The car-ownership affordability crisis runs wide and deep.

The average middle-income American household can no longer afford the average used car, according to common financial advice. That’s a single average used car—never mind two—in a country where a car is a necessity for nearly every working adult.

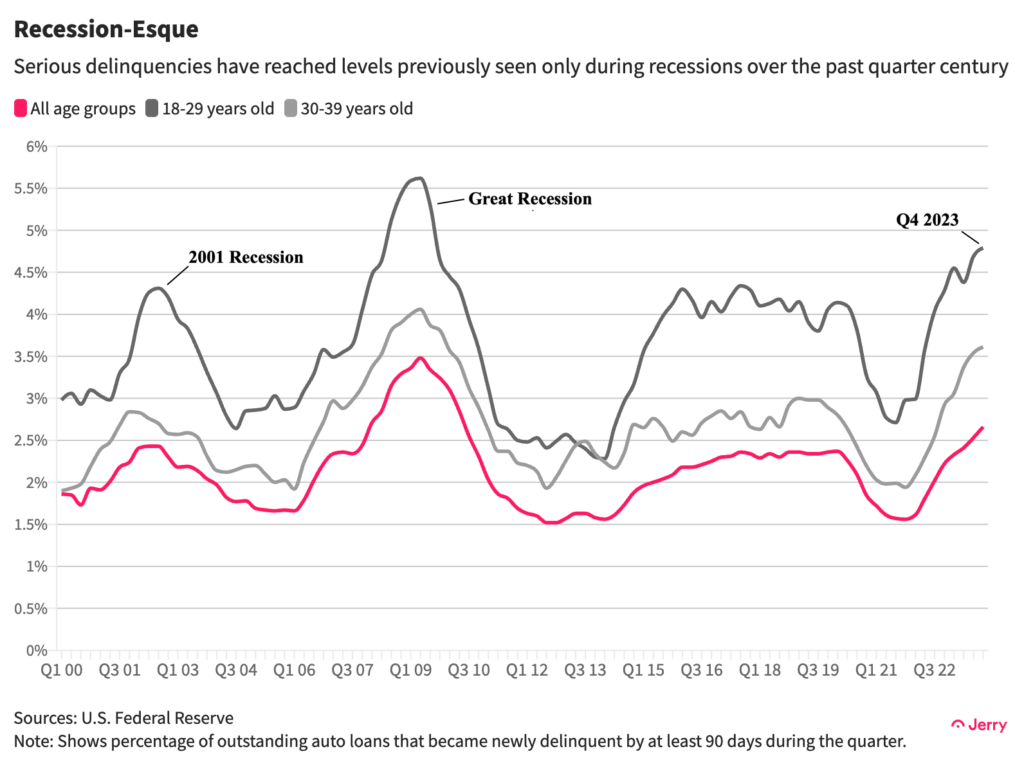

It’s little wonder, then, that the rate of serious auto-loan delinquencies is now higher than at any time during the 2020 COVID-19 or 2001 recessions, even though the unemployment rate sits just slightly above the lowest level since the 1960s.

As part of our mission to reinvent car ownership, Jerry dug into the numbers to find out just how many Americans are affected by the car-ownership affordability crisis. For our affordability threshold, we chose 17.5% of after-tax income, halfway between the 15% and 20% commonly suggested by financial advisers.

Here’s what we found:

Key Insights

- The average American household, making $64,000 a year after taxes, must pay nearly one-fifth (19%) of their income to make loan payments on an average used car and drive it 15,000 miles a year.

- Even with an average car loan, the cost of paying for and driving a single used car has become unaffordable for all but the highest-earning 40% of American households, who make at least $84,000 a year.

- A household earning $100,000 a year after taxes would need to spend nearly a quarter (24%) of that income to make payments on two used cars and drive them each 15,000 miles a year.

- To make the average monthly loan payment on just one new car and drive it 15,000 miles a year, middle-income households (who earn $64,000 a year after taxes) must pay 23% of their net income.

- To make payments on two new vehicles and drive them 15,000 miles each, middle-income households would have to pay nearly half of their after-tax income—46%, more than two and a half times the recommended allocation of their income.

- The typical lower-middle-income household would have to pay 62% of their post-tax income to make average loan payments on two used cars and drive them each 15,000 miles a year each.

- In the fourth quarter of 2023, the percentage of outstanding auto loans that had become at least 90 days delinquent in the previous four quarters hit the highest level since 2010, in the immediate aftermath of the Great Recession. Those recently delinquent loans alone are worth $43 billion.

