Key findings:

- A new analysis from Jerry, covering more than 500 vehicle models, estimates that auto tariffs could add an average estimated 13.7% — or $5,009 — to the price of non-luxury vehicles, including models like the Hyundai Elantra, Toyota Prius and Kia Niro.

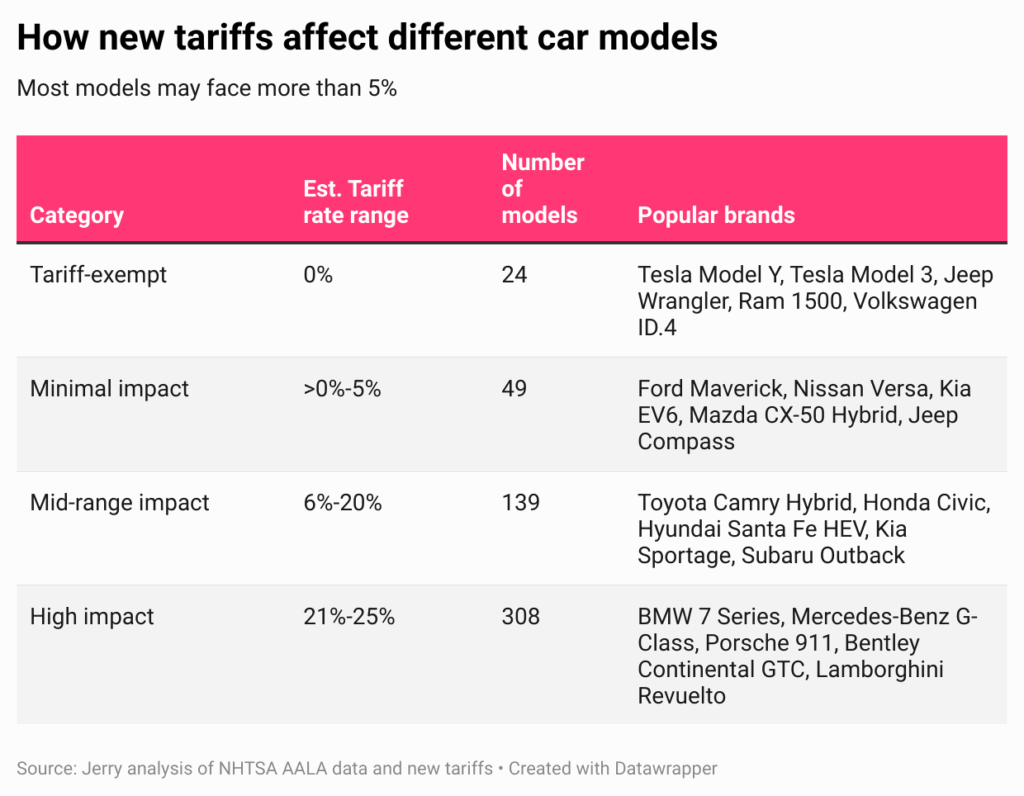

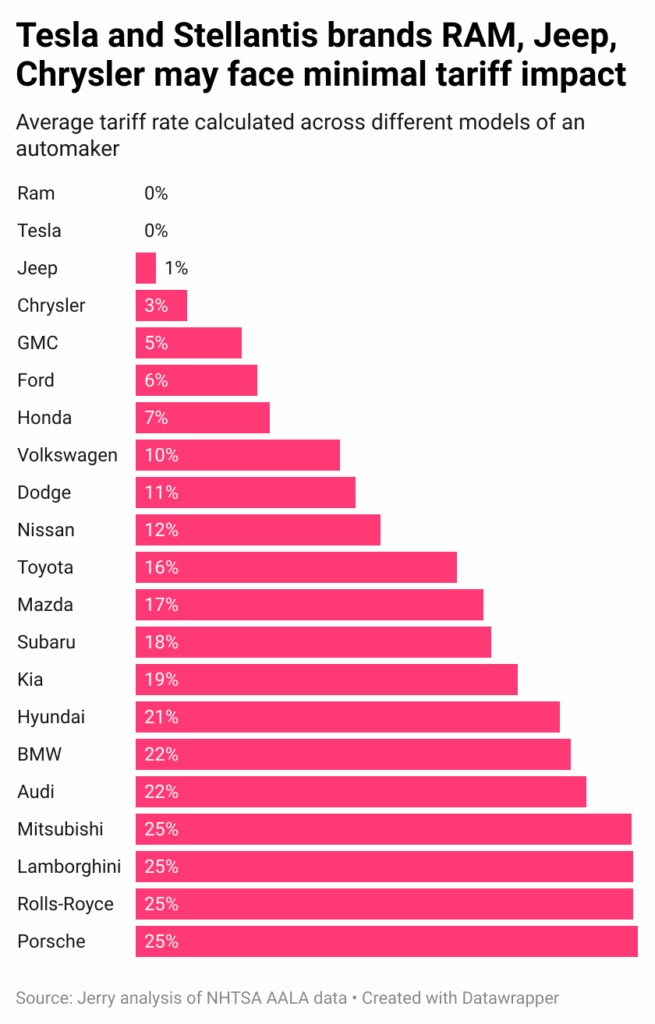

- The new tariff policy rewards North American automakers and localized production. Jerry’s analysis found 24 car models — including all current Teslas and several trims from Jeep, Ram and Volkswagen — that face zero tariff impact under the new rules. Another 49 models, including the Ford Maverick, Nissan Versa and Kia EV6 are estimated to incur surcharges no higher than 5%.

- Tariff impacts on non-luxury vehicles are far from uniform. Popular models like the Toyota Camry Hybrid and Ford F150 still face estimated tariffs between $2,000 and $4,000, despite high North-American content and U.S. assembly.

