It’s our data and we should control how it’s used.

That’s the message from American drivers as the collection and, in many cases, the selling and sharing of data from customers’ cars by automakers is becoming a growing issue. Nearly all of the drivers in a recent survey by Jerry—96% of them—said they should own any data generated by their cars and expressed deep uneasiness at the prospect of automakers selling or sharing that data with third-party data brokers, insurance companies, and law enforcement agencies.

The issue has gained traction among the public, lawmakers, and regulators since a New York Times report in March described how one car owner faced an unexpected insurance rate hike after their driving data—metrics on braking, turning, acceleration, and cornering, for example—ended up in insurers’ hands via a third-party data broker. Faced with a public uproar, the automaker later stopped sharing customer data.

But it’s not just one automaker. No matter the brand, today’s cars are “a privacy nightmare,” according to the Mozilla Foundation, a global non-profit organization that researches digital privacy. All 25 automakers studied by Mozilla earned a privacy warning label, leading Mozilla to declare cars the worst product category for privacy they’d ever reviewed.

Key Insights

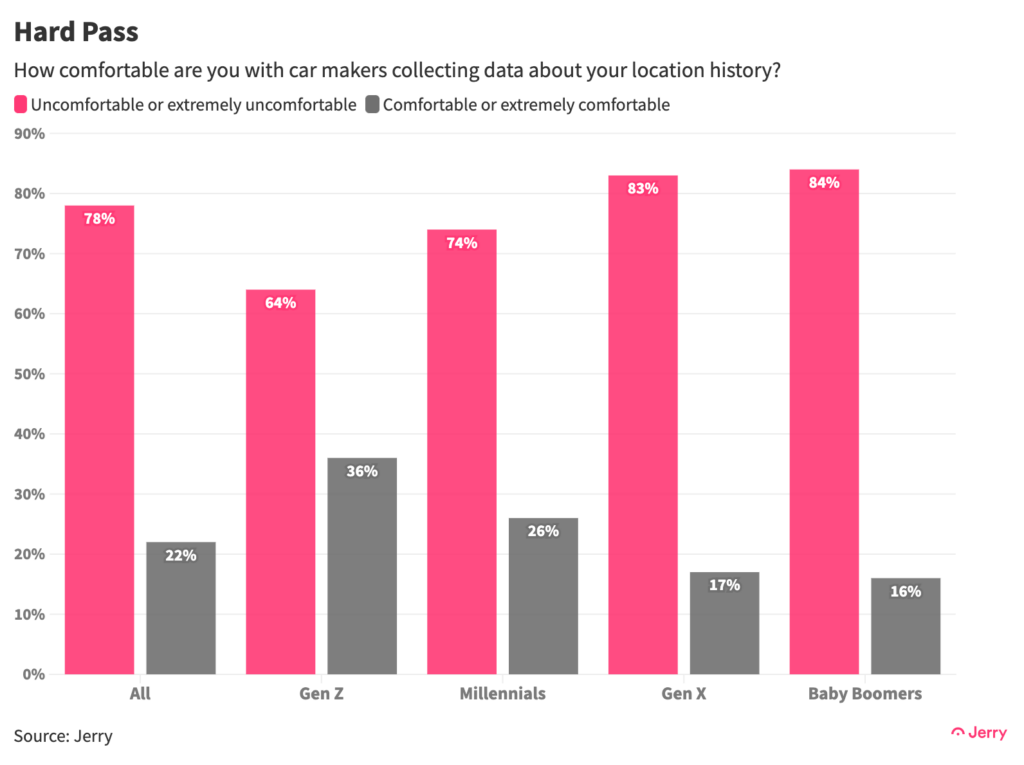

- The vast majority (78%) of American drivers are uncomfortable or extremely uncomfortable with automakers collecting data such as location history from their cars. That includes majorities of each generation and gender, Republicans and Democrats, and residents of rural, urban and suburban areas. More than a third of American drivers describe themselves as “extremely uncomfortable” with such data collection.

- Nearly all drivers (96%) said the owner of a car should own any and all data generated from that car.