- Despite low unemployment and a robust economy, serious delinquencies (90+ days) have exceeded the peaks reached during the 2001 dotcom recession and the 2020 COVID-19 recession.

| Bottom 20% of household incomes | Lower middle 20% | Middle 20% | Upper middle 20% | Highest 20% | |

|---|---|---|---|---|---|

| Avg. post-tax household income | $16,337 | $39,300 | $63,676 | $99,891 | $196,794 |

| Avg. annual costs for one new car | $14,493 | $14,493 | $14,493 | $14,493 | $14,493 |

| % income for one new car | 89% | 37% | 23% | 15% | 7% |

| Avg. annual costs for one used car | $12,177 | $12,177 | $12,177 | $12,177 | $12,177 |

| % income for one used car | 75% | 31% | 19% | 12% | 6% |

| % income for one used, one new car | 163% | 68% | 42% | 27% | 14% |

| % income for two used cars | 149% | 62% | 38% | 24% | 12% |

| % income for two new cars | 177% | 74% | 46% | 29% | 15% |

| Avg. number cars | 1 | 1.5 | 1.9 | 2.3 | 2.6 |

Staggering Burden

It’s not just low- and middle-income families struggling with the costs of car ownership these days. Even a household earning $100,000 a year after taxes would have to spend 24% of their take-home pay to make loan payments on and drive two average used vehicles 15,000 miles a year. That’s more than the 15%-20% of income financial advisers recommend as a limit.

A middle-income household earning $64,000 a year after taxes? They would need to spend 38% of their take-home pay to drive two average used cars.

Of course it’s worse for lower-middle-income households, those falling in the second 20% on the income distribution scale. They’d have to pay nearly two-thirds (62%) of their post-tax income to take on two average used-car car loan payments and drive the cars 15,000 miles a year each.

Only the highest-earning 20% of households can afford two new cars—once a marker of the American dream. And even they’d have to pay 15% of their after-tax income to do so—the upper limit of some financial advisers’ affordability threshold.

Different Generations

As is typical with younger generations, Gen Z struggles the most financially, and their delinquency rates have been at the highest levels since the Great Recession for a year.

The average Gen Z household would need to spend 25% of their income on a single used car, higher than any generation except the now long-retired Silent Generation.

The average Millennial family would have to spend 26% of their take-home pay to own and drive two used vehicles. Members of Gen X, the highest-earning generation at $109,000 a year per household after taxes, would need to pay 25% of their after-tax income for one used and one new car.

| Gen Z | Millennials | Gen X | Boomers | Silent | |

|---|---|---|---|---|---|

| Avg. post-tax household income | $49,618 | $89,641 | $108,615 | $73,086 | $45,519 |

| Avg. annual costs for new car | $14,493 | $14,493 | $14,493 | $14,493 | $14,493 |

| % income for one new car | 29 | 16 | 13 | 20 | 32 |

| Avg. annual costs for used car | $12,177 | $12,177 | $12,177 | $12,177 | $12,177 |

| % income for used car | 25 | 14 | 11 | 17 | 27 |

| % income for one new, one used | 54 | 30 | 25 | 36 | 59 |

| % income for two used cars | 49 | 27 | 22 | 33 | 54 |

| % income for two new cars | 58 | 32 | 27 | 40 | 64 |

| Avg. number cars | 1.2 | 1.8 | 2.1 | 2 | 1.4 |

Conclusion

The car-ownership affordability crisis has been brewing for years. Vehicle prices flatlined in the wake of the Global Financial Crisis, while sustained rock-bottom interest rates and ever-lengthening loan-repayment periods helped consumers cope with stagnant incomes as prices for other goods and services rose.

Then COVID-19 struck, reigniting inflation and sending vehicle prices soaring. Sharply higher interest rates compounded the problem for borrowers, as did soaring insurance rates and repair costs, a result of a shortage of repair technicians, among other things.

Lower interest rates would certainly help alleviate the pain, and the U.S. Federal Reserve is expected to start cutting them in the coming months. But rates are unlikely to return to the lows seen over the past couple of decades, at least anytime soon, and vehicle prices aren’t expected to fall much, either, even for used cars, as automakers increasingly focus on higher-margin vehicles.

Methodology

Common financial advice holds that you shouldn’t pay more than 15%-20% of your after-tax income on a car, including car payments and operating expenses. For our affordability threshold, we chose 17.5%.

To calculate the average annual cost of paying for and driving a new car ($14,493), we used Experian’s average yearly loan payments for a new vehicle ($8,712) as of the third quarter of 2023 (the latest available), and added AAA’s average annual cost of driving a compact SUV 15,000 miles a year in 2023 ($5,781 for fuel, maintenance, full-coverage insurance, license, registration and taxes).

To calculate the average annual cost of paying for and driving a used car ($12,177), we used Experian’s average yearly loan payments for a used vehicle ($6,396) as of the third quarter of 2023, and added AAA’s average annual cost of driving a compact SUV 15,000 miles a year as of 2023 ($5,781 for fuel, maintenance, full-coverage insurance, license, registration and taxes).

All data on delinquencies comes from the U.S. Federal Reserve Bank of New York’s Quarterly Report on Household Debt and Credit, released in February 2024. All data on incomes is from the year 2022 and comes from the U.S. Census Bureau.

(An earlier version of this study misstated the historical context of the unemployment level. It sits just slightly above the lowest level since the 1960s, not the 1950s.)

Henry Hoenig previously worked as an economics editor for Bloomberg News and a senior news editor for The Wall Street Journal. His data journalism at Jerry has been featured in outlets including CBS News, Yahoo! Finance, FOX Business, Business Insider, Bankrate, The Motley Fool, AutoWeek, Money.com and more.