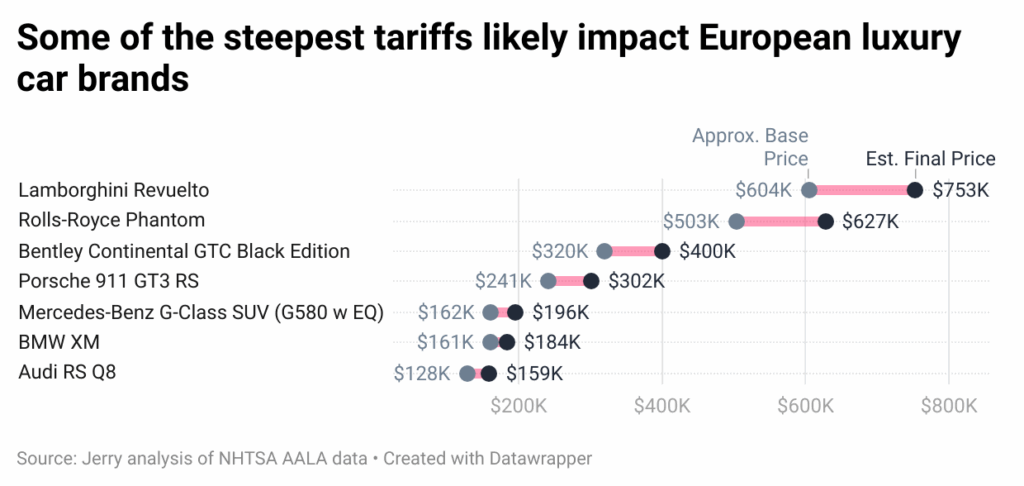

- Luxury buyers are hit hard. The upscale cohort sees 21.2% average estimated tariffs, or $21,600 per car. A total of nine Rolls-Royce, Bentley and Lamborghini models now exceed $75,000 apiece in tariff charges.

- The most-impacted model by tariffs is the Lamborghini Revuelto. With a base price of $604,000 and virtually no domestic regional content, it faces an estimated $149,490 in tariffs.

Check how prices could increase for more than 500 car models on this interactive tool developed by Jerry.

How tariffs may impact car prices

See the effect on specific models

Despite softer approach, auto tariffs are likely to cost consumers

Despite the White House’s April 29 announcement easing tariffs on U.S.-assembled and North-America-manufactured vehicles, consumers still stand to pay an additional estimated 13.7%, or $5,009 per vehicle, according to Jerry’s review of over 500 models.

