Executive Summary

Car insurance rates inflicted yet more pain on beleaguered American drivers in 2024, rising at the fastest pace in decades again, putting them up more than 50% over the past three years, according to the Bureau of Labor Statistics. Little wonder that 8 in 10 American drivers say car insurance is now unaffordable for the average person. But of course they have no choice but to buy it. So they’re doing whatever they can—from switching insurers to buying less coverage to cutting back on everything from family vacations to groceries.

They’re not getting much relief elsewhere. While inflation appears to be finally under control, the prices of most goods and services—especially those related to car ownership—will likely never return to pre-COVID levels. Sure, used car prices came down again in 2024, but they’re still nearly 30% higher than before COVID, while new car prices are up about 20% in the same period. The cost of repairs? Up by more than 50% and still rising rapidly. The bottom line: Owning a car is far more expensive than it was a few years ago and there is little reason to believe that will ever change.

The 2025 State of the American Driver report offers insights into how this new era of higher-cost car ownership is affecting Americans, how they are reacting, their outlook for car buying in the new year, their views on electric vehicles (EVs) and hybrids, and their attitudes toward driving technology and data collection. In compiling it, Jerry surveyed 1,000 American drivers across all age groups and regions of the country. We also drew on internal research on topics including insurance rates, inflation, and data-collection habits.

At Jerry, our mission is to make car ownership affordable and accessible for everyone through our AllCar™ app. This annual report reflects our commitment to explore the economic, educational, and safety challenges facing those car owners.

In 2024, more than 1 million customers used Jerry to search for savings on car insurance. Many took advantage of our other AllCar™ app services to improve their driving safety, keep up with vehicle maintenance, estimate repair costs, and more.

Key Insights

- After two years of soaring premiums, 8 in 10 American drivers now say car insurance has become unaffordable for the average person.

- Many drivers simply cut back on car insurance last year. More than a quarter (27%) chose a higher deductible in return for a lower rate, while 26% reduced their coverage.

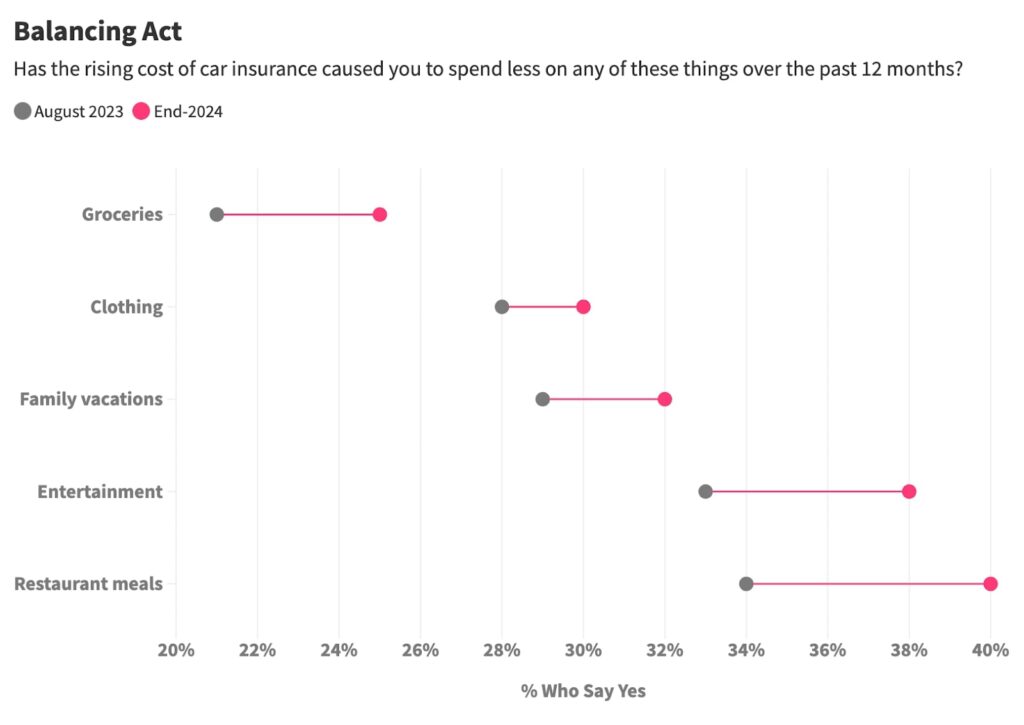

- The cost of car insurance has forced people to cut spending elsewhere, including on family vacations (32% of respondents), clothing (30%) and groceries (26%).

- For some, the high cost meant simply going uninsured for a time. Nearly one in 10 (9.7%) American drivers said they went uninsured for at least a while in the previous year because they were unable to keep up with their premiums.