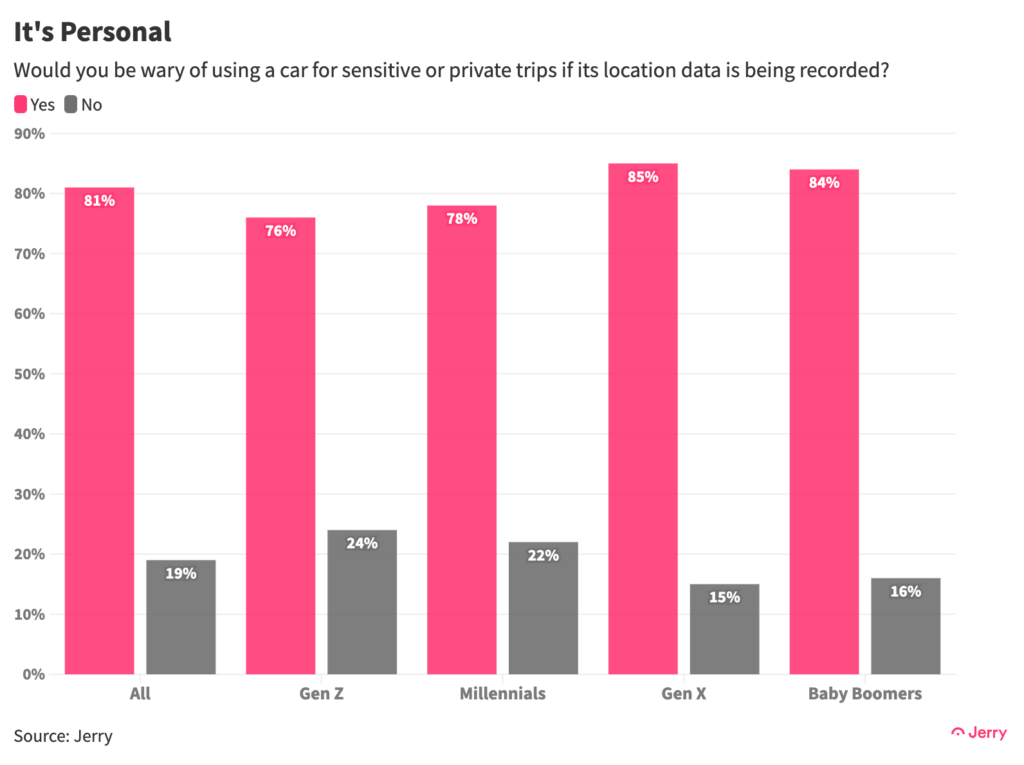

- Eight of 10 American drivers (81%) said they would be wary of using a vehicle for sensitive or private trips if they knew the location data was likely to be shared.