Under the new rules, a 25% levy is applied to the portion of any vehicle sourced outside the United States-Mexico-Canada (USMCA) bloc. A credit of 3.75% on the price is granted to cars assembled in the U.S. in the first year, and vehicles whose parts content is at least 85% North American are fully exempt from tariffs. Unlike earlier proposals, the current measures do not stack additional steel or aluminium surcharges on top of that figure.

Clear winners and losers between models

Some car prices are set to skyrocket, while others remain unaffected. Luxury imports are affected more severely, with a surcharge of 21.2% that translates to about $21,600 per car, on average. Twenty-four models escape the tariff entirely — every Tesla currently on sale, together with several Jeep, Ram and Volkswagen trims — because their supply chains already meet the 85% USMCA threshold. A further 49 models, among them the Ford Maverick, Nissan Versa and Kia EV6, face tariffs no higher than 5%.

Rather than favoring domestic brands, the new tariff policy favors localizers. This means the Toyota Corolla gets roughly the same treatment as domestic brands, because it is primarily assembled in the U.S. Even so, imported components leave a residual charge on every vehicle, driving prices up for consumers.

The amount of imported content, not just price tag, drives the surcharge for any given model. A $29,000 Ford Maverick picks up a little over $900, yet a similarly priced Subaru Forester absorbs nearly $7,500, because almost every major component is sourced outside North America.

For consumers, outcomes will be model-specific: Many domestically built pickups and electric cars will see little or no change, whereas high-end imports and certain globally sourced SUVs are likely to carry noticeably higher sticker prices.

Luxury vehicles hit hard by tariffs

European luxury imports absorb the steepest blow: A Porsche 911 GT3 RS picks up roughly $60,000 in estimated extra duty, while the Bentley Continental GTC Mulliner sees an estimated $93,000 added to its sticker, thanks to their virtually all-foreign supply chains.