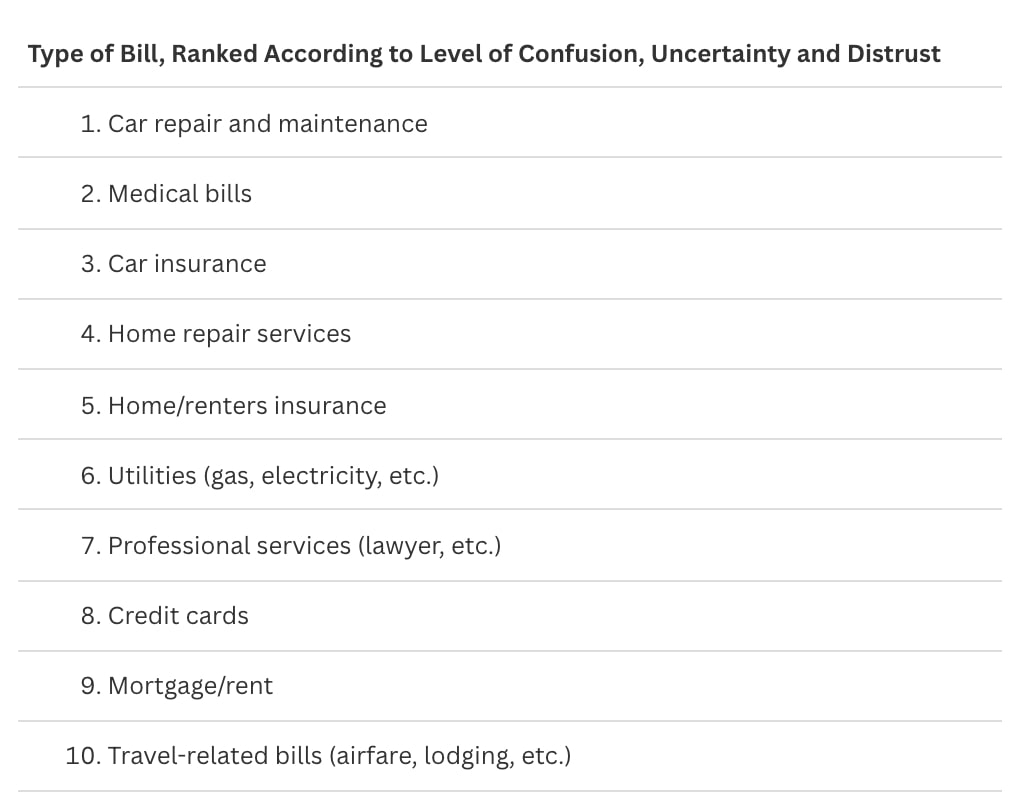

- No type of bill generates more distrust, confusion and frustration than car repair and maintenance bills, our survey found. Not even medical bills.

- Three-fourths of drivers (76%) said they definitely or probably have been overcharged for a repair job or maintenance work, while only 1.5% said they definitely had not and 5.5% said they probably had not.

- Of those planning to buy or lease a new or used car in 2025, more than one in five (22%) said they previously would have bought a new car but now they’ll consider a lightly used one due to higher prices for new vehicles.

- Nearly a quarter (22%) of American drivers say they expect to buy or lease their first electric vehicle within the next three years, and another 17% say they expect to do so within the next five years. Yet 9% of drivers say it will be at least 10 years before they get one and another 37% say they don’t plan to ever get one—both figures are up slightly from a year ago.

