Key Insights

- Despite used-car prices falling a bit in recent months, lightly used versions of seven of the 10 best-selling vehicles in America are still worth more than the sticker price on comparable new 2022 models. That’s down from nine of 10 in June, adding to signs that the worst of the red-hot price increases for used vehicles are likely behind us. But it hardly points to a return to normal.

- In another sign of cooling, the market values of eight of those 10 lightly used versions of the best-selling vehicles have fallen since late August, the last time we conducted this study. The exceptions were the Ford F-150 and the Chevrolet Silverado, which both rose in value.

- Strong demand for electric vehicles (EVs) in this year of record-high gas prices helped turn some of the EV market upside down as well. Three of the top five best-selling EVs from 2021 are now worth more lightly used than the sticker price on comparable new 2022 models. That’s the same number as in late August, although the values of all five used models have fallen since then.

- The pace of annual price increases for used cars has slowed in recent months. Prices for used cars and trucks rose 7.2% in September from the previous year, down from a 41% jump in February.

- Prices for used vehicles have actually fallen from the previous month for three straight months, but the declines have been minimal. In September, prices fell 1% from August. That was actually the second-biggest month-on-month decline this year, behind an 8% drop in March.

Disruptions to New and Used Vehicle Markets

The value of a new car previously fell by thousands of dollars as soon as you drove it off the dealer’s lot. The pandemic changed that for many models. Because of the semiconductor shortage and other disruptions, many car manufacturers, including Toyota and Honda, have been forced to cut production despite strong demand, resulting in fewer new cars on dealer lots and longer wait times for delivery. This has driven up the prices of both new and used cars as many would-be buyers of new vehicles turned to the used market.

Making matters worse, the used car market has been deprived of much of its traditional supply. Due to the shortage of new vehicles, rental car companies have released fewer of their used vehicles into the market during fleet upgrades. In addition, more individuals who leased new vehicles have chosen to purchase them when their leases expired because the values of the vehicles had risen dramatically, making them a good deal under terms set two or three years earlier.

Seven of 10 Best-Selling Vehicles Are Cheaper New Than Used

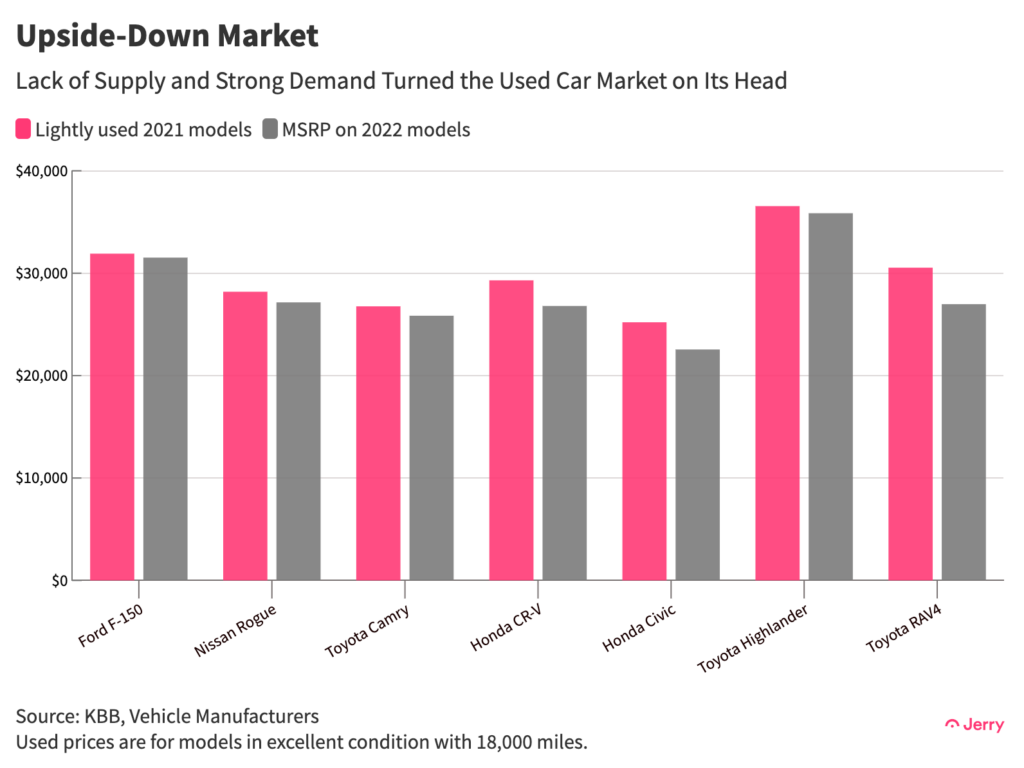

Our study compared market values for 2021 models with fewer than 20,000 miles to the Manufacturer’s Suggested Retail Price (MSRP) for comparable new 2022 models. (Many new models are selling for more than MSRP.)

Our analysis found that, among the 10 best-selling vehicles in the U.S., the following lightly used 2021 models are worth more than the sticker prices on new 2022 models:

- Toyota RAV4 ($3,600 more)

- Honda Civic ($2,700 more)

- Honda CR-V ($2,500 more)

- Nissan Rogue ($1,000 more)

- Toyota Camry ($900 more)

- Toyota Highlander ($700 more)

- Ford F-Series ($400 more)

We also found that lightly used 2021 models of the following EVs were worth more than the sticker price on comparable 2022 models.

- Volkswagen ID.4 ($6,000 more)

- Ford Mustang Mach-E ($5,000 more)

- Tesla Model 3 ($900 more)

Conclusion

The worst of the huge price increases in the used car market are likely behind us but the market has hardly returned to the pre-pandemic normal. Used car prices remain near all-time highs, with some of the most popular models still selling for more than the list price of new vehicles.

While we’ve seen small price declines in the retail used car market, we’ve seen modestly bigger declines in the wholesale used car market, where prices fell 3% in September from August and another 2% in the first half of October. Wholesale prices are a leading indicator for retail prices, which means buyers can expect more relief in the months ahead.

But the underlying supply imbalance that pushed used vehicle prices up by about 50% over two and a half years hasn’t been resolved. Even if production returns to normal in the near future, because fewer new vehicles were produced over the past couple years, there will be fewer lightly used vehicles hitting the market for some time. So anyone looking to buy a lightly used version of one of the best-selling vehicles in the U.S. will probably need to pay a premium price for a while longer.

Methodology

We analyzed national and state-specific prices, both new and used, for the 10 best-selling vehicles in the U.S. from the past 12 months. Due to regional pricing variations, there was no established national average price for those used models. Jerry researched average prices for used models in the largest city by population in each state, as well as an overall national average price of used cars (not model specific).

To arrive at a national average price for specific used models, we chose the average price for that model in an area of Denver, the city whose overall average used car price most closely matched the overall national average.

To avoid price disparities due to trim levels, we compared Kelley Blue Book private party values for 2021 base models in excellent condition and with 18,000 miles with MSRPs for the same base vehicle models in the 2022 model year.

Price changes for the overall used car market are taken from the Bureau of Labor Statistics’ seasonally adjusted data.

(Note: This is the fourth update of this study, which was first published March 21, 2022.)

Henry Hoenig previously worked as an economics editor for Bloomberg News and a senior news editor for The Wall Street Journal. His data journalism at Jerry has been featured in outlets including CBS News, Yahoo! Finance, FOX Business, Business Insider, Bankrate, The Motley Fool, AutoWeek, Money.com and more.