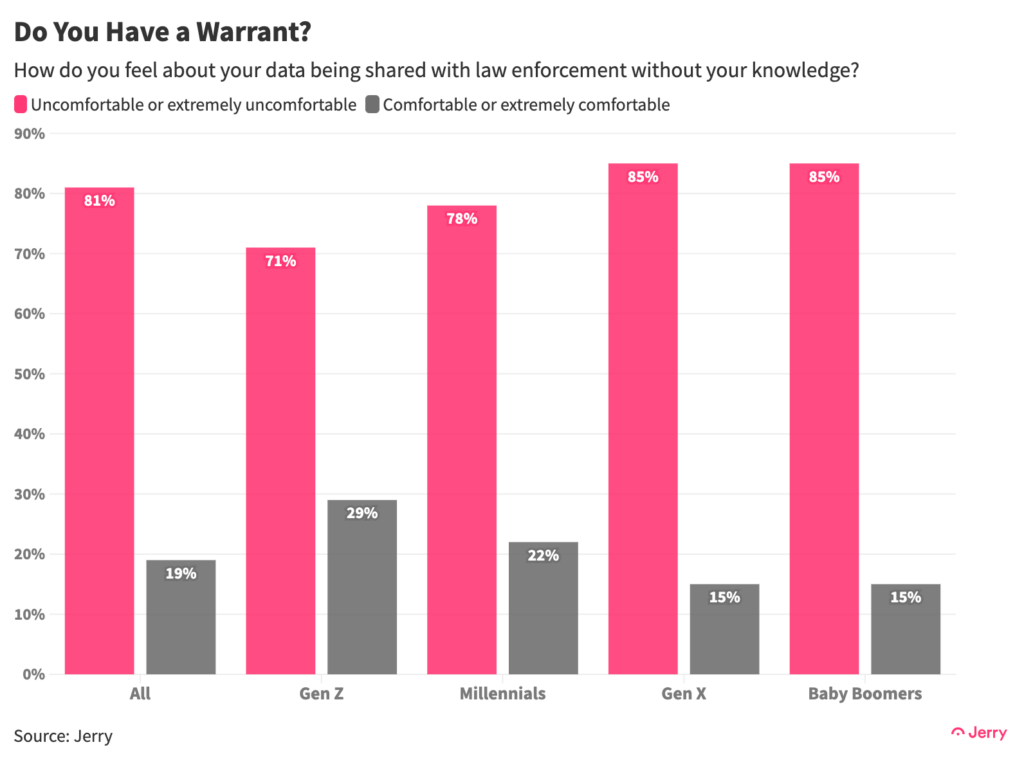

- Eight of 10 drivers (81%) said they would be uncomfortable or extremely uncomfortable if car makers or data brokers shared data collected from their car with law enforcement officials without their knowledge. Nearly half (47%) of all respondents said they would be extremely uncomfortable, as did majorities of rural residents (54%), Republicans (52%) and members of Gen X (52%).

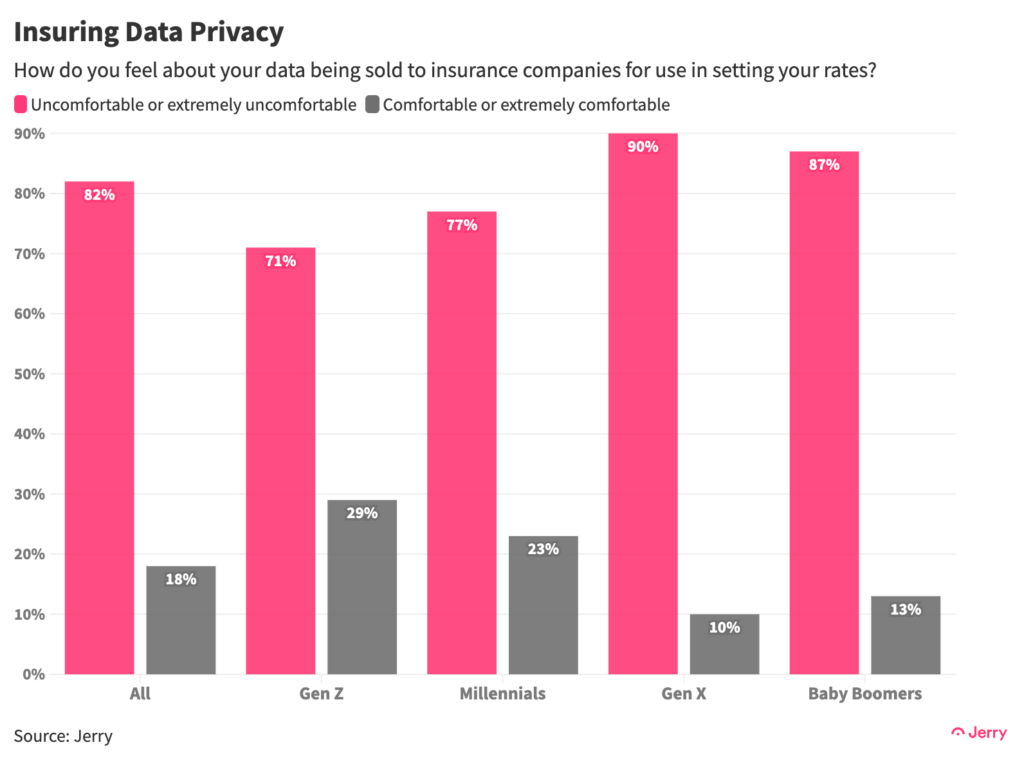

- Eighty-two percent of all respondents said they would be uncomfortable or extremely uncomfortable if data brokers sold data collected from their cars to insurance companies for use in setting their rates. Nearly half (48%) said they would be extremely uncomfortable with that.

