amount before your insurance will payout a claim. Collision and comprehensive insurance are a good investment if your vehicle is worth more than $4,000 and may be required for leased vehicles.

You can purchase collision and comprehensive coverage on their own—however, most drivers choose to include both options on their liability insurance policy to make a full coverage policy.

Here’s how much you can expect to pay, on average, for a full coverage policy with some of the nation’s top providers:

| Insurance provider | Liability + collision | Liability + comprehensive | Full coverage |

|---|---|---|---|

| Allstate | $233 | $124 | $198 |

| Bristol West | $151 | $203 | $360 |

| Dairyland | $92 | $173 | $321 |

| Gainsco | $253 | $63 | $222 |

| Kemper | $105 | $114 | $176 |

| National General | $150 | $92 | $200 |

| Plymouth Rock | $260 | $141 | $227 |

| Progressive | $127 | $86 | $178 |

| Safeco | $151 | $94 | $200 |

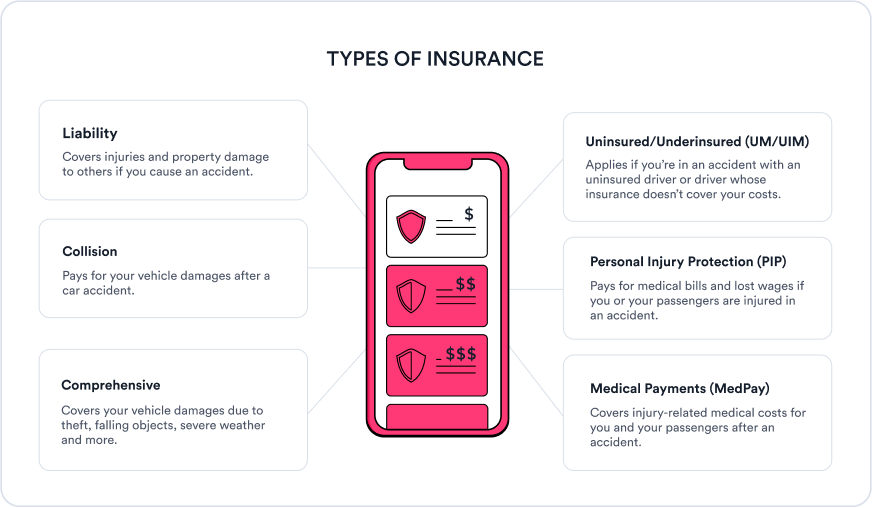

Other types of insurance

There are a few other types of coverage that you may be required to add to your policy, or that you can choose to add to your existing coverage. These types of insurance include:

- Uninsured/underinsured motorist coverage (UM/UIM): A 2021 study by the Insurance Information Institute showed that 12.6% of U.S. drivers are uninsured.1 UM/UIM coverage protects you if you get into an accident with one of these drivers by helping you pay the resulting medical bills after an accident with an uninsured or underinsured driver. This coverage costs an average of $67 per month.

- Personal injury protection (PIP): Personal injury protection is required in no-fault states, where it covers things like medical expenses, lost wages, and even funeral expenses for you and your passengers after an accident. PIP costs an average of $10-$35 per month.

- Medical Payments (MedPay): Similarly to PIP, MedPay covers health-related expenses after an accident. It’s only required in Maine, but is available as optional coverage in other states. On average, drivers pay $2-$15 per month for MedPay coverage.

Learn more: Medpay vs. PIP

Shopping for car insurance with specific coverage needs

In some cases, you may have more specific insurance requirements than other drivers. These circumstances include:

- You have a teen driver on your policy: Young drivers under 25 are more likely to get into a car accident than any other age group, meaning they see higher car insurance rates. Choose a high liability limit (100/300/100 or more) to cover yourself in the event of an expensive accident. If your teen drives a new car, opt for full coverage, too.

- You have an older used vehicle: If your vehicle’s actual cash value (ACV) is less than $4,000, it’s a good idea to stick to state minimum liability coverage for your vehicle. The cost of full coverage insurance won’t be worth the payout after an accident for many older cars.

- You have an SR22 filing requirement: Check out the SR-22 insurance requirements in your state and make sure that you’re getting enough coverage. If you’re denied coverage by multiple insurance providers, you may also need to look into non-standard car insurance companies to find the coverage you need.