Insurance

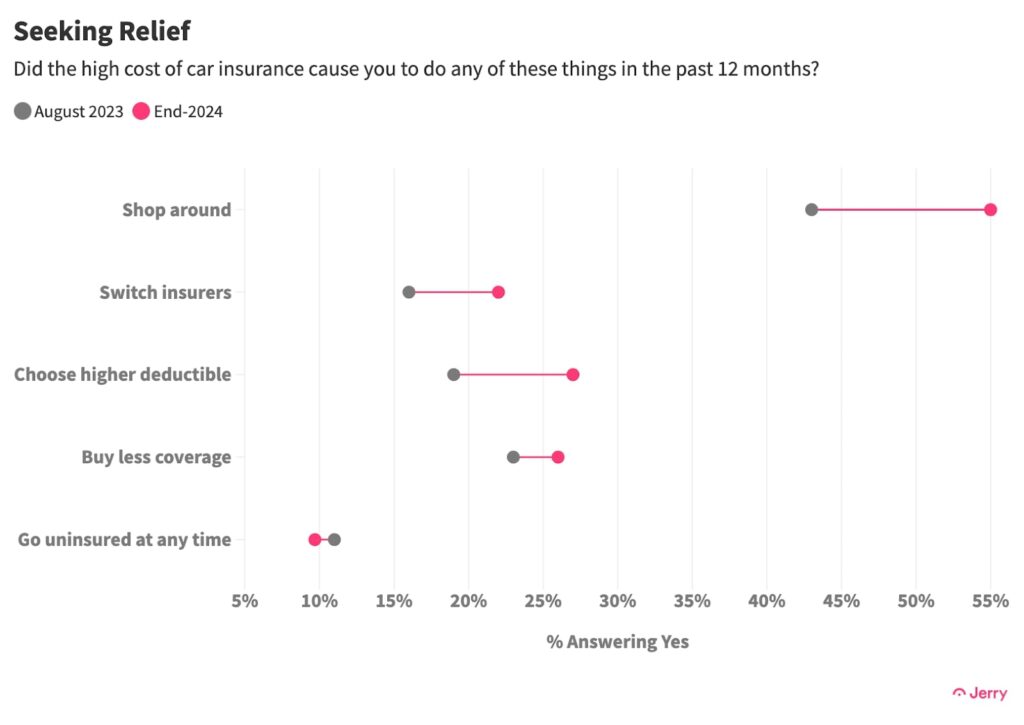

Three years of soaring insurance rates are changing consumer behavior. People shopped around more often in 2024 and switched insurers more frequently when they found lower rates. They also raised their deductible and bought less coverage more frequently than a year ago.

A majority (55%) of drivers shopped around for car insurance in the past 12 months, up from 38% a year ago, while more than one in five (22%) said they switched insurers to take advantage of lower rates.

Younger generations are shopping around and switching insurers more often than their elders. Around two thirds of Gen Z (64%) and Millennials (67%) said they shopped for lower rates in the previous year, compared to 53% of Gen X and 42% of Boomers. Nearly a third of Gen Z (31%) and Millennials (30%) switched insurers during the year—double the number of Gen X (15%) and Boomers (15%) who did so.

Many American drivers took on more risk to lower their rates. More than a quarter (27%) chose a higher deductible in exchange for a lower monthly premium in 2024—up from 21% who did so the previous year. Another 26% of drivers bought less coverage than they previously had—and nearly two thirds of them (63%) said they bought less than they might need.

Yet higher deductibles and less coverage weren’t enough help for most people. A majority of drivers were forced to cut spending elsewhere to offset higher car insurance costs. Nearly a third said they spent less money on family vacations (32%) and clothing (30%) due to insurance costs, while more than a quarter (26%) spent less on groceries. Only 37% of respondents said they didn’t cut other spending at all.

Even the highest-earning American households haven’t escaped the pain of three years of rate hikes. Among households earning more than $129,000 annually before taxes, nearly half (49%) shopped around for better deals in the last year, more than 1 in 5 chose a higher deductible and 14% said they bought less coverage. Of those who bought less coverage, 53% said they got less than they thought they might need.

Perhaps the clearest sign of acute pain from insurance rates, however, is that about 1 in 10 American drivers (9.7%) just went without car insurance for at least part of the year because they couldn’t keep up with the premiums.

| Drawing on his work with Jerry’s partner network of 55 car insurance companies, Josh Damico, vice president of insurance operations, shares his predictions for insurance shopping in 2025. Overall, he’s expecting more consumer choices and more stability in the auto insurance market in the year ahead: |

| The Year of Stabilization: Insurance companies gained approval for rate adjustments that allow them to lower down payments and offer more flexible monthly plans, providing some relief to consumers who clearly need it. Insurers also say they plan to welcome more new customers in 2025 after 2 years of limiting the amount of new policies they sold. Expect 2%-3% Rate Increases: After a 51% increase in rates over the past three years, 2025 is expected to bring average rate increases of just 2%–3% as the market normalizes. Competitive Shopping Environment: With insurers eager to grow their business and confident in their competitive rates, 2025 is an ideal time to shop around for the lowest rate. |

Repairs and Maintenance

No other major type of bill creates more confusion, frustration, and distrust among American drivers than the cost of car repairs and maintenance. Survey respondents ranked it worse than credit cards, home repair services, and even medical bills.