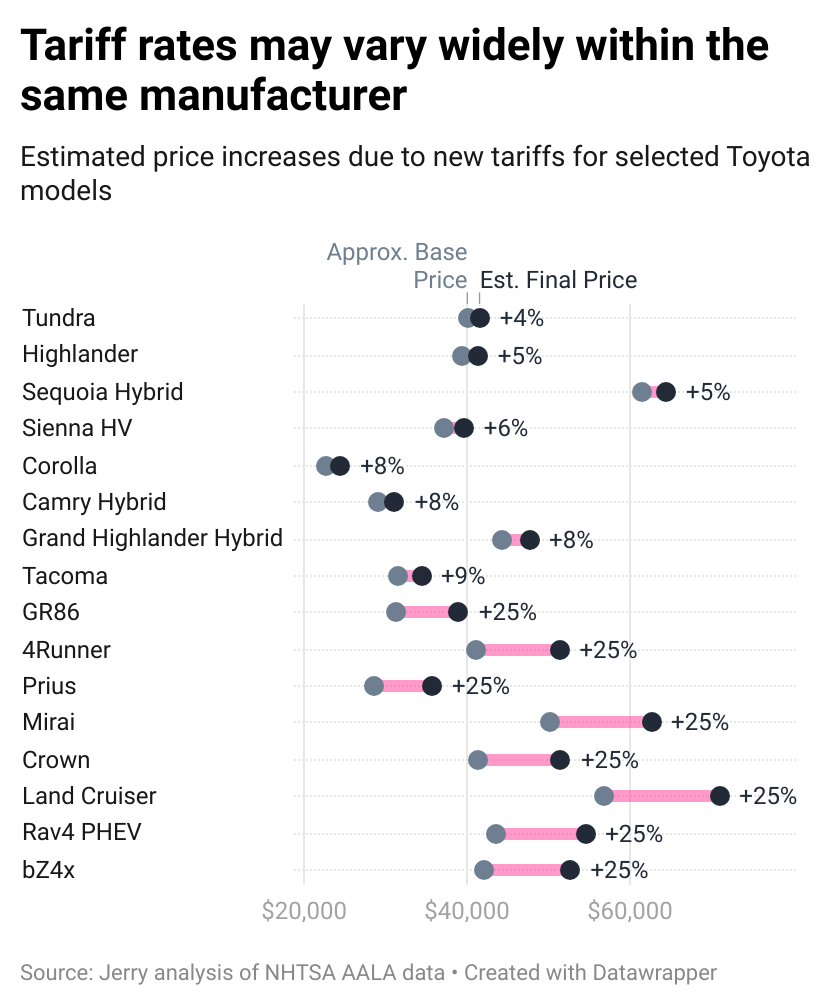

Tariff impacts can swing wildly inside the same showroom

Toyota’s U.S-built Corolla — assembled in Mississippi with a high share of North American parts — adds roughly $1,700 in duty, whereas the globally sourced Toyota Land Cruiser incurs about $14,000. A similar split appears at BMW: the South Carolina-made X5 carries an estimated $9,000 tariff, yet the fully imported 7 Series absorbs nearly $26,400, reflecting the full 25% charge on its overseas content.

Car tariffs price estimator methodology

Jerry’s data journalist and editorial team analyzed over 500 vehicle models using the 2025 National Highway Traffic Safety Administration American Automobile Labeling Act (AALA) data to estimate the impact of trade tariffs on vehicle prices1.

We calculated the share of each vehicle’s parts sourced from the U.S., Mexico and Canada to assess compliance with the United States-Mexico-Canada Agreement (USMCA)23.

Tariffs were applied using the following logic:

If a car is assembled in the U.S.:

- If the vehicle is 85% or more North-American, no tariff is owed4.

- Otherwise, a 15% credit was applied to the non-North American slice and then 25% tariffs were applied to the remaining portion of non-North American parts. Credits are only computed for the first year.

If the car is assembled outside the U.S., except for China: The entire non-North American slice pays the 25% tariff.

China premium: Whatever share of that dutiable slice traces to Chinese parts is charged 145% instead of 25%.

MSRP data was compiled from multiple sources including Kelley Blue Book, Car and Driver, TrueCar, manufacturers websites and dealership listings. Prices are ballpark estimates of starting prices and differ based on trim levels, configurations and geography.

We then calculated the total tariff rate, the estimated cost impact in dollars and the revised post-tariff price for each vehicle.

In cases where identical models were manufactured in multiple locations (e.g., some Honda CR-Vs are assembled in the U.S., others in Canada), we computed the average tariff cost for each model within its manufacturer to provide a unified view.

Citations

- NHTSA. “MY2024 AALA by Percent Content.” National Highway Traffic Safety Administration (NHTSA), American Automobile Labeling Act (AALA). https://www.nhtsa.gov/part-583-american-automobile-labeling-act-reports ↩︎

- U.S. Trade Representative. “Chapter 4: Rules of Origin.” USMCA Full Text. https://ustr.gov/sites/default/files/files/agreements/FTA/USMCA/Text/04-Rules-of-Origin.pdf ↩︎

- Congressional Research Service. “IF12082 – U.S. Auto Tariffs and the U.S.-Mexico-Canada Agreement.” https://www.congress.gov/crs-product/IF12082 ↩︎

- The White House.” Fact Sheet: President Donald J. Trump Incentivizes Domestic Automobile Production.” https://www.whitehouse.gov/fact-sheets/2025/04/fact-sheet-president-donald-j-trump-incentivizes-domestic-automobile-production/ ↩︎

Sinduja Rangarajan is an award-winning journalist whose work has spurred legislative actions and prompted major companies to change their policies. Her most recent role was as a senior investigative data reporter for Bloomberg News, where her work received multiple honors, including an Overseas Press Club Award and several Society for Advancing Business Editing and Writing (SABEW) awards. Her contributions to Bloomberg Green’s “water grab” series sparked legislative conversations in California and Australia and were recognized as a Pulitzer Prize finalist.

Before joining Bloomberg, she served as a data and interactives editor at Mother Jones and as a data reporter at Reveal from The Center for Investigative Reporting. She holds two master’s degrees in communications and journalism, as well as a bachelor’s degree in computer science. She lives in the San Francisco Bay Area with her partner and two children.