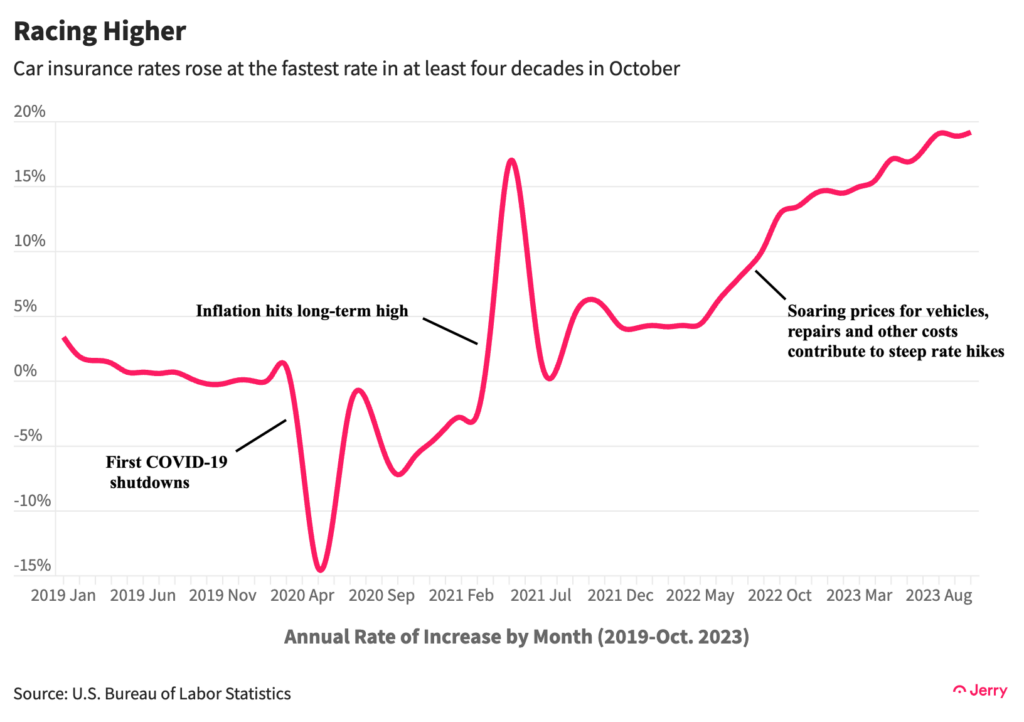

There is plenty more pain ahead for American drivers. The rise in car insurance rates hit a four-decade high in October, reaching nearly 20% annually, even as overall inflation cooled.

Car insurers are still playing catch-up with rate hikes. Many suffered huge losses resulting from a surge in severe accidents and more than two years of elevated inflation. They’ve been asking for and receiving state regulators’ approvals for rate hikes. The latest data show there’s little reason to think the increases will stop anytime soon.

The price of car insurance is already taking a heavy toll on drivers. Three quarters of Americans say car insurance is becoming unaffordable for the average person. More than half say high premiums have forced them to cut spending in other areas.

Key Insights

- Vehicle insurance rose at an annual rate of 19.2 percent in October, the fastest increase since at least 1985, the earliest year for which data is available.

- Car insurance has risen 35% since April 2021, when U.S. inflation woke up from a years-long slumber and raced to the highest level in four decades.

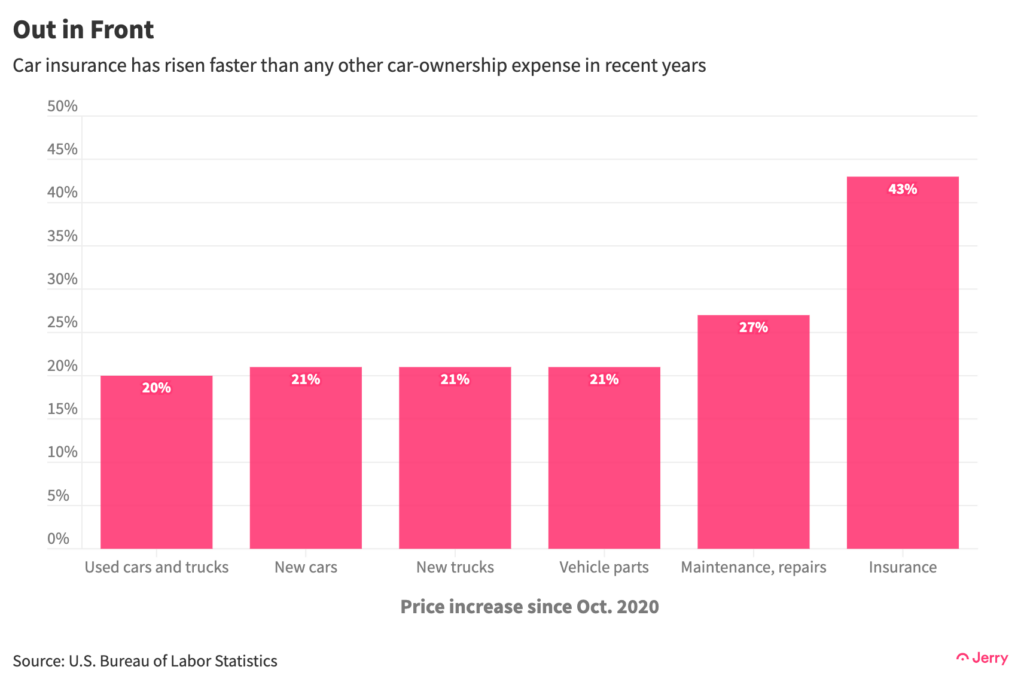

- Car insurance has risen 43% in the past three years, more than any other car-ownership expense.

Skyrocketing car insurance rates are just one part of a car-ownership affordability crisis. The prices of vehicles, maintenance and repair services, and vehicle parts have all risen sharply in recent years. But none have risen faster than insurance.

Conclusion

Price increases for many car-ownership expenses are slowing, with used vehicle prices actually declining. But there is no sign that insurers are done with steep rate increases as they seek to catch up to the soaring costs they’ve faced in recent years. That spells more pain for American drivers.

Methodology

All data comes from the U.S. Bureau of Labor Statistics.

Henry Hoenig previously worked as an economics editor for Bloomberg News and a senior news editor for The Wall Street Journal. His data journalism at Jerry has been featured in outlets including CBS News, Yahoo! Finance, FOX Business, Business Insider, Bankrate, The Motley Fool, AutoWeek, Money.com and more.