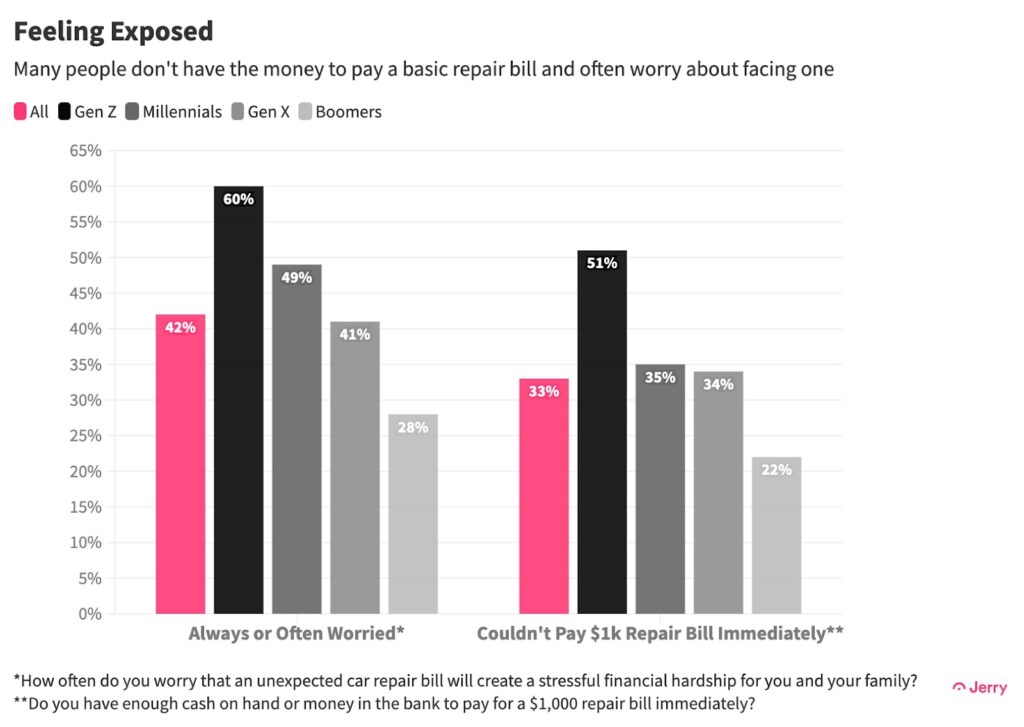

Repair costs are up 41% over the past two years and maintenance costs are up 28%, adding to the overall financial stress of car ownership. In fact, worries about the impact of an unexpected repair job weigh on a huge portion of American drivers. More than 40% say they “often” or “always” worry that they’ll need a repair that will cause serious financial hardship for them and their family. That’s up from 33% who said so in a similar survey in May 2023, and includes 1 in 5 respondents with a household income above $129,000.

Yet that’s not surprising, given that a third of drivers (33%) said if they faced a $1,000 repair job tomorrow, they wouldn’t have enough money in the bank to pay for it immediately. That includes 51% of Gen Z, the highest of any generation, and 37% of women (versus 29% of men). That also includes a quarter (24%) of drivers with a household income of $78,000-$129,000 and 11% of those with a household income above $129,000.

Adding to their stress is a feeling of helplessness and exploitation at the repair shop. More than three fourths of respondents said they definitely (29%) or probably (48%) have been overcharged for repair or maintenance work, while only 1.5% said they had definitely not. A majority (57%) said they definitely (16%) or probably (41%) have paid for a repair or maintenance they didn’t need. Only 4.6% said they definitely hadn’t.

Shopping around can certainly pay off. For example, Jerry researchers contacted 145 repair shops around Phoenix, Arizona, to request quotes for services to a 2019 Nissan Sentra (4-cylinder engine, Turbo, 1.6 liter) and found costs for engine air filter replacement could range from $20 to $60, changing transmission fluid could range from $125 to $320, and replacing brake pads could range from $240 to $900.

Still, a majority of drivers don’t shop around for the lowest price when they need a repair. Only 44% said they do, up from 34% in a similar survey in May 2023. But many more younger drivers shop around than older ones. Nearly two thirds (64%) of Gen Z and 54% of Millennials said they shop around, compared to 44% of Gen X and only 24% of Boomers.

Car Buying and EVs

Despite the struggles with car ownership costs, 40% of American drivers say they plan to buy or lease a vehicle in 2025. That’s down slightly from 42% who said the same a year ago, as prices for new vehicles and interest rates, while both down a bit, remain elevated. There was a sharp gender divide on this issue: Half of men say they plan to get a vehicle in 2025, up from 43% a year ago, while only 31% of women said the same, down from 40% last year.

Naturally, vehicle prices and interest rates are stopping some would-be buyers. Nearly a quarter (24%) said they’d like to get a new or used vehicle in 2025, but don’t plan to do so. More than half of them (54%) said lower prices would change their mind, down from 86% last year, while 20% said lower interest rates would change their mind, down from 47% last year. Nearly one in five (19%) said tax-deductible interest on car loans—a policy mentioned by President-elect Donald Trump—would change their mind about car shopping in 2025. Another 51% said it probably would change their mind.

Naturally, insurance rates are on car owners’ minds, with 71% saying they consider the cost of car insurance when choosing a vehicle. That includes 85% of Gen Z and 75% of Gen X.