- Nearly eight in 10 drivers (79%) don’t trust data brokers at all with the data generated from their vehicles. Only 3.5% said they fully trust them.

- Younger drivers were somewhat less uncomfortable with automakers collecting data from their cars than older drivers. For each question, smaller percentages of members of Gen Z and Millennials said they were uncomfortable or extremely uncomfortable than members of Gen X and Boomers.

- Men were somewhat less uncomfortable than women. For each question, higher percentages of women said they were uncomfortable or extremely uncomfortable than men did.

- Residents of rural areas were the most uncomfortable with automakers collecting and sharing data generated from their cars. In each case, residents of urban areas were the least uncomfortable.

- When asked about law enforcement or insurance companies gaining access to their car’s data, more people answered that they were extremely uncomfortable than merely uncomfortable.

Location, Location, Location

Nearly eight in 10 (78%) drivers said they were uncomfortable (40%) or extremely uncomfortable (38%) with automakers collecting their location history. Generally, the older the driver, the more uncomfortable they were. But even in the least uncomfortable generation—Gen Z—about two thirds (64%) of drivers expressed discomfort with automakers collecting their location history.

One consequence of a loss of privacy is that it begins to change people’s behavior in insidious ways. It doesn’t take much imagination to see that having your car’s location tracked might affect where you go. In fact, 81% of survey respondents said they would be wary of using a vehicle whose location is being tracked by automakers for sensitive or private trips.

Oversharing

Law enforcement agencies have long been in the habit of asking corporations for data on their customers and many automakers are willing to share it. More than half (56%) of automakers studied by Mozilla said they could share data collected from customers’ cars in response to a “request” by the government or law enforcement. Many automakers do not require a warrant before handing over customer data.

Nearly half of drivers surveyed by Jerry (47%) said they would be extremely uncomfortable about automakers sharing their car’s data without their knowledge, while another 34% said they would be uncomfortable.

Again, age was a factor in the responses. Nearly a third (29%) of Gen Z respondents said they would be comfortable or extremely comfortable with such a practice. That’s nearly twice as many as the 15% of Gen X and Baby Boomers who said the same.

As car insurance rates rise, telematics programs are becoming increasingly popular among consumers. Voluntary telematics programs, that is. In such programs, drivers agree up front to share data about their driving behaviors, and can earn insurance discounts for safe driving, perhaps becoming a better driver in the process. More than half (54%) of the people surveyed for Jerry’s 2024 State of the American Driver report said they would be open to allowing their insurance company to monitor their driving if it meant a lower premium.

But sharing drivers’ data with insurers without the drivers’ knowledge is another thing entirely. In all, 82% said they would be uncomfortable (34%) or extremely uncomfortable (48%) with automakers or data brokers selling insurers their data so it could be used to set their insurance premiums.

Conclusion

Members of Congress are starting to ask automakers hard questions about their collection and sharing of customer data, and some states are beginning to take action. New Jersey, Tennessee, New York and California have all passed legislation covering vehicle data.

But monetization of that data could bring automakers billions of dollars. So it remains to be seen who ends up controlling data collected from the new generation of connected vehicles.

Methodology

All survey data is based on a nationally representative survey of 1,300 respondents conducted in April 2024 using Pollfish. Respondents were filtered to include only those aged 18+ who own or lease a vehicle and drive at least once a week. More information about Pollfish and its audiences can be found on its website.

Henry Hoenig previously worked as an economics editor for Bloomberg News and a senior news editor for The Wall Street Journal. His data journalism at Jerry has been featured in outlets including CBS News, Yahoo! Finance, FOX Business, Business Insider, Bankrate, The Motley Fool, AutoWeek, Money.com and more.