Learn more: Find cheap car insurance quotes for high-risk drivers

Step 3: Collect the documents you need

Before you can get car insurance quotes, you’ll need to gather various documents to show your insurance provider. These will help auto insurance companies give you accurate quotes. To get car insurance, you’ll need the following:

- Personal information: Your provider will ask for the main policyholder’s name and birthdate as well as the full name, birthdate, driver’s license number, social security number, and driving history of any driver listed on the policy.

- Vehicle information: You’ll need to provide the make, model, year, trim, and vehicle identification number (VIN) for any vehicles listed on your policy.

- Previous policy information: Potential providers will ask for information about any current auto insurance policy and any claims you’ve filed within the last five years.

- Driving information: Insurance companies want to know why, how often, and how well you drive, so be ready with information about your annual mileage, vehicle usage (pleasure versus commute), and your driving record.

- Special information: If you need to file an SR-22, have your case number ready.

Step 4: Compare insurance providers

Now, it’s finally time to gather and compare quotes from different providers to see which insurance company is right for you. Don’t base your policy on auto insurance rates alone; things like customer satisfaction, claims handling, and overall company’s reputation should all play a role in your final decision.

Jerry experts conducted one of the nation’s largest consumer surveys, having over 15,000 real policyholders to rate their experience with their current provider. Using a 5.0 scale, respondents rated their insurers in the areas of customer service, claims satisfaction, and policy cost.

Based on this data, we were able to gather together some of the top providers who scored 4.0 or higher overall and who have the cheapest monthly coverage options:

| Insurance provider | Minimum coverage cost | Full coverage cost | Cost rating | Overall Jerry rating |

|---|---|---|---|---|

| Anchor General | $52 | $167 | 4.6 | 4.9 |

| Clearcover | $66 | $130 | 4.6 | 4.6 |

| Kemper | $69 | $176 | 4.6 | 4.1 |

| Madison Mutual | $57 | $140 | 5.0 | 4.7 |

| Nationwide | $61 | $155 | 4.0 | 4.3 |

| Progressive | $79 | $178 | 3.8 | 4.2 |

| Safeco | $70 | $165 | 4.2 | 4.6 |

| State Auto | $58 | $162 | 4.3 | 4.4 |

| Travelers | $59 | $141 | 4.2 | 4.6 |

If you choose to use Jerry to help you shop for car insurance, you can do more than compare rates. You can also compare provider ratings and real customer reviews to help you find the best provider for your budget and coverage needs.

Step 5: Purchase a new policy

After you find the ideal provider, it’s time to purchase your new car insurance policy.

Before you sign the paperwork, be sure to read through your agreement. Check that your final rate is what you expected, as it may differ slightly from the quote you were given. Be certain to schedule any current policy’s end date on or after your new insurance kicks in to avoid an insurance lapse.

Once you’ve purchased your new policy, you’ll receive an insurance ID card, which acts as proof of insurance. Generally, you’ll keep this card in your vehicle in case you’re subject to a routine traffic stop—however, with the Jerry app, you can find it easily in your digital glovebox on the app.

Make sure to compare rates every six months to keep saving

While the shopping process may be over once you secure a policy, it’s recommended that you look for new quotes every six months or every time you experience a major life change (such as a move, a new car, or a car accident).

Shopping regularly can help you keep your rates low while ensuring that you have the coverage you need. If you choose to use the Jerry app, you can turn on notifications for our auto-reshop feature. When your policy is up for renewal, we’ll reshop your policy to help you stay on top of potential savings opportunities, either with your current provider or another insurer.

FAQ

- What are the best limits for liability insurance?

- Is roadside assistance available through your insurance?

- What is full coverage car insurance?

- What is gap insurance?

- Is bundling your car insurance and homeowners insurance a good idea?

Source

Liz Jenson is an insurance writer who specializes in general automotive and insurance topics. Liz’s mission is to produce informative and useful content to help car owners make smart choices when buying cars and car insurance. Since joining Jerry in 2021, Liz has written nearly 4,000 long- and short-form articles on topics including state-specific insurance recommendations, common car insurance questions, and deep dives into vehicle model details. Before they came to Jerry, Liz was a full-time student at Indiana University, Bloomington working on a double major in English and French.

Kianna Walpole is an insurance writer and editor with a comprehensive background in consumer behavior and online publishing. With experience in car insurance, maintenance, and repair, she is dedicated to building informative content that helps customers reduce costs while achieving the best service. Prior to joining the Jerry editorial team, Kianna worked as a junior editor in the content marketing industry, using consumer data and key insights to create and edit content for an array of large-scale clients in the real estate, cybersecurity, and healthcare industries.