EV Interest

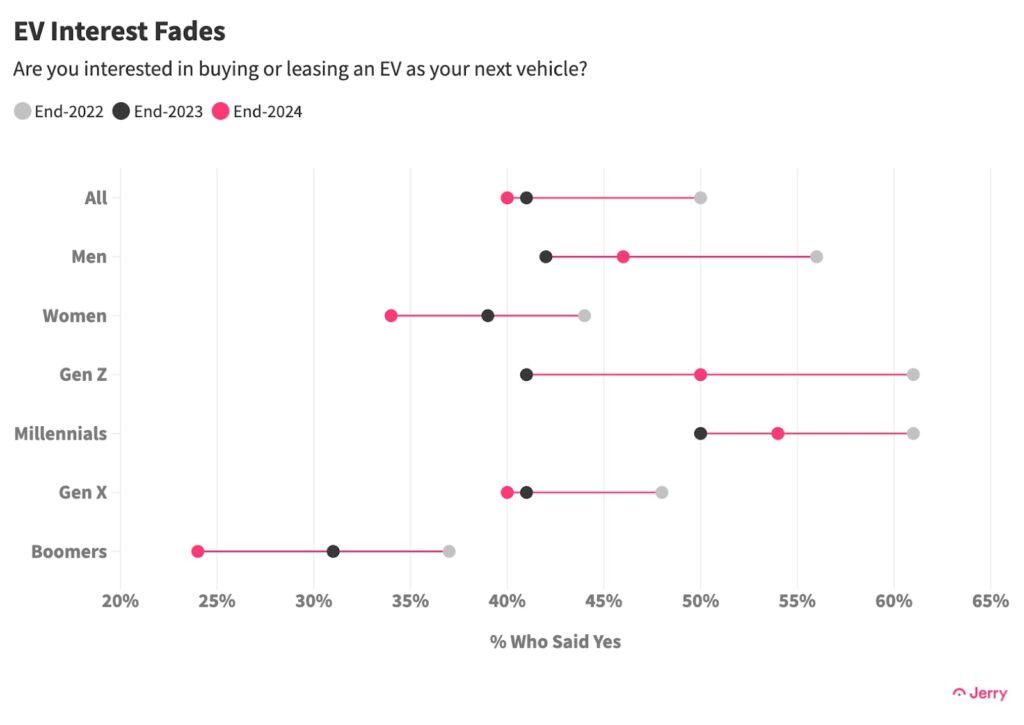

The percentage of drivers who say they’re interested in getting an EV as their next vehicle fell slightly, to 40% from 41% last year. But that’s down from 50% two years ago. Age and gender were clear factors. Interest in getting an EV as their next vehicle rose among Gen Z and Millennials, but fell among Gen X and Boomers. Interest rose among men but fell among women.

Yet 9% of drivers say it will be at least 10 years before they get an EV and another 37% say they don’t ever plan to get one. Both figures are up slightly from a year ago. Those in the “never” category include 26% of both Gen Z and Millennials.

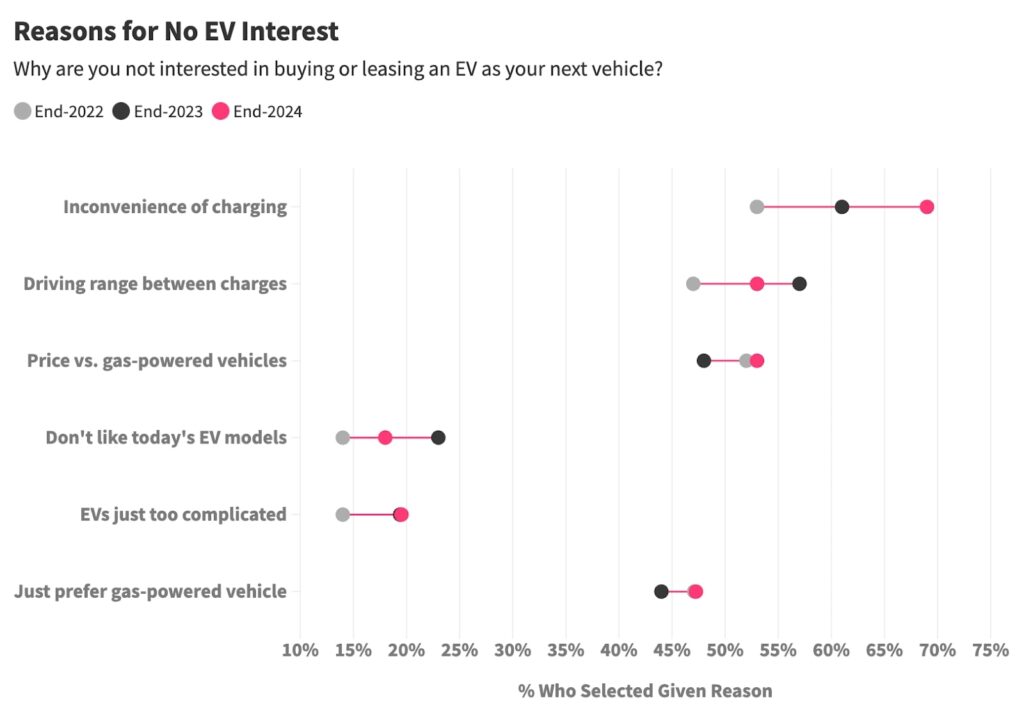

The number of public EV charging stations has more than doubled since 2020, and 64% of Americans now live within two miles of one. But the inconvenience of charging remains the top reason people cite for their lack of interest in buying an EV—and the number citing it continues to grow. Nearly 7 in 10 respondents (69%) who said they weren’t interested in an EV as their next vehicle pointed to the inconvenience of charging, up from 61% a year earlier and 52% two years ago. Concerns about driving range between charges (57%) and EV prices (53%) also remain big obstacles, as does simply preferring gas-fueled vehicles (47%).

Not surprisingly, then, more than 8 in 10 people (83%) said if given a choice of two identical vehicles at the same price—one a hybrid that does not require charging, and one an EV that does—they would choose the hybrid.

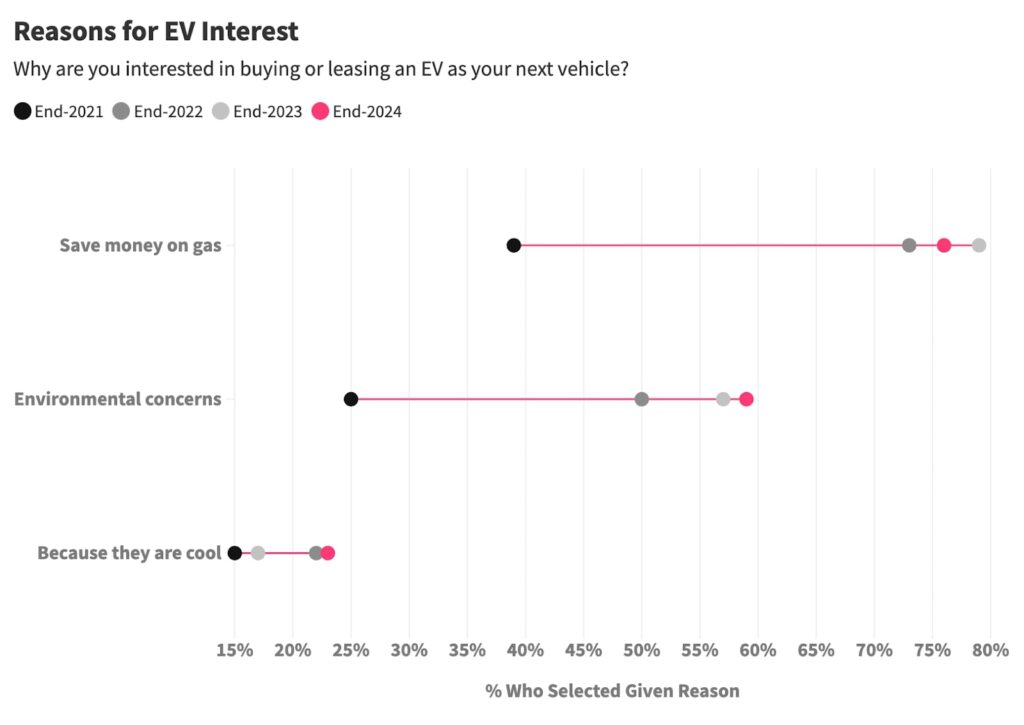

Those who are interested in getting an EV as their next vehicle most frequently cited the ability to save money on gas (76%), followed by concern about the environment (59%), while 32% cited a lower cost of ownership over the long term. In line with past yearly surveys, more respondents in older generations cited the environment, as did more women than men. In fact, more Boomers cited the environment (80%) than did saving money on gas (71%). Among Gen X, 60% said concern about the environment, compared to 50% of Millennials and 57% of Gen Z. Nearly 7 in 10 (69%) women did, far more than the 51% of men who did.

Technology and Driving Data

Many drivers are now coming to grips with how advances in technology are changing cars, driving, and car ownership. Their attitudes toward technology—especially the collection of data generated by their cars—depend to a large degree on the context. Choice appears to matter.

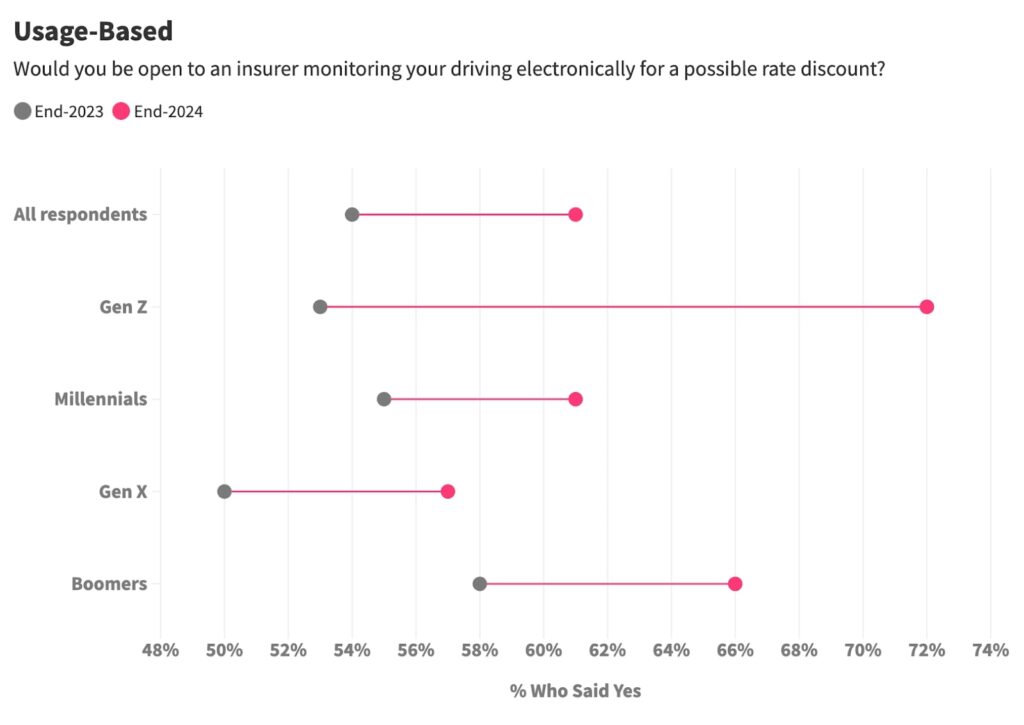

With insurance rates rising rapidly, more people are at least open to remote electronic monitoring of their driving if it means a possible rate discount. A solid majority (61%) said they would consider that trade-off, up from 54% just a year ago. Attitudes about this appear correlated with age (which is, perhaps, also linked to financial need and openness to technology and data-sharing). Nearly three quarters (72%) of Gen Z respondents said they would be open to electronic monitoring, compared with 61% of Millennials, 57% of Gen X, and 56% of Boomers.

On the other hand, a majority of drivers (54%) said they would consider leaving any insurer that required electronic monitoring of their driving. More than a third (35%) said they would be uncomfortable—and another 41% would be extremely uncomfortable—if insurers obtained such data for rate-setting purposes from data brokers or their car’s manufacturer.

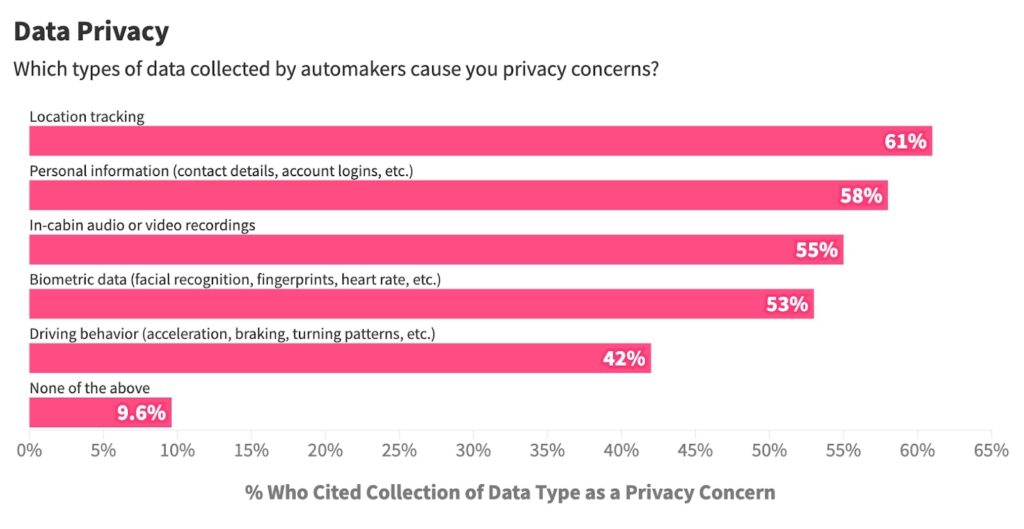

Many drivers also said the collection of car-generated data by automakers, a widespread practice under growing scrutiny, made them uncomfortable for privacy reasons. A majority (61%) said they were uncomfortable with location tracking, 58% cited the collection of personal information, and 55% pointed to the collection of in-cabin audio or video. Only 9.6% said they had no privacy concerns at all.

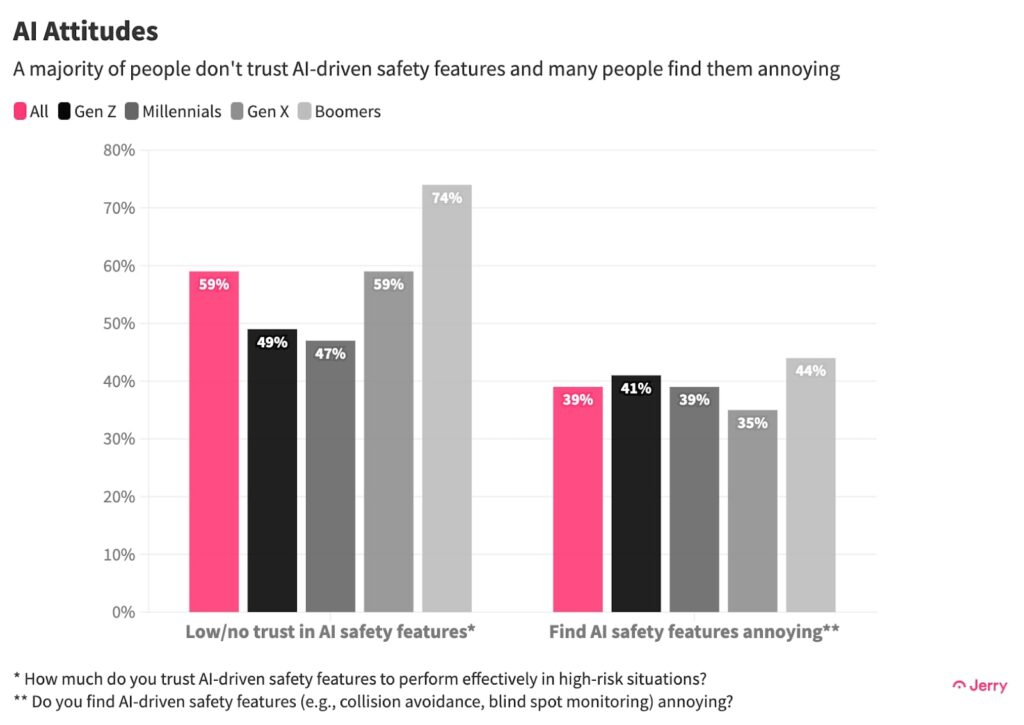

Even AI-driven safety features such as blind spot monitoring, which has been around for years, are merely tolerated by many people. In fact, 39% find the technologies “annoying,” including 43% of women and 35% of men.

Drivers don’t have a lot of trust in even the most basic AI-driven safety features, a warning to automakers working on fully autonomous driving. Only 6.6% said they had a high level of trust and 35% reported a moderate level of trust that safety features such as collision avoidance and blind spot monitoring would perform effectively in high-risk situations. One in four said they had “no trust” at all.

Younger generations trust the AI-driven safety technology more than their older counterparts, with slight majorities of Gen Z (51%) and Millennials (53%) expressing high or moderate trust, versus just 41% of Gen X and just 26% of Boomers.

Conclusion

American car owners have reason to hope car-ownership costs won’t get much worse in 2025. The worst of the insurance rate increases are likely behind us, with rate hikes in 2025 expected to be a more-moderate 2%-3%. Interest rates are forecast to come down again, while new car prices have stabilized and used vehicle prices continue to drift lower, at least for now. In short, we may be on the verge of settling into a new normal—a more expensive new normal, but one in which price increases return to levels resembling the pre-COVID years.

The price increases of the COVID era have already changed consumer behavior. More people than ever are buying used cars or considering doing so, for example, and shopping around for insurance and switching insurers have become more common. How things go for drivers in 2025 may have a lot to do with whether these habits take hold permanently.

The Jerry team will keep finding new ways to make car ownership more affordable and accessible for all American drivers in 2025. With quick and easy insurance and repair comparison solutions—plus rewards for safe driving—we have you covered. Visit jerry.ai to learn more.

Methodology

Jerry’s 2025 State of the American Driver report is based on data from a nationally representative survey of 1,000 people conducted in November 2024 using a platform and audience from Pollfish. All respondents own or lease a vehicle, drive at least once a week, and are responsible for paying for car insurance for themselves and/or their family. Respondents were blended for age, gender, and region. More information about Pollfish and its audiences can be found on its website. Inflation figures are based on data from the Bureau of Labor Statistics. Data on EV charging stations comes from the Department